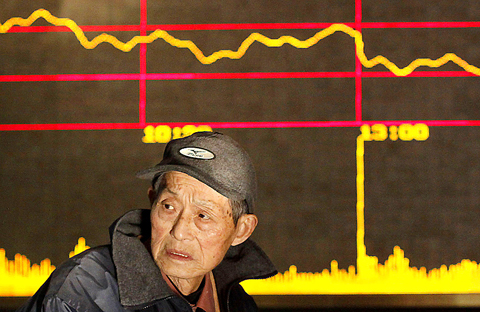

Global stock markets tumbled on Friday as fears mounted of a collapse of the Big Three US automakers after the US Senate refused to throw them a financial lifeline, traders said.

Share prices plunged in Asia and at the start of European trade after hours of late-night negotiations among US senators on a bailout of the troubled industry collapsed.

The US dollar in turn fell sharply, hitting a 13-year low against the yen.

PHOTO: AP

“It’s a very bad sign. US stocks will likely nosedive,” said Yasutoshi Nagai, chief economist at Daiwa Securities SMBC.

Wall Street will reopen at 1430 GMT after losing 2.24 percent on Thursday.

Tokyo’s Nikkei index slumped by more than 7 percent at one point as the dollar tumbled below the key ¥90 level for the first time since 1995.

The Japanese benchmark ended down 5.6 percent as exporters reeled from the stronger yen, which undercuts their overseas earnings.

Hong Kong shares closed down 5.48 percent, Seoul dived 4.38 percent and Sydney was off 2.4 percent.

Elsewhere in the Asia-Pacific yesterday, Taipei ended down 3.7 percent, Shanghai closed down 3.81 percent, Wellington lost 1.8 percent and Manila dropped 2.0 percent.

In early European trade, London dived 4.07 percent, Frankfurt tumbled 4.16 percent, Paris lost 4.74 percent, Madrid gave up 3.93 percent and Zurich lost 3.91 percent.

A US$14 billion deal passed the House of Representatives this week but it faced stiff opposition from senators in US President George W. Bush’s Republican Party.

“I’m terribly disappointed that we are not able to arrive at a conclusion,” said Senate Majority Leader Harry Reid, a member of president-elect Barack Obama’s Democratic Party. “We have tried very, very hard to arrive at a point where we could legislate for the automobile industry.”

Japan was also reportedly set today to raise its own stimulus package to ¥40 trillion (US$437 billion) from ¥26.9 trillion as the outlook rapidly worsens in Asia’s largest economy.

Investors reacted cautiously to the reports, noting that Prime Minister Taro Aso — who unveiled a ¥26.9 trillion boost in late October — is struggling amid voter discontent with his handling of the economy.

Aso “is already a lame duck,” said Hideaki Higashi, a strategist at SMBC Friend Securities. “We do not know how seriously we should believe the reported measures would be implemented.”

In China, shares closed down 3.81 percent yesterday due to concerns about weak fourth quarter earnings and Beijing’s lack of new economy-boosting measures, dealers said.

China’s retail sales growth eased to 20.8 percent last month from 22.0 percent in October, reinforcing concerns that consumption in the world’s fourth-largest economy was slowing.

“Many investors chose to sell as China’s economy has shown clear signs of further slowdown, and corporate earnings in the fourth quarter will be poor,” TX Investment’s Wu Feng said.

The benchmark Shanghai Composite Index, which covers A and B shares, closed down 77.47 points at 1,954.22 on turnover of 73.4 billion yuan (US$10.7 billion).

In New York on Thursday, the Dow Jones Industrial Average slid 2.24 percent as investors fretted over the rescue plan for the troubled US auto industry.

Market nervousness was reinforced by news that US jobless claims in the past week soared to a fresh 26-year high of 573,000, well above expectations.

There was also disappointment that the trade deficit widened 1.1 percent in October to US$57.2 billion, with both exports and imports down, suggesting demand is falling worldwide.

The sharp drop on Asian markets wiped out several days of gains. Japan’s Nikkei index is now down 46.5 percent this year while Hong Kong’s Hang Seng is off almost 48 percent.

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

A bipartisan group of US representatives have introduced a draft US-Taiwan Defense Innovation Partnership bill, aimed at accelerating defense technology collaboration between Taiwan and the US in response to ongoing aggression by the Chinese Communist Party (CCP). The bill was introduced by US representatives Zach Nunn and Jill Tokuda, with US House Select Committee on the Chinese Communist Party Chairman John Moolenaar and US Representative Ashley Hinson joining as original cosponsors, a news release issued by Tokuda’s office on Thursday said. The draft bill “directs the US Department of Defense to work directly with Taiwan’s Ministry of National Defense through their respective

Tsunami waves were possible in three areas of Kamchatka in Russia’s Far East, the Russian Ministry for Emergency Services said yesterday after a magnitude 7.0 earthquake hit the nearby Kuril Islands. “The expected wave heights are low, but you must still move away from the shore,” the ministry said on the Telegram messaging app, after the latest seismic activity in the area. However, the Pacific Tsunami Warning System in Hawaii said there was no tsunami warning after the quake. The Russian tsunami alert was later canceled. Overnight, the Krasheninnikov volcano in Kamchatka erupted for the first time in 600 years, Russia’s RIA