Wall Street enters the year-end holiday season this coming week with little to cheer about as the worst bear market in decades appears to be grinding on.

While some say stocks have been beaten down to cheap levels, investors remain fearful that the worst is not yet over, fretting over a possible collapse of the US auto industry or more troubles for major banks.

As a result, the cheer normally expected with the US Thanksgiving Day holiday on Thursday that traditionally opens the year-end holiday is noticeably absent.

The Dow Jones Industrial Average and NASDAQ hit their lowest levels in more than five years in the past week and the broad-market Standard & Poor’s 500 fell to its weakest since 1997.

Although the market ended Friday on a high note, with a big rally inspired by news that US president-elect Barack Obama had chosen New York Federal Reserve president Timothy Geithner as Treasury secretary, the losses for the week were still staggering.

In the week to Friday, Dow index tumbled 5.31 percent to 8,046.42. The tech-heavy NASDAQ sank 8.74 percent to 1,384.35 and the broad-market Standard & Poor’s 500 dropped 8.39 percent to 800.03.

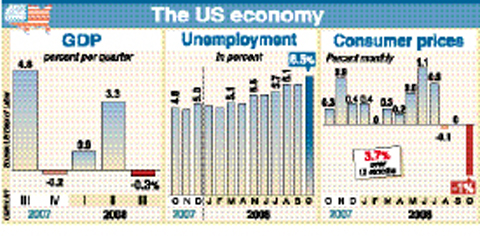

The past week was filled with glum economic news. US unemployment claims surged to a 16-year high while housing starts fell to the lowest levels on record.

Consumer prices fell at a steep rate, raising worries about deflation, while the Federal Reserve slashed its economic outlook, acknowledging a likely recession well into next year.

Citigroup shares plunged by some 50 percent, raising fears about the survival of one the US banking titans, and an anticipated bailout of the US auto sector was postponed in Congress, raising the specter of collapse.

Yves Smith, analyst with the financial Web site Naked Capitalism, said a collapse of General Motors (GM) would be “a disaster of colossal proportions.”

“GM would be a massive bankruptcy. It is doubtful whether it could obtain enough [debtor] financing, which means it might be forced into a partial, perhaps a full liquidation. The ramifications are nightmarish,” Smith said.

The stock market reflected those worries.

“Stocks are down roughly 50 percent from their highs in the US, Canada and Europe, representing the worst bear market in the postwar period,” said Sherry Cooper, chief economist at BMO Capital Markets.

In a sign of the panic in the past week, the bond market soared to historic highs.

The yield on the 10-year Treasury bond fell to 3.167 percent from 3.750 percent a week earlier, and then the 30-year Treasury bond tumbled to 3.663 percent against 4.230 percent. The lower yields reflect higher bond prices.

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

A bipartisan group of US representatives have introduced a draft US-Taiwan Defense Innovation Partnership bill, aimed at accelerating defense technology collaboration between Taiwan and the US in response to ongoing aggression by the Chinese Communist Party (CCP). The bill was introduced by US representatives Zach Nunn and Jill Tokuda, with US House Select Committee on the Chinese Communist Party Chairman John Moolenaar and US Representative Ashley Hinson joining as original cosponsors, a news release issued by Tokuda’s office on Thursday said. The draft bill “directs the US Department of Defense to work directly with Taiwan’s Ministry of National Defense through their respective

Tsunami waves were possible in three areas of Kamchatka in Russia’s Far East, the Russian Ministry for Emergency Services said yesterday after a magnitude 7.0 earthquake hit the nearby Kuril Islands. “The expected wave heights are low, but you must still move away from the shore,” the ministry said on the Telegram messaging app, after the latest seismic activity in the area. However, the Pacific Tsunami Warning System in Hawaii said there was no tsunami warning after the quake. The Russian tsunami alert was later canceled. Overnight, the Krasheninnikov volcano in Kamchatka erupted for the first time in 600 years, Russia’s RIA