Asian stocks and US futures advanced on speculation governments will step up efforts to revive economies and after the Wall Street Journal reported Citigroup Inc may be sold.

Bank of East Asia Ltd gained 4.9 percent after Hong Kong’s monetary authority said China branches of the city’s lenders can receive liquidity from the mainland’s central bank. Mizuho Financial Group Inc, Japan’s second-largest bank, climbed 14 percent on optimism a merger between Citigroup and a rival would reduce risk in the financial system. Fortescue Metals Group Ltd jumped 40 percent on a profit report.

“The best stimulus out there is for governments to spend,” said Jonathan Ravelas, a strategist at Banco de Oro Unibank Inc in Manila, which manages more than US$6 billion.

A Citigroup merger would “avert a collapse, which the financial system and investors wouldn’t want to hear at this stage,” he said.

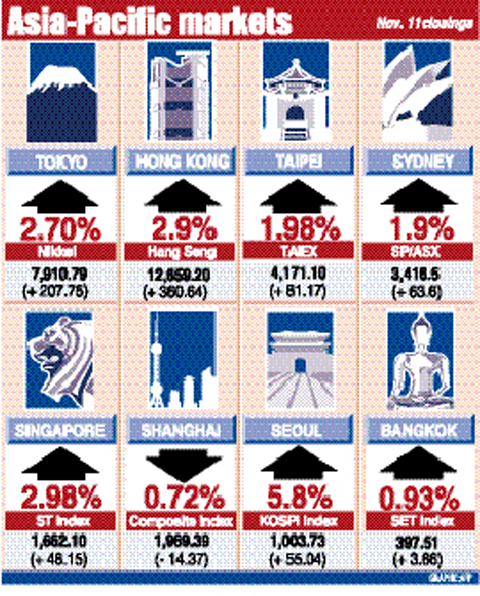

The MSCI Asia-Pacific Index added 2.9 percent to 77.37 at 7:11pm in Tokyo, erasing a 2.3 percent retreat. Finance companies were the biggest contributor to the gain. Friday’s advance pared the weekly retreat to 6.9 percent.

Futures on the US Standard & Poor’s 500 Index added 4.3 percent. US stocks tumbled on Thursday, with the S&P 500 dropping 6.7 percent to its lowest in 11 years, as economic data pointed to a worsening recession and lawmakers postponed a vote on a plan to salvage the auto industry.

MSCI’s Asian index has plunged 51 percent this year as global financial companies’ losses and writedowns from the collapse of the US subprime-mortgage market neared US$1 trillion, eventually toppling Lehman Brothers Holdings Inc. Rallies have fizzled — most recently a 25 percent gain posted in the seven trading days following Oct. 27 — as the economies of the US, Japan and the euro-zone entered recession.

Shares on the MSCI gauge are now valued at 9.5 times trailing earnings after falling to as low as 8.2 times last month. That compares with 19.5 times on Nov. 11 last year, when the measure hit a peak of 172.32. Prior to the current market turmoil, it never dropped below 10, Bloomberg data dating back to 1995 show.

TAIPEI

Taiwanese share prices are expected to stage a technical rebound next week on hopes that investors continue to take advantage of cheap electronics, dealers said on Friday.

With the US Thanksgiving holiday coming, Wall Street is likely to turn quiet next week to leave the local bourse breathing space after recent steep declines, they said.

But concerns over domestic an global economic conditions are expected to cap the upside.

For the week to Friday, the weighted index closed down 281.60 points, or 6.32 percent, at 4,171.10 after a 6.11 percent decline a week earlier.

The market made a comeback on Friday, closing up 1.98 percent, as bargain-hunting reversed early heavy losses.

“The market just kicked off a rebound and with depressed share prices, the momentum is unlikely to stop here,” Mega Securities (兆豐證券) analyst Alex Huang (黃國偉) said.

Huang said the bellwether electronics sector was likely to take the lead in the upside.

TOKYO

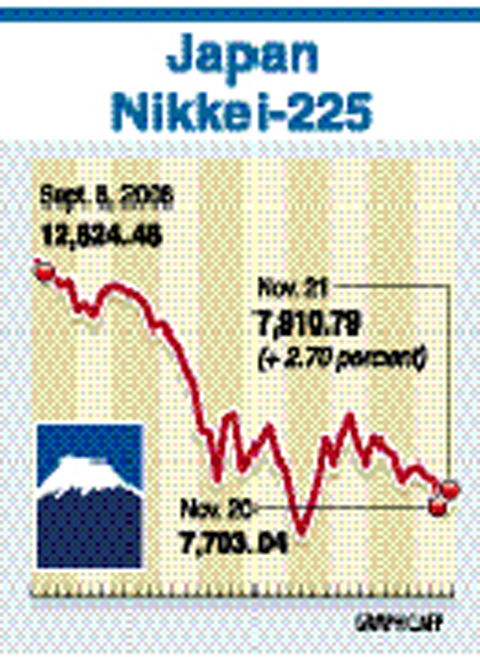

Japan’s Nikkei stock index closed up 2.7 percent on Friday.

The Nikkei climbed 207.75 points to end at 7,910.79. The TOPIX index of all first section issues rose 20.41 points, or 2.6 percent, to 802.69.

HONG KONG

Hong Kong share prices closed 2.9 percent higher on Friday. The benchmark Hang Seng Index rose 360.64 points to 12,659.20.

CASH Asset Management fund manager Patrick Yiu said the local market was boosted by speculation that China will introduce more pro-market measures and ease monetary policy over the weekend.

Yu said that if there are no such measures this weekend, the local market is likely to fall on profit-taking tomorrow.

KUALA LUMPUR

Malaysian share prices closed 0.2 percent higher. The Kuala Lumpur Composite Index rose 1.56 points to close at 866.88.

JAKARTA

Indonesian shares ended 0.8 percent lower. The Jakarta Composite Index dropped 8.69 points to 1,146.28.

MANILA

Philippine share prices closed 4.14 percent lower. The composite index was down 76.43 points at 1,765.90 points.

WELLINGTON

New Zealand share prices closed 2.52 percent lower. The benchmark NZX-50 index fell 66.57 points to close at 2,578.10.

MUMBAI

Indian shares rose 5.49 percent. The benchmark 30-share SENSEX rose 464.2 points to 8,915.21.

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

A bipartisan group of US representatives have introduced a draft US-Taiwan Defense Innovation Partnership bill, aimed at accelerating defense technology collaboration between Taiwan and the US in response to ongoing aggression by the Chinese Communist Party (CCP). The bill was introduced by US representatives Zach Nunn and Jill Tokuda, with US House Select Committee on the Chinese Communist Party Chairman John Moolenaar and US Representative Ashley Hinson joining as original cosponsors, a news release issued by Tokuda’s office on Thursday said. The draft bill “directs the US Department of Defense to work directly with Taiwan’s Ministry of National Defense through their respective

Tsunami waves were possible in three areas of Kamchatka in Russia’s Far East, the Russian Ministry for Emergency Services said yesterday after a magnitude 7.0 earthquake hit the nearby Kuril Islands. “The expected wave heights are low, but you must still move away from the shore,” the ministry said on the Telegram messaging app, after the latest seismic activity in the area. However, the Pacific Tsunami Warning System in Hawaii said there was no tsunami warning after the quake. The Russian tsunami alert was later canceled. Overnight, the Krasheninnikov volcano in Kamchatka erupted for the first time in 600 years, Russia’s RIA