Asian stocks rose for a second week, the first consecutive gain in six months, after central banks cut interest rates and US president-elect Barack Obama’s victory in the US election sparked speculation his spending plans will stimulate growth.

Mizuho Financial Group Inc jumped 20 percent, the best week since 2003, as Japan’s three-month interbank rate tumbled the most in almost a decade. Shinhan Financial Group Ltd gained 16 percent after South Korea pledged to pump US$10.5 billion into its economy and the Bank of Korea lowered rates for the third time in a month. Nintendo Co, the world’s biggest maker of handheld video-game consoles, rallied 7 percent after the election of Obama, who has urged Congress to pass a US$175 billion economic stimulus bill.

“The stability of financial markets has been restored somewhat,” said Hideyuki Ookoshi, who helps oversee about US$365 million at Chiba-Gin Asset Management Co in Tokyo. “Investors are keeping a keen eye on government efforts to shore up banks’ capital, which is the key to the recovery of global economies.”

PHOTO: AFP

The MSCI Asia-Pacific Index added 1.5 percent to 87.23 in the five days to Friday. It’s the first time the gauge has risen for consecutive weeks since May. A measure of financial companies climbed 5.1 percent, the most among the index’s 10 industry groups.

MSCI’s Asian index has lost 45 percent this year, exceeding declines for benchmark indexes in the US and Europe, as the 15-month credit crisis curtailed lending, and fund redemptions and currency market volatility prompted an exodus of capital from the region.

TAIPEI

Taiwanese share prices are expected to challenge the key 5,000-point mark on an extended technical rebound as investors hunt bargains, dealers said on Friday.

After being seriously hit recently, financials may continue to lead the upside on optimism of closer cross-strait economic exchanges which are expected to produce more opportunities in China for the sector, they said.

Investors also set aside anti-China sentiment from the Democratic Progressive Party, even though violent protests against a visit by a top Chinese envoy left more than 60 police and dozens of others injured, dealers said.

Buying interest is likely to shift back to transport and tourism stocks after Taiwan and China signed historic agreements on direct air and shipping links, they said.

While the market may rise to 5,000 points again next week, selling pressure may emerge to erode the gains with technical support at around 4,500 points, dealers said.

For the week to Friday, the TAIEX lost 128.33 points, or 2.63 percent, to 4,742.33 after a 6.36 percent increase a week earlier.

Average daily turnover stood at NT$72.04 billion (US$2.2 billion), compared with NT$68.42 billion a week ago.

The market staged a comeback in late Friday trading, recovering from early heavy losses, after a plunge on Thursday.

TOKYO

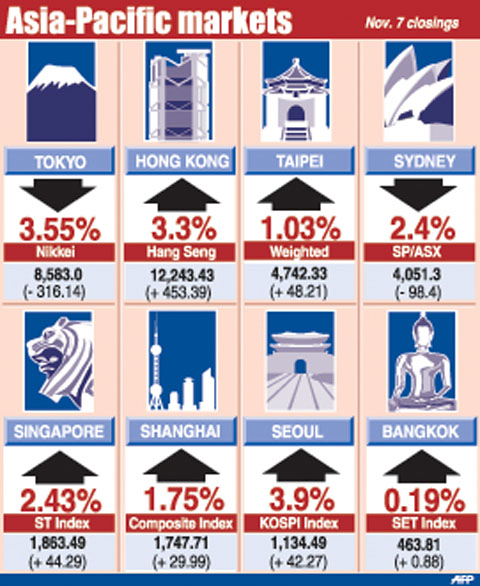

Japan’s Nikkei stock index ended down 3.55 percent. The benchmark fell 316.14 points to 8,583.00.

The TOPIX index of all first section issues fell 30.30 points, or 3.33 percent, to 879.00.

HONG KONG

Shares closed 3.3 percent higher. The benchmark Hang Seng Index was up 453.39 points to 14,243.43.

Analysts said investors likely saw a 25 basis point rate cut by HSBC as a sign of easing pressures on a tight interbank market, as local commercial banks had been reluctant to lend to one another due to the global credit crisis.

SYDNEY

Australian shares closed down 2.4 percent. The benchmark S&P/ASX200 closed down 98.4 points to 4,051.3, while the broader All Ordinaries fell 99.9 points to 4,006.6.

The fall followed a 4.3 percent drop on Thursday.

SHANGHAI

Chinese share prices closed up 1.75 percent.

Shares opened lower after some index heavyweights posted weak earnings or cut production, but bargain hunters emerged after the break on hopes Beijing may cut interest rates in the coming months, dealers said.

The benchmark Shanghai Composite Index, which covers A and B shares, closed up 29.99 points to 1,747.71.

SEOUL

South Korean share prices closed 3.9 percent higher. The KOSPI index ended up 42.27 points at 1,134.49.

SINGAPORE

Singapore shares closed 2.43 percent up. The main Straits Times Index rose 44.29 points to 1,863.49.

KUALA LUMPUR

Malaysian share prices closed 0.2 percent lower. The Kuala Lumpur Composite Index lost 2.00 points to close at 893.95.

BANGKOK

Thai share prices closed 0.19 percent higher. The Stock Exchange of Thailand (SET) composite index edged up 0.88 points to close at 463.81.

JAKARTA

Indonesian shares ended up 2.3 percent. The Jakarta Composite Index rose 30.47 points to 1,338.36.

MANILA

Philippine share prices closed 1 percent lower. The composite index lost 20.28 points to 1,921.34.

WELLINGTON

New Zealand share prices closed 1.71 percent lower. The benchmark NZX-50 index fell 48.48 points to 2,791.65.

MUMBAI

Indian shares rose 2.36 percent. The benchmark 30-share SENSEX index rose 230.07 points to 9,964.29.

Rainfall is expected to become more widespread and persistent across central and southern Taiwan over the next few days, with the effects of the weather patterns becoming most prominent between last night and tomorrow, the Central Weather Administration (CWA) said yesterday. Independent meteorologist Daniel Wu (吳德榮) said that based on the latest forecast models of the combination of a low-pressure system and southwesterly winds, rainfall and flooding are expected to continue in central and southern Taiwan from today to Sunday. The CWA also warned of flash floods, thunder and lightning, and strong gusts in these areas, as well as landslides and fallen

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

SOUTH CHINA SEA? The Philippine president spoke of adding more classrooms and power plants, while skipping tensions with China over disputed areas Philippine President Ferdinand Marcos Jr yesterday blasted “useless and crumbling” flood control projects in a state of the nation address that focused on domestic issues after a months-long feud with his vice president. Addressing a joint session of congress after days of rain that left at least 31 dead, Marcos repeated his recent warning that the nation faced a climate change-driven “new normal,” while pledging to investigate publicly funded projects that had failed. “Let’s not pretend, the people know that these projects can breed corruption. Kickbacks ... for the boys,” he said, citing houses that were “swept away” by the floods. “Someone has

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole