Wall Street sustained a fresh bruising in the past week as renewed concerns over the financial health of major banks and two large mortgage-financing firms shook investor confidence.

The main market indexes have entered “bear market” territory with a drop of more than 20 percent from their peaks amid a lingering housing market slump, a credit crunch and rocketing world oil prices.

Fears about the financial stability of Fannie Mae and Freddie Mac, two companies which help prop up the vast US mortgage market, sparked a heavy selloff of the companies’ shares and dented wider market sentiment.

PHOTO: BLOOMBERG

The leading Dow Jones Industrial Average shed 1.7 percent to 11,100.54 in the week to Friday.

The tech-rich NASDAQ lost a much slighter 0.3 percent for the week to 2,239.08, while the broad-market Standard & Poor’s 500 index shed 1.9 percent to 1,239.49.

“This time, credit concerns came in the heavyweight variety, as investors were spooked by talk that mortgage giants Fannie Mae and Freddie Mac may need a bailout by Washington,” Douglas Porter, an economist at BMO Capital Markets, said in a briefing note.

Worries about Fannie and Freddie clouded the market on Friday, as US Treasury Secretary Henry Paulson said the government wanted to support the two firms “in their current form.”

Analysts say that Fannie and Freddie help to keep the multitrillion-dollar mortgage market lubricated because of their role in buying up mortgage portfolios from big banks, repackaging them and selling them as securities to investors.

Concern about their financial health has rippled through Wall Street and global markets because the two firms own or guarantee more than US$5 trillion in loans, or about 40 percent of the total value of home loans in the US.

Analysts said nagging concerns about the banking sector — Wachovia bank warned investors on Wednesday it would likely post a second quarter loss as large as US$2.8 billion — also weighed down Wall Street.

Mortgage and credit woes have been plaguing the banking sector for months, despite the efforts of some banks to stem such losses and raise fresh capital from cash-rich foreign investors.

Traders continued to keep a close eye on Lehman Brothers, a large investment bank, which has seen its stock pounded in recent weeks as some market players have questioned its finances.

The news flow is set to accelerate in the coming week, as a flurry of companies report their latest quarterly earnings, but investors say sentiment is unlikely to change any time soon.

“Next week has the potential to be crucial in terms of near-term market direction. In addition to the start of the heavy flow of second quarter earnings reports, there is a relatively heavy calendar of economic releases,” said Gregory Drahuschak, a market analyst at Janney Montgomery Scott.

A flurry of economic reports, including snapshots on inflation, retail sales and home construction, will be released in the coming week.

Bonds got a lift from the stock market’s troubles. The yield on the 10-year Treasury bond fell to 3.940 percent from 3.990 percent a week earlier and that on the 30-year bond eased to 4.517 percent from 4.531 percent.

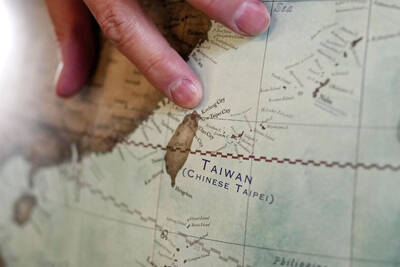

TAIWAN IS TAIWAN: US Representative Tom Tiffany said the amendment was not controversial, as ‘Taiwan is not — nor has it ever been — part of Communist China’ The US House of Representatives on Friday passed an amendment banning the US Department of Defense from creating, buying or displaying any map that shows Taiwan as part of the People’s Republic of China (PRC). The “Honest Maps” amendment was approved in a voice vote on Friday as part of the Department of Defense Appropriations Act for the 2026 fiscal year. The amendment prohibits using any funds from the act to create, buy or display maps that show Taiwan, Kinmen, Matsu, Penghu, Wuciou (烏坵), Green Island (綠島) or Orchid Island (Lanyu, 蘭嶼) as part of the PRC. The act includes US$831.5 billion in

‘WORLD WAR III’: Republican Representative Marjorie Taylor Greene said the aid would inflame tensions, but her amendment was rejected 421 votes against six The US House of Representatives on Friday passed the Department of Defense Appropriations Act for fiscal 2026, which includes US$500 million for Taiwan. The bill, which totals US$831.5 billion in discretionary spending, passed in a 221-209 vote. According to the bill, the funds for Taiwan would be administered by the US Defense Security Cooperation Agency and would remain available through Sept. 30, 2027, for the Taiwan Security Cooperation Initiative. The legislation authorizes the US Secretary of Defense, with the agreement of the US Secretary of State, to use the funds to assist Taiwan in procuring defense articles and services, and military training. Republican Representative

Taiwan is hosting the International Linguistics Olympiad (IOL) for the first time, welcoming more than 400 young linguists from 43 nations to National Taiwan University (NTU). Deputy Minister of Education Chu Chun-chang (朱俊彰) said at the opening ceremony yesterday that language passes down knowledge and culture, and influences the way humankind thinks and understands the world. Taiwan is a multicultural and multilingual nation, with Mandarin Chinese, Taiwanese, Hakka, 16 indigenous languages and Taiwan Sign Language all used, Chu said. In addition, Taiwan promotes multilingual education, emphasizes the cultural significance of languages and supports the international mother language movement, he said. Taiwan has long participated

Taiwan must invest in artificial intelligence (AI) and robotics to keep abreast of the next technological leap toward automation, Vice President Hsiao Bi-khim (蕭美琴) said at the luanch ceremony of Taiwan AI and Robots Alliance yesterday. The world is on the cusp of a new industrial revolution centered on AI and robotics, which would likely lead to a thorough transformation of human society, she told an event marking the establishment of a national AI and robotics alliance in Taipei. The arrival of the next industrial revolution could be a matter of years, she said. The pace of automation in the global economy can