Countrywide Financial Corp, under pressure to help stem growing home loan defaults, says it will expand programs to help borrowers manage their mortgage payments regardless of the type of subprime loan they have or whether they have already fallen behind on payments.

Full details of the initiative, the result of a pact with the national community advocacy group, were to be disclosed yesterday.

Initial plans to disclose the deal were postponed last month after Calabasas-based Countrywide agreed to be acquired by Bank of America Corp for US$4.1 billion in stock.

Countrywide, the largest US mortgage lender and home loan servicer, has sought to address the growing number of defaults on its books by modifying loan terms, working out long-term repayment plans and other actions. It said last month it helped more than 81,000 borrowers keep their mortgage payments manageable last year.

The firm also was among the lenders who agreed to a Bush administration-proposed agreement to freeze rates on some subprime mortgages for five years.

Those efforts focused on borrowers with adjustable rate mortgages that were still being paid but set to adjust to higher monthly payments.

The latest initiative, brokered with the Association of Community Organizations for Reform Now (ACORN), calls for Countrywide to try to manage payment plans for borrowers that are already behind in payments, regardless of which type of subprime loan they have.

"Through this partnership, Countrywide and ACORN have agreed to a set of home retention standards to help borrowers who are in various situations of financial difficulty to establish suitable repayment plans or other solutions," Steve Bailey, Countrywide's senior managing director of loan administration, said in a prepared statement.

Some 6.96 percent of the 9 million loans in Countrywide's servicing portfolio were delinquent as of Dec. 31, up from 5.02 percent in December 2006.

About 1.04 percent of the mortgage loans, or 93,961, were pending foreclosure, up from 0.65 percent.

Under the latest plan, borrowers with subprime hybrid adjustable-rate mortgages, which typically were issued with a low "teaser" interest rate and then adjust higher after two or three years, could be offered the option of refinancing into a lower prime rate loan, or have their initial interest rate frozen for five years.

Homeowners with fixed-rate subprime loans who have fallen behind on payments could be offered short-term repayment plans, loan modifications or other adjustments, including having their interest rate frozen or adding their overdue balances to their principal loan amount.

Despite the efforts to modify loans for some borrowers, some consumer groups argue the mortgage industry has not done enough, noting many borrowers continue to fall behind on payments.

Maude Hurd, national president of ACORN, however, praised Countrywide's latest initiative.

"We hope others in the mortgage servicing industry will adopt similar practices," Hurd said.

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

CHINA’s BULLYING: The former British prime minister said that he believes ‘Taiwan can and will’ protect its freedom and democracy, as its people are lovers of liberty Former British prime minister Boris Johnson yesterday said Western nations should have the courage to stand with and deepen their economic partnerships with Taiwan in the face of China’s intensified pressure. He made the remarks at the ninth Ketagalan Forum: 2025 Indo-Pacific Security Dialogue hosted by the Ministry of Foreign Affairs and the Prospect Foundation in Taipei. Johnson, who is visiting Taiwan for the first time, said he had seen Taiwan’s coastline on a screen on his indoor bicycle, but wanted to learn more about the nation, including its artificial intelligence (AI) development, the key technology of the 21st century. Calling himself an

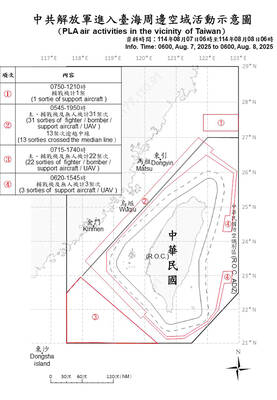

Sixty-three Chinese incursions into waters and airspace around Taiwan were detected in the 24 hours to 6am yesterday, with 38 craft crossing the median line of the Taiwan Strait and entering the nation’s northern, central, southwestern and eastern air defense identification zones, the Ministry of National Defense (MND) said. The activity represented a ramp-up of Beijing’s “gray zone” warfare directed at Taiwan over the past two days, the ministry said. A wave of 31 Chinese craft, consisting of fighters, fighter-bombers and uncrewed aerial vehicles, was tracked from 5:45am to 7:50am on Thursday, it said. In an apparent act of provocation, 13 of them