Stocks rose as investors capped a capricious week by engaging in a bit of Black Friday bargain hunting while awaiting word of how retailers might fare during what is expected to be a tough holiday shopping season.

Friday's holiday-shortened session ended three hours early and followed fractious trading that on Wednesday saw the Dow Jones industrial average and the Standard & Poor's 500 index give up more than 1.5 percent. The S&P's climb on Friday put the index back into positive territory for the year.

The day after Thanksgiving, Black Friday, which marks the kickoff of the holidays shopping season, is so named because it historically was when stores turned a profit.

The day's gains weren't enough to reverse losses for the week, however, and observers cautioned the session could prove more an aberration than a reversal of recent trends. With many of Wall Street's principal players on vacation, volume was light as is typical on such days.

"While I'd love to celebrate this rally, it is on very thin volume and we have to really wait until next week to get a sense of the true direction of this market," said Jack Ablin, chief investment officer at Harris Private Bank in Chicago.

Still, he said it's a good sign that stocks didn't extend Wednesday's slide.

"It looks like a little rebound rally," Ablin said. "Maybe the day off for Thanksgiving enabled investors to reflect that maybe the bottom isn't falling out of the economy."

The Dow rose 181.84, or 1.42 percent, to 12,980.88, finishing at the highs of the session rather than losing steam in the final minutes as has occurred often in recent weeks.

Broader stock indicators also rose. The Standard & Poor's 500 index advanced 23.93, or 1.69 percent, to 1,440.70, and the NASDAQ composite index rose 34.45, or 1.34 percent, to 2,596.60.

For the week, the Dow lost 1.49 percent, the S&P slid 1.24 percent and the NASDAQ gave up 1.54 percent.

Government bonds showed little movement. The yield on the 10-year Treasury note, which moves inversely to its price, stood at 4.01 percent, flat with late Wednesday.

The dollar was lower against other major currencies, while gold prices rose.

With no major economic data arriving and not much in the way of corporate news, some investors appeared to make some pro forma trades and search for any insights into the health of the economy, particularly with the arrival of Black Friday.

Oil prices, which flirted with US$100 per barrel earlier in the week, gained as heating oil rose amid concerns about tightening supplies. Light, sweet crude for January delivery advanced US$0.89 to settle at US$98.18 per barrel on the New York Mercantile Exchange.

Friday's advance came after the S&P 500 on Wednesday slipped into negative territory for the year -- unwelcome news as many investments such as mutual funds mirror the index. By Friday, however, the S&P had rebounded and was up 1.58 percent for the year.

The stock market's recent swoon is owed in part to concerns about the health of the banking sector and how it will emerge from a recent string of write-offs on soured subprime loans, which are those made to borrowers with poor credit. Banks have announced about US$75 billion in writedowns for the third and fourth quarters.

Ron Kiddoo, chief investment officer at Cozad Asset Management in Champaign, Illinois, said Wall Street needs a dose of good news such as continued strength in the job market to shed its sense of anxiety.

Analysts view a robust labor market as crucial to upholding strong consumer spending.

Financial stocks, which have seen steep selloffs in recent weeks showed gains on Friday. Some of the concern came after goverment-sponsored mortgage-makers Freddie Mac and Fannie Mae reported huge quarterly losses in recent weeks.

Among retailers drawing Wall Street's attention on Black Friday, Circuit City Stores Inc. jumped US$1.06, or 19.5 percent, to US$6.51, while Target Corp. climbed US$3.07, or 5.7 percent, to US$57.17. Wal-Mart Stores Inc, the world's largest retailer, rose US$0.87 to US$45.73.

Advancing issues outnumbered decliners by about 5 to 1 on the New York Stock Exchange, where volume came to 670.4 million shares.

The Russell 2000 index of smaller companies rose 14.73, or 1.99 percent, to 755.03.

Rainfall is expected to become more widespread and persistent across central and southern Taiwan over the next few days, with the effects of the weather patterns becoming most prominent between last night and tomorrow, the Central Weather Administration (CWA) said yesterday. Independent meteorologist Daniel Wu (吳德榮) said that based on the latest forecast models of the combination of a low-pressure system and southwesterly winds, rainfall and flooding are expected to continue in central and southern Taiwan from today to Sunday. The CWA also warned of flash floods, thunder and lightning, and strong gusts in these areas, as well as landslides and fallen

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

SOUTH CHINA SEA? The Philippine president spoke of adding more classrooms and power plants, while skipping tensions with China over disputed areas Philippine President Ferdinand Marcos Jr yesterday blasted “useless and crumbling” flood control projects in a state of the nation address that focused on domestic issues after a months-long feud with his vice president. Addressing a joint session of congress after days of rain that left at least 31 dead, Marcos repeated his recent warning that the nation faced a climate change-driven “new normal,” while pledging to investigate publicly funded projects that had failed. “Let’s not pretend, the people know that these projects can breed corruption. Kickbacks ... for the boys,” he said, citing houses that were “swept away” by the floods. “Someone has

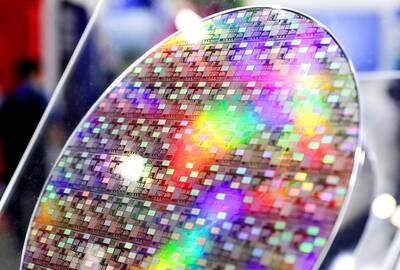

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole