The plot is sinister: Officials in Washington conspire to keep the dollar low and force Japanese authorities to intervene in the exchange market to buy the US currency -- not to save vulnerable Japanese exporters from the dangers of a high yen, but to keep the American economy from sliding.

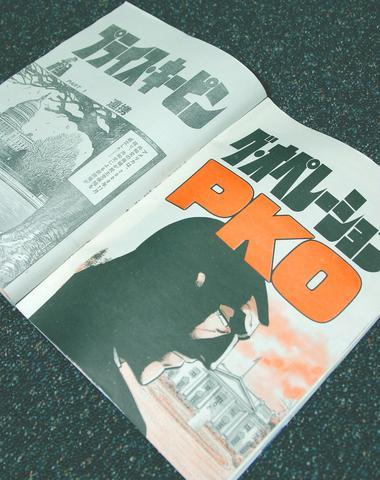

This story line from a top selling comic book in Japan is entertaining and delightfully implausible. Nonetheless, it highlights growing fears here over currency fluctuations.

PHOTO: AP

There's little doubt that if the yen rises too much against the dollar, Japan's fragile export-driven recovery could sputter. Prices for Japanese products abroad would soar and earnings of major companies would plunge.

It's true that Japanese authorities have been dipping into the market for months. They have been spending a fortune buying and bolstering the value of the dollar while keeping the yen lower.

Now that dry economic reality has been turned inside out to become improbable fictional fodder for fans of Golgo 13 -- a "manga" action hero serial that's featured in the weekly Big Comic magazine.

Manga is a style of comic wildly popular in Japan among adults as well as children. The main character of Golgo 13 is a macho sniper-assassin, whose weekly illustrated exploits reflect the big social, political and financial changes on the world scene.

In the latest three-part series he's caught up in the center of a dramatic battle between the yen and dollar.

In the real world, analysts say there's no doubt Japan's shopping spree for dollars is helping the US economy.

"It's keeping US interest rates low and helping push up American share prices," says Mamoru Yamazaki, economist at Barclays Capital Japan in Tokyo.

But Yamazaki believes the intervention campaign has been excessive, fueled by exaggerated fears about a surging yen among Japanese officials and media.

"Sometimes a strong yen can be a good thing, like from a consumer's point of view," he said, referring to how a strong yen would push down import prices. "Excessive intervention is distorting the market."

The Japanese authorities spent a record ¥20 trillion (US$182 billion) to intervene in the currency market last year to curb the dollar's slide. They spent about ¥10 trillion (US$91 billion) in the first two months of this year alone.

Even so, the dollar has fallen more than 10 percent from last year to ?105 levels in February but has recovered lately to above 110 yen. All the while, Japan has been aggressively snatching up US Treasury bonds to keep their currency from getting too strong.

Japanese officials continue to brush aside speculation that interventions may be finally ebbing.

The dollar fell in Tokyo early yesterday amid continued speculation that Japan would ease up on its interventions. The greenback bought ?108.84 at 11am yesterday, down ?0.78 from late Tuesday in Tokyo but above the ?108.78 it bought in New York later that day.

It's hardly the dialogue of an action hero. But the creators of Golgo 13 have spiced things up.

In it high-profile Washington figures, including one apparently inspired by National Security Adviser Condoleezza Rice, are depicted as intensely worried about the dollar's possible plunge.

An overly weak dollar will not only set off a job exodus to China and India but will cause capital to flee from America, they fret.

The story suggests that the US has concocted a diabolical trap to force Tokyo to cough up a massive amount of cash to finance ballooning US deficits while preventing a crash in US Treasuries.

NATIONAL SECURITY THREAT: An official said that Guan Guan’s comments had gone beyond the threshold of free speech, as she advocated for the destruction of the ROC China-born media influencer Guan Guan’s (關關) residency permit has been revoked for repeatedly posting pro-China content that threatens national security, the National Immigration Agency said yesterday. Guan Guan has said many controversial things in her videos posted to Douyin (抖音), including “the red flag will soon be painted all over Taiwan” and “Taiwan is an inseparable part of China,” while expressing hope for expedited “reunification.” The agency received multiple reports alleging that Guan Guan had advocated for armed reunification last year. After investigating, the agency last month issued a notice requiring her to appear and account for her actions. Guan Guan appeared as required,

A strong cold air mass is expected to arrive tonight, bringing a change in weather and a drop in temperature, the Central Weather Administration (CWA) said. The coldest time would be early on Thursday morning, with temperatures in some areas dipping as low as 8°C, it said. Daytime highs yesterday were 22°C to 24°C in northern and eastern Taiwan, and about 25°C to 28°C in the central and southern regions, it said. However, nighttime lows would dip to about 15°C to 16°C in central and northern Taiwan as well as the northeast, and 17°C to 19°C elsewhere, it said. Tropical Storm Nokaen, currently

PAPERS, PLEASE: The gang exploited the high value of the passports, selling them at inflated prices to Chinese buyers, who would treat them as ‘invisibility cloaks’ The Yilan District Court has handed four members of a syndicate prison terms ranging from one year and two months to two years and two months for their involvement in a scheme to purchase Taiwanese passports and resell them abroad at a massive markup. A Chinese human smuggling syndicate purchased Taiwanese passports through local criminal networks, exploiting the passports’ visa-free travel privileges to turn a profit of more than 20 times the original price, the court said. Such criminal organizations enable people to impersonate Taiwanese when entering and exiting Taiwan and other countries, undermining social order and the credibility of the nation’s

‘SALAMI-SLICING’: Beijing’s ‘gray zone’ tactics around the Pratas Islands have been slowly intensifying, with the PLA testing Taiwan’s responses and limits, an expert said The Ministry of National Defense yesterday condemned an intrusion by a Chinese drone into the airspace of the Pratas Islands (Dongsha Islands, 東沙群島) as a serious disruption of regional peace. The ministry said it detected the Chinese surveillance and reconnaissance drone entering the southwestern parts of Taiwan’s air defense identification zone early yesterday, and it approached the Pratas Islands at 5:41am. The ministry said it immediately notified the garrison stationed in the area to enhance aerial surveillance and alert levels, and the drone was detected in the islands’ territorial airspace at 5:44am, maintaining an altitude outside the effective range of air-defense weaponry. Following