Asian stocks had their second-best week this year after China slashed interest rates, spurring speculation government measures will pull the global economy out of recession and boost demand.

Inpex Corp, Japan’s largest energy explorer, jumped 26 percent in Tokyo after oil had its best week in six months. Zijin Mining Group Co, China’s largest gold producer, surged 25 percent as bullion climbed. Guangzhou R&F Properties Co jumped 41 percent after China cut its key lending rate by the most in 11 years to revive the world’s fourth-largest economy, three weeks after the government announced a stimulus plan worth more than US$500 billion.

“Sentiment is stabilizing,” said Kwon Hyeuk-boo, a fund manager at Daishin Investment Trust Management Co in Seoul, which oversees about US$1.4 billion in assets. “Investors are buying into expectations that support measures will keep coming. China’s strong will to support its economy is serving as a key catalyst to Asian markets.”

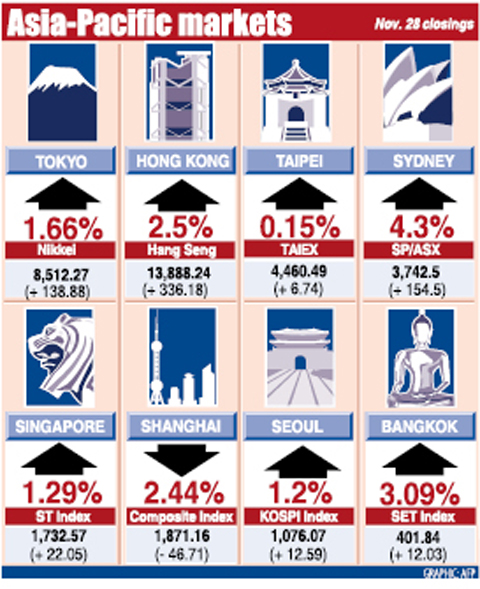

The MSCI Asia-Pacific Index rose 6.8 percent to 82.67, the second-best gain this year, surpassed only by a 6.9 percent rally at the end of last month, when central banks from Japan to Taiwan lowered borrowing costs. Commodities producers had the biggest gains among the 10 industry groups.

Japan’s Nikkei 225 Stock Average advanced 7.6 percent to 8,512.27. Elpida Memory Inc, Japan’s biggest memory-chip maker, climbed 27 percent after saying it plans to gain control of a production venture with Taiwan’s Powerchip Semiconductor Corp (力晶半導體).

Elpida jumped 27 percent to ¥445. The Tokyo-based chipmaker will increase its stake in joint venture Rexchip Electronics Corp (瑞晶) to 52 percent, Hsinchu-based Powerchip said on Thursday. The investment will give Elpida control of a factory that runs on the latest technology for making computer-memory chips at a fraction of the cost of building a plant.

Asian shares also climbed after the US Federal Reserve committed US$800 billion to unfreeze credit markets, while Citigroup Inc received a US$306 billion government rescue and the EU proposed a 200 billion euro (US$257 billion) spending package.

The gain for MSCI’s Asia-Pacific index pared this month’s drop to 3.8 percent, the seventh monthly decline and the longest losing streak since the gauge began in December 1987.

MSCI’s Asian index has plunged 48 percent this year as global financial companies’ losses and writedowns from the collapse of the US subprime-mortgage market neared US$1 trillion.

Shares on the MSCI gauge are now valued at 10.2 times trailing earnings after falling to as low as 8.2 times last month. That compares with 19.5 times on Nov. 11 last year, when the measure hit a peak of 172.32. Prior to the current market turmoil, the price-earnings ratio never dropped below 10, Bloomberg data show.

The People’s Bank of China on Wednesday cut its one-year lending rate by 108 basis points to 5.58 percent, less than three weeks after announcing a 4 trillion yuan (US$586 billion) economic stimulus plan. China is the largest trading partner for Japan and Australia and was the biggest contributor to global economic growth last year.

TAIPEI

Taiwanese share prices are expected to encounter strong resistance in the week ahead as the index approaches the upper technical 4,500 to 4,600 point range, dealers said on Friday.

Despite a recent significant technical rebound, market confidence remains weak amid lingering concerns over a global economic downturn and further volatility on Wall Street, they said.

Investors have turned cautious before bellwether electronics companies release their sales figures for this month, starting from next week, to give a clearer indication on economic fundamentals, they added.

While profit taking may continue to weigh in the market next week, a short-term technical support could be seen at around 4,100 points, dealers said.

For the week to Friday, the weighted index closed up 289.39 points, or 6.94 percent, at 4,460.49 after a 6.32 percent fall a week earlier.

Other regional markets:

KUALA LUMPUR: Malaysian shares closed 0.4 percent lower. The Kuala Lumpur Composite Index shed 3.84 points to end the day at 866.14.

JAKARTA: Indonesian shares ended 3.3 percent higher. The Jakarta Composite Index rose 39.47 points to 1,241.54.

MANILA: Philippine share prices closed 0.2 percent higher. The composite index added 4.56 points to 1,971.57. Trading resumes on Tuesday as markets will be closed tomorrow for a public holiday.

WELLINGTON: New Zealand shares closed 1.58 percent higher. The benchmark NZX-50 index rose 42.22 points to 2,710.96.

MUMBAI: Indian shares closed up 0.73 percent. The benchmark 30-share SENSEX rose 66 points to 9,092.72.

MORE VISITORS: The Tourism Administration said that it is seeing positive prospects in its efforts to expand the tourism market in North America and Europe Taiwan has been ranked as the cheapest place in the world to travel to this year, based on a list recommended by NerdWallet. The San Francisco-based personal finance company said that Taiwan topped the list of 16 nations it chose for budget travelers because US tourists do not need visas and travelers can easily have a good meal for less than US$10. A bus ride in Taipei costs just under US$0.50, while subway rides start at US$0.60, the firm said, adding that public transportation in Taiwan is easy to navigate. The firm also called Taiwan a “food lover’s paradise,” citing inexpensive breakfast stalls

PLUGGING HOLES: The amendments would bring the legislation in line with systems found in other countries such as Japan and the US, Legislator Chen Kuan-ting said Democratic Progressive Party (DPP) Legislator Chen Kuan-ting (陳冠廷) has proposed amending national security legislation amid a spate of espionage cases. Potential gaps in security vetting procedures for personnel with access to sensitive information prompted him to propose the amendments, which would introduce changes to Article 14 of the Classified National Security Information Protection Act (國家機密保護法), Chen said yesterday. The proposal, which aims to enhance interagency vetting procedures and reduce the risk of classified information leaks, would establish a comprehensive security clearance system in Taiwan, he said. The amendment would require character and loyalty checks for civil servants and intelligence personnel prior to

The China Coast Guard has seized control of a disputed reef near a major Philippine military outpost in the South China Sea, Beijing’s state media said, adding to longstanding territorial tensions with Manila. Beijing claims sovereignty over almost all of the South China Sea and has waved away competing assertions from other countries as well as an international ruling that its position has no legal basis. China and the Philippines have engaged in months of confrontations in the contested waters, and Manila is taking part in sweeping joint military drills with the US which Beijing has slammed as destabilizing. The Chinese coast guard

US PUBLICATION: The results indicated a change in attitude after a 2023 survey showed 55 percent supported full-scale war to achieve unification, the report said More than half of Chinese were against the use of force to unify with Taiwan under any circumstances, a survey conducted by the Atlanta, Georgia-based Carter Center and Emory University found. The survey results, which were released on Wednesday in a report titled “Sovereignty, Security, & US-China Relations: Chinese Public Opinion,” showed that 55.1 percent of respondents agreed or somewhat agreed that “the Taiwan problem should not be resolved using force under any circumstances,” while 24.5 percent “strongly” or “somewhat” disagreed with the statement. The results indicated a change in attitude after a survey published in “Assessing Public Support for (Non)Peaceful Unification