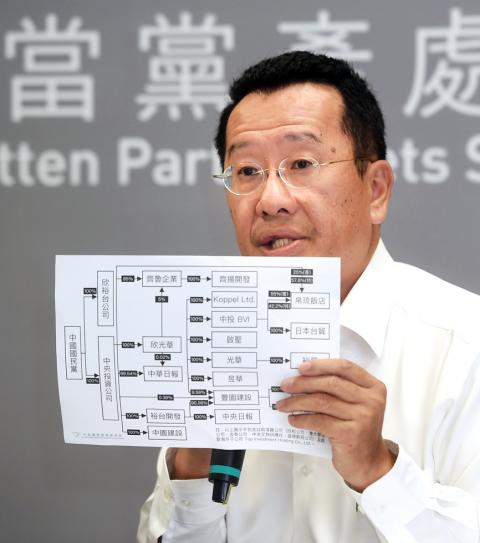

The Chinese Nationalist Party (KMT) must transfer all its rights to shares issued by Central Investment Co (中央投資公司) and Hsinyutai Co (欣裕台) to the government, the Ill-gotten Party Assets Settlement Committee said yesterday, after concluding that the two companies were founded using illegally obtained assets.

Committee Chairman Wellington Koo (顧立雄) said the committee would send the KMT a letter of disposition no later than Tuesday and give it 30 days to comply with the assets transfer.

The “rent” the KMT pays for its headquarters on Taipei’s Bade Road, Sec 2 — registered under Central Investment and Hsinkuanghua Co (欣光華股份有限公司) — must be paid to the government after the transfer of shareholding rights, Koo told a news conference after the committee meeting.

Photo: Fang Pin-chao, Taipei Times

Central Investment is a wholly owned holding company of the KMT, while Hsinkuanghua is a fully owned subsidiary of Central Investment, the committee’s investigation found.

The KMT in late July signed a five-year contract with Central Investment and Hsinkuanghua to lease the building and paid the rent — totaling about NT$320 million (US$10 million) — in advance, despite not having allocated any funds for the rent this year, Koo said, adding that the KMT probably secured the lease out of fear of having its ill-gotten assets seized.

Citing the committee’s investigation, Koo rebutted KMT Administration and Management Committee director Chiu Da-chan’s (邱大展) claims on Thursday that Central Investment’s and Hsinyutai’s capital came from legitimate sources.

Photo: CNA

“In an era when there was no distinction between the party and the state, half of the KMT’s revenue came from state subsidies, while its affiliated organizations provided about 20 percent, and it had some other sources of income,” Koo said.

The KMT’s legitimate assets and income from the so-called “special surcharges” it levied on businesses to increase the national defense budget made up a tiny portion of its revenue, he said.

However, with the exception of 1959 and 1961, in which the then-KMT administration produced a surplus of NT$1.2 million and NT$220,000 respectively, the KMT had been mired in deficit from 1953 to 1971, accumulating a debt of NT$253.5 million, Koo said.

“How could the KMT have had NT$200 million of government securities when it founded Central Investment in 1972?” Koo said.

The committee has rejected the KMT’s request that it cash in Central Investment’s and Hsinyutai’s shares and property holdings to pay its employees’ pension and severance packages, because it would run counter to the commission’s decision that the KMT transfer the firms’ shareholding rights.

However, to allow the party to pay its employees’ health and labor insurance premiums, land taxes and pension, the committee has decided to unfreeze the KMT’s account at Bank SinoPac (永豐銀行), which has more than NT$350 million.

Including the rent it paid in advance and money in the account, the KMT has NT$1.25 billion from its legal sources of capital, including nine checks worth NT$468 million made payable to it by the Bank of Taiwan, the NT$100 million the Chang Yung-fa Foundation owes the party and NT$9 million in advance payments it made to an attorney, Koo said.

He urged the KMT to use this money to deal with fees it needs to pay its employees.

CHAOS: Iranians took to the streets playing celebratory music after reports of Khamenei’s death on Saturday, while mourners also gathered in Tehran yesterday Iranian Supreme Leader Ayatollah Ali Khamenei was killed in a major attack on Iran launched by Israel and the US, throwing the future of the Islamic republic into doubt and raising the risk of regional instability. Iranian state television and the state-run IRNA news agency announced the 86-year-old’s death early yesterday. US President Donald Trump said it gave Iranians their “greatest chance” to “take back” their country. The announcements came after a joint US and Israeli aerial bombardment that targeted Iranian military and governmental sites. Trump said the “heavy and pinpoint bombing” would continue through the week or as long

An Emirates flight from Dubai arrived at Taiwan Taoyuan International Airport yesterday afternoon, the first service of the airline since the US and Israel launched strikes against Iran on Saturday. Flight EK366 took off from the United Arab Emirates (UAE) at 3:51am yesterday and landed at 4:02pm before taxiing to the airport’s D6 gate at Terminal 2 at 4:08pm, data from the airport and FlightAware, a global flight tracking site, showed. Of the 501 passengers on the flight, 275 were Taiwanese, including 96 group tour travelers, the data showed. Tourism Administration Deputy Director-General Huang He-ting (黃荷婷) greeted Taiwanese passengers at the airport and

TRUST: The KMT said it respected the US’ timing and considerations, and hoped it would continue to honor its commitments to helping Taiwan bolster its defenses and deterrence US President Donald Trump is delaying a multibillion-dollar arms sale to Taiwan to ensure his visit to Beijing is successful, a New York Times report said. The weapons sales package has stalled in the US Department of State, the report said, citing US officials it did not identify. The White House has told agencies not to push forward ahead of Trump’s meeting with Chinese President Xi Jinping (習近平), it said. The two last month held a phone call to discuss trade and geopolitical flashpoints ahead of the summit. Xi raised the Taiwan issue and urged the US to handle arms sales to

State-run CPC Corp, Taiwan (CPC, 台灣中油) yesterday said that it had confirmed on Saturday night with its liquefied natural gas (LNG) and crude oil suppliers that shipments are proceeding as scheduled and that domestic supplies remain unaffected. The CPC yesterday announced the gasoline and diesel prices will rise by NT$0.2 and NT$0.4 per liter, respectively, starting Monday, citing Middle East tensions and blizzards in the eastern United States. CPC also iterated it has been reducing the proportion of crude oil imports from the Middle East and diversifying its supply sources in the past few years in response to geopolitical risks, expanding