The TAIEX yesterday plunged to a two-year low as the local bourse entered a bear market amid concerns China’s slowdown and currency devaluation would hurt domestic economic fundamentals. A steep drop on Wall Street overnight also lent a blow.

The main trading index ended down 3.02 percent, or 242.89 points, to 7,786.92, dropping below the 10-year moving average and more than 20 percent from a 15-year high on April 27, the threshold for a bear market, analysts said.

“The sharp declines in the TAIEX seen in the past week are the worst since the global financial crisis in 2008,” Masterlink Securities Investment Advisory Corp (元富投顧) president Liu Kun-hsi (劉坤錫) said by telephone.

Photo: Wang Meng-lun, Taipei Times

Liu attributed the downturn to a global economic slowdown and weakening fundamentals in domestic markets.

The nation’s export-focused economy is forecast to grow a mere 0.1 percent this quarter, Liu said, citing a recent projection by the Directorate-General of Budget, Accounting and Statistics.

Turnover totaled NT$101.6 billion (US$3.1 billion), with foreign institutional investors selling a net NT$7.1 billion in local shares, Taiwan Stock Exchange data showed.

Foreign investors pulled a net US$2.5 billion from local shares so far this quarter, the most in Asia after Japan and South Korea, the data showed.

Technology sector bellwethers led the tumble, with the electronics sub-index losing 3.35 percent, deeper than the benchmark index.

Most technology companies have given conservative guidance about business in the second half of this year.

Camera lens maker Largan Precision Co (大立光), chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and smartphone assembler Hon Hai Precision Industry Co (鴻海精密) saw shares drop by 2.46 percent, 3.97 percent and 1.9 percent respectively.

“A downward correction is likely to persist until we see a brighter economic outlook, which might occur when critical statistics are updated later this month or in September,” Liu said.

The margin trading balance, a gauge of risk appetite, fell 0.5 percent, or NT$756 million, to NT$149.52 billion, Taiwan Stock Exchange data showed, as wild volatility raised caution among investors.

The figure stood at NT$162.1 billion on Aug. 3, with the TAIEX standing at 8,524.41, according to the data.

Grim sentiment also weighed on the New Taiwan dollar, which shed NT$0.198 yesterday to close at NT$32.876 against the US dollar in Taipei trading.

The financial sub-index dropped 2.57 percent to 994.7, the first time it has fallen below the 1,000-point mark since May last year.

Only a few listed financial companies did not see drastic declines, such as Taiwan Life Insurance Co (台灣人壽保險), Ta Chong Bank Ltd (TC Bank, 大眾銀行) and EnTie Commercial Bank (安泰銀行), as they are soon to be acquired by larger peers.

Data from the Taiwan Stock Exchange showed that based on yesterday's intraday low of 7813.33 points, about NT$6.23 trillion in market value has vanished since the TAIEX's tumble from 10,014.28 points on April 28.

With the nation's investing public numbering at around 9.43 million, each portfolio is estimated to have sustained losses of NT$200,000 in this month alone.

Taiwan is projected to lose a working-age population of about 6.67 million people in two waves of retirement in the coming years, as the nation confronts accelerating demographic decline and a shortage of younger workers to take their place, the Ministry of the Interior said. Taiwan experienced its largest baby boom between 1958 and 1966, when the population grew by 3.78 million, followed by a second surge of 2.89 million between 1976 and 1982, ministry data showed. In 2023, the first of those baby boom generations — those born in the late 1950s and early 1960s — began to enter retirement, triggering

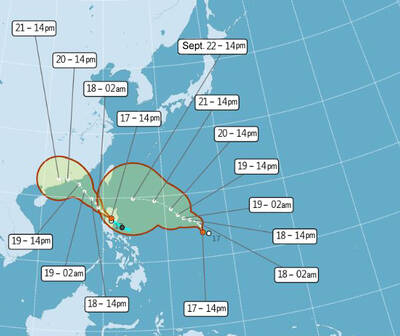

One of two tropical depressions that formed off Taiwan yesterday morning could turn into a moderate typhoon by the weekend, the Central Weather Administration (CWA) said yesterday. Tropical Depression No. 21 formed at 8am about 1,850km off the southeast coast, CWA forecaster Lee Meng-hsuan (李孟軒) said. The weather system is expected to move northwest as it builds momentum, possibly intensifying this weekend into a typhoon, which would be called Mitag, Lee said. The radius of the storm is expected to reach almost 200km, she said. It is forecast to approach the southeast of Taiwan on Monday next week and pass through the Bashi Channel

NO CHANGE: The TRA makes clear that the US does not consider the status of Taiwan to have been determined by WWII-era documents, a former AIT deputy director said The American Institute in Taiwan’s (AIT) comments that World War-II era documents do not determine Taiwan’s political status accurately conveyed the US’ stance, the US Department of State said. An AIT spokesperson on Saturday said that a Chinese official mischaracterized World War II-era documents as stating that Taiwan was ceded to the China. The remarks from the US’ de facto embassy in Taiwan drew criticism from the Ma Ying-jeou Foundation, whose director said the comments put Taiwan in danger. The Chinese-language United Daily News yesterday reported that a US State Department spokesperson confirmed the AIT’s position. They added that the US would continue to

The number of Chinese spouses applying for dependent residency as well as long-term residency in Taiwan has decreased, the Mainland Affairs Council said yesterday, adding that the reduction of Chinese spouses staying or living in Taiwan is only one facet reflecting the general decrease in the number of people willing to get married in Taiwan. The number of Chinese spouses applying for dependent residency last year was 7,123, down by 2,931, or 29.15 percent, from the previous year. The same census showed that the number of Chinese spouses applying for long-term residency and receiving approval last year stood at 2,973, down 1,520,