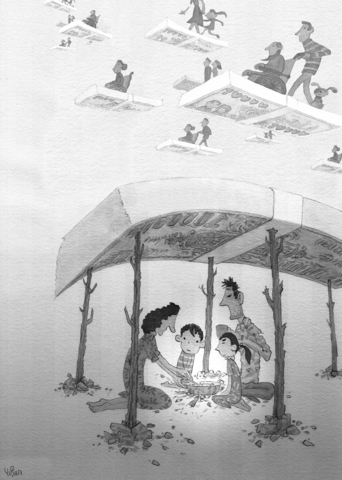

Bill Gates and Warren Buffett, the richest and second richest person in the US, and perhaps the world, are often described as admirers of Andrew Carnegie's famous 1889 essay The Gospel of Wealth. Carnegie's treatise, an American classic, provides a moral justification for the concentration of wealth that capitalism tends to create by arguing that immense wealth leads to well-spent charitable contributions and support of the arts and sciences. In short, Carnegie thought that great personal wealth leads to great civilizations.

The Gospel of Wealth is based on the premise that business competition results in "survival of the fittest" -- the fittest being those endowed with the most "talent for organization." Carnegie argued that those who thrive in business and acquire huge personal fortunes doing so are better at judging how the world really works, and thus are better qualified to judge where resources should be directed. Successful people, according to Carnegie, should retire from business while they still retain those talents and devote their remaining years to spending their fortunes on philanthropy.

Carnegie also advocated an inheritance tax as an incentive, arguing that it would "induce the rich man to attend to the administration of wealth during his life." Encouraging the rich to spend their fortunes on good causes while still alive, Carnegie maintained, is far better than leaving the disposition of their wealth to the care of their (probably untalented) children.

Last month, Bill Gates announced that he will do what Carnegie recommended: In two years, he will change his priorities so that he can work full time for the Bill and Melinda Gates Foundation, which he and his wife founded. Even earlier than Carnegie, who quit at 65, Gates will devote his life to spending his huge fortune on philanthropy.

Warren Buffett, by contrast, is 76, so he has missed his chance to apply his talents to running a charitable foundation. But, by leaving the bulk of his fortune, approximately US$31 billion, to the Gates Foundation, he will have done the next best thing.

Gates is a controversial figure, but few doubt that he is smart. Even so, whereas Carnegie's theory makes some sense (which is why his essay is remembered so well more than a century later), it isn't obvious that he was right to believe that successful business people are the best administrators of charitable foundations. Useful traits in business, like aggressiveness or political savvy, might be poorly suited to philanthropy. Likewise, running a foundation may well require studying social problems or the arts and sciences -- activities that may not accord with former capitalists' inclinations and talents.

The deeper flaw in Carnegie's theory may be that it is just too difficult psychologically for business people to make the mid-life career transition to philanthropy. Having accumulated great wealth as "survivors" of the business world, will they really turn their talents to the task of giving it away? Regardless of whether Gates lives up to his promise, are people like him the exception that proves the rule? It is easy to be skeptical that his example will spur a new wave of early retirements to run philanthropies.

The public-spirited justification of the concentration of wealth offered in The Gospel of Wealth has more support in the US than elsewhere, which reflects Americans' relatively greater admiration of business people. But Carnegie's argument never became received doctrine even in the US, because most people reject the view that rich business people are smarter and morally superior. Certainly, Gates and Buffett claim nothing of the sort. Similarly, even in the US, movies and TV shows do not dramatize the lives of great tycoon philanthropists. Americans, like everyone else, prefer portrayals of business people who are truly evil and in the end receive their just deserts.

And yet there is more charitable giving in the US than in other countries, reflecting a greater sense in the US that private benevolence is an obligation. According to the Johns Hopkins University Comparative Nonprofit Sector Project, headed by Lester Salamon, the US leads major countries in private contributions to nonprofits. Excluding donations to churches, such contributions amount to 1 percent of GDP in the US, which is six times higher than in Germany or Japan, and 30 times higher than in Mexico.

However, 1 percent of GDP is still not a very big number, and the Gates Foundation, with about US$60 billion after Buffett's bequest, now accounts for a substantial share of the total. Of course, Gates and Buffett deserve praise, and we should certainly wish them well. But we should not yet consider their example a vindication of The Gospel of Wealth.

Robert Shiller is professor of economics at Yale University and chief economist at MacroMarkets LLC, which he co-founded.

Copyright: Project Syndicate

In the US’ National Security Strategy (NSS) report released last month, US President Donald Trump offered his interpretation of the Monroe Doctrine. The “Trump Corollary,” presented on page 15, is a distinctly aggressive rebranding of the more than 200-year-old foreign policy position. Beyond reasserting the sovereignty of the western hemisphere against foreign intervention, the document centers on energy and strategic assets, and attempts to redraw the map of the geopolitical landscape more broadly. It is clear that Trump no longer sees the western hemisphere as a peaceful backyard, but rather as the frontier of a new Cold War. In particular,

As the Chinese People’s Liberation Army (PLA) races toward its 2027 modernization goals, most analysts fixate on ship counts, missile ranges and artificial intelligence. Those metrics matter — but they obscure a deeper vulnerability. The true future of the PLA, and by extension Taiwan’s security, might hinge less on hardware than on whether the Chinese Communist Party (CCP) can preserve ideological loyalty inside its own armed forces. Iran’s 1979 revolution demonstrated how even a technologically advanced military can collapse when the social environment surrounding it shifts. That lesson has renewed relevance as fresh unrest shakes Iran today — and it should

The last foreign delegation Nicolas Maduro met before he went to bed Friday night (January 2) was led by China’s top Latin America diplomat. “I had a pleasant meeting with Qiu Xiaoqi (邱小琪), Special Envoy of President Xi Jinping (習近平),” Venezuela’s soon-to-be ex-president tweeted on Telegram, “and we reaffirmed our commitment to the strategic relationship that is progressing and strengthening in various areas for building a multipolar world of development and peace.” Judging by how minutely the Central Intelligence Agency was monitoring Maduro’s every move on Friday, President Trump himself was certainly aware of Maduro’s felicitations to his Chinese guest. Just

On today’s page, Masahiro Matsumura, a professor of international politics and national security at St Andrew’s University in Osaka, questions the viability and advisability of the government’s proposed “T-Dome” missile defense system. Matsumura writes that Taiwan’s military budget would be better allocated elsewhere, and cautions against the temptation to allow politics to trump strategic sense. What he does not do is question whether Taiwan needs to increase its defense capabilities. “Given the accelerating pace of Beijing’s military buildup and political coercion ... [Taiwan] cannot afford inaction,” he writes. A rational, robust debate over the specifics, not the scale or the necessity,