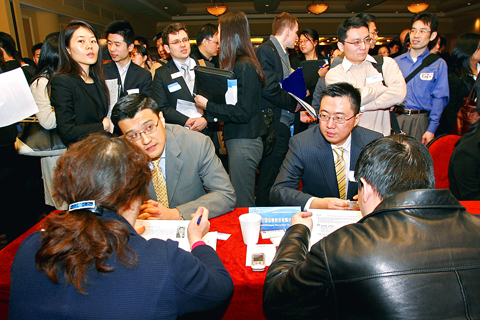

Mary Yu pitches hard to the recruiter sitting in front of her.

“I’ve got experience in risk management,” she says, naming the bank where she works and watching anxiously as the recruiter scribbles on her resume.

Yu, 43, breathes a sigh of relief when the recruiter places her resume in the review pile — she might be called back for another round of interviews.

PHOTO: NY TIMES NEWS SERVICE

Yu was just one of hundreds of jobseekers who attended a recruiting event in the ballroom of the Sheraton LaGuardia East Hotel in Flushing, Queens, where some of China’s largest financial institutions have traveled to recruit talent from abroad. The recruiters are picking from the ranks of financial sector employees who fear what the future might bring.

“I flew all the way from Charlotte [North Carolina], for this event. I’m trying to create a safety net for myself,” Yu said.

The New York event was the last of three stops made by the visiting Chinese delegation, which was made up of recruiters and representatives from more than 27 Chinese financial firms. The delegation, which held events in London and Chicago as part of its global recruiting tour, hoped to fill 170 positions by the end of its trip.

With jobs quickly disappearing from Wall Street and the boom in global finance over for the near future, China still offers opportunity, even as its own economy slows. Worldwide, thousands of financial service jobs have been erased because of the credit crisis, with London and New York suffering large losses.

Now, in a reverse miniature brain drain, Chinese financial institutions are taking advantage of the downturn and focusing on the newly unemployed to diversify and upgrade their own staffs.

“We’re looking very hard right now for experienced, senior-level talent who have knowledge of China. For our junior-level positions, we continue to recruit from our local Chinese talent pool,” said Chen Hong (陳宏), the chief executive of the Hina Group (漢能集團), a boutique global investment bank. The company specializes in cross-border mergers and acquisition advisory and has offices in Beijing and San Francisco.

In another reversal of fortune, China, because of its closed financial sector — which Washington and the West have been insisting China open — has been largely shielded from the toxic mortgage-backed securities that brought down many of the world’s banks. Capital flows in and out of China are tightly controlled and China’s capital markets are closed to foreign companies.

But China’s insular financial system has also kept it underdeveloped. Although employees of large Chinese financial institutions usually graduate from top Chinese universities, they lack practical market experience.

That lack of experience has sometimes led to poor decisions, and in some cases outright blunders. For example, the Citic Pacific Group of China (中信泰富) recently said its realized and potential losses from an attempt to hedge currency risk associated with a large purchase of Australian dollars (needed to buy iron for its steel mills in China) topped US$2.4 billion. The China Investment Corp (中國投資集團), the country’s sovereign wealth fund, which controls US$200 billion in assets, has lost money on almost all of its investments, including a loss of US$2.46 billion, or 82 percent, of the US$3 billion it invested in the Blackstone Group.

Perhaps it is not surprising then that the majority of the 27 financial institutions represented at the recruiting event, including Citic, the Bank of Shanghai (上海銀行), the Pudong Development Bank (浦東發展銀行) and the Shanghai Stock Exchange, all advertised for senior risk managers with three years to 10 years of experience with international companies in comparable positions.

More than 250 people pre-registered for the Queens event and more than 850 packed the ballroom. A long line spilled down the hallway, forcing staff members to limit interviews to three minutes. The applicants were a diverse array of nationalities.

“Institutions here are looking for people to fill senior positions overseeing risk management, compliance and derivatives. Most importantly, they’re looking for people with a global view,” said Qin Wang, 32, a banker and a member of the Chinese Finance Association, which helped organize the New York event.

In addition to formal recruiting events, many financial sector workers have sought jobs in China on their own, working through friends and informal social networks.

Tom Leggett, 30, left his investment banking job at Lazard in New York in July, ahead of expected layoffs, and moved to Beijing to search for opportunities.

“I talked things over with my parents and friends and decided to come to Beijing to canvas the scene,” he said. “I’ve been talking to both recruiters and friends in my network.”

Despite the swelling number of unemployed financial service employees, those qualified to work for Chinese firms is extremely small. Leggett’s background in Chinese — he studied Mandarin for four years as an undergraduate student at Columbia — made his move feasible. He has shocked many recruiters with his Chinese ability: “They see a tall, white guy and they’ve got low expectations. When they find out I can say a lot more than ‘hello,’ in Chinese, they begin to take me seriously.”

While most Chinese employees of financial institutions can speak English, Chinese is still a must for many recruiters.

“We’re looking for bilingual candidates because we are constantly negotiating with local Chinese companies, and those meetings are all in Chinese,” Hong said.

Despite the opportunities China can present, many candidates decide, in the end, not to move — hence the Chinese companies’ global search.

Robert Eng, 53, who used to work in the global investment division of Citigroup in New York, traveled to Hong Kong to interview for the director of private wealth position at a large Chinese financial institution. He received an offer, but turned it down, choosing to remain in the US.

“The compensation package was great, but at this point in my life it doesn’t make sense for me; my family is here. Maybe if I were 20 years younger,” Eng said.

For many ambitious overseas candidates, a matter of worry is that they are all but guaranteed to hit a glass ceiling at state-run Chinese companies. Senior management is appointed by the personnel department of the Chinese Communist Party — regardless of the votes or recommendations of shareholders or board directors.

And for many foreigners, the decision to move to China involves accepting a drastic change in lifestyle.

Brian Connors, 35, is the owner of the Bridge cafe, a popular Italian-style restaurant and cafe in the northwest of Beijing that caters to foreigners studying Mandarin and Chinese looking to practice their English.

“I’ve seen expatriates come and go — it’s a cyclical thing here. One of the major setbacks that causes foreigners to leave is health: pollution and congestion are hard on your body and lifestyle,” he said.

NO HUMAN ERROR: After the incident, the Coast Guard Administration said it would obtain uncrewed aerial vehicles and vessels to boost its detection capacity Authorities would improve border control to prevent unlawful entry into Taiwan’s waters and safeguard national security, the Mainland Affairs Council (MAC) said yesterday after a Chinese man reached the nation’s coast on an inflatable boat, saying he “defected to freedom.” The man was found on a rubber boat when he was about to set foot on Taiwan at the estuary of Houkeng River (後坑溪) near Taiping Borough (太平) in New Taipei City’s Linkou District (林口), authorities said. The Coast Guard Administration’s (CGA) northern branch said it received a report at 6:30am yesterday morning from the New Taipei City Fire Department about a

IN BEIJING’S FAVOR: A China Coast Guard spokesperson said that the Chinese maritime police would continue to carry out law enforcement activities in waters it claims The Philippines withdrew its coast guard vessel from a South China Sea shoal that has recently been at the center of tensions with Beijing. BRP Teresa Magbanua “was compelled to return to port” from Sabina Shoal (Xianbin Shoal, 仙濱暗沙) due to bad weather, depleted supplies and the need to evacuate personnel requiring medical care, the Philippine Coast Guard (PCG) spokesman Jay Tarriela said yesterday in a post on X. The Philippine vessel “will be in tiptop shape to resume her mission” after it has been resupplied and repaired, Philippine Executive Secretary Lucas Bersamin, who heads the nation’s maritime council, said

CHINA POLICY: At the seventh US-EU Dialogue on China, the two sides issued strong support for Taiwan and condemned China’s actions in the South China Sea The US and EU issued a joint statement on Wednesday supporting Taiwan’s international participation, notably omitting the “one China” policy in a departure from previous similar statements, following high-level talks on China and the Indo-Pacific region. The statement also urged China to show restraint in the Taiwan Strait. US Deputy Secretary of State Kurt Campbell and European External Action Service Secretary-General Stefano Sannino cochaired the seventh US-EU Dialogue on China and the sixth US-EU Indo-Pacific Consultations from Monday to Tuesday. Since the Indo-Pacific consultations were launched in 2021, references to the “one China” policy have appeared in every statement apart from the

More than 500 people on Saturday marched in New York in support of Taiwan’s entry to the UN, significantly more people than previous years. The march, coinciding with the ongoing 79th session of the UN General Assembly, comes close on the heels of growing international discourse regarding the meaning of UN Resolution 2758. Resolution 2758, adopted by the UN General Assembly in 1971, recognizes the People’s Republic of China (PRC) as the “only lawful representative of China.” It resulted in the Republic of China (ROC) losing its seat at the UN to the PRC. Taiwan has since been excluded from