Chip designer MediaTek Inc (聯發科) on Thursday released a new 5G smartphone chip that it hopes will be used in premium-priced Android smartphones, a market Qualcomm Inc currently dominates.

The Hsinchu-based company said its new Dimensity 9000 chip will be the world’s first to use its manufacturing partner Taiwan Semiconductor Manufacturing Co’s (台積電) “N4” chipmaking process, which helps makes chips that are smaller and faster. MediaTek said it would be the first smartphone chip to feature a powerful new computing core from Arm Ltd called the Cortex X2.

Along with Qualcomm and Samsung Electronics Co Ltd, MediaTek is one of only three firms in the world that makes 5G smartphone chips. The fourth major player — Huawei Technologies Co Ltd — was forced out of the market by US sanctions.

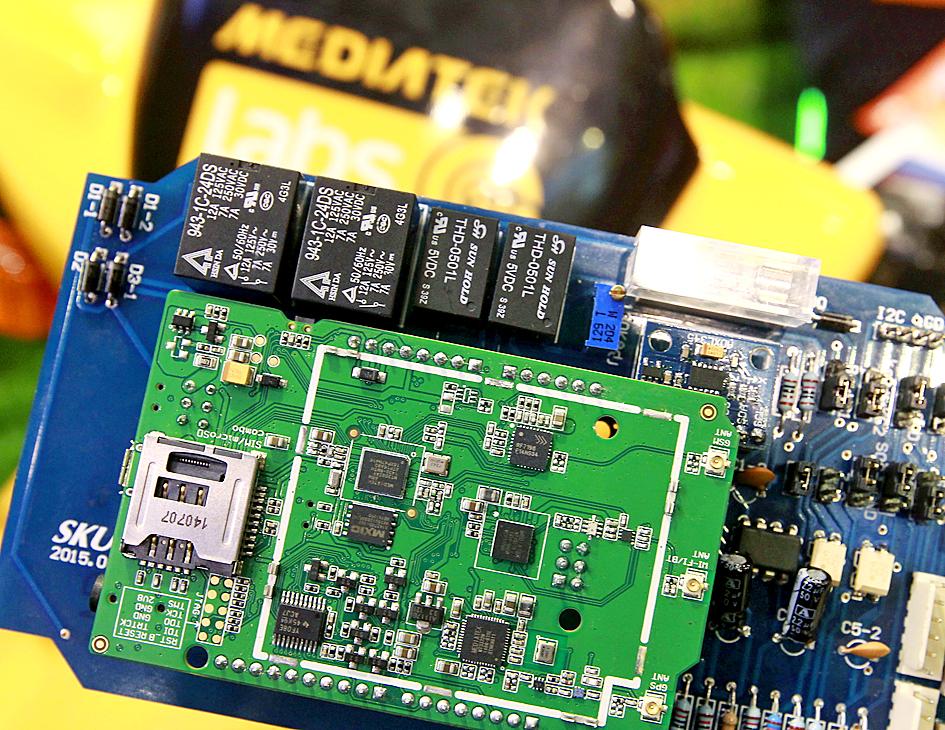

Photo: Reuters

Huawei’s exit set off a scramble by Android smartphone makers to capture market share vacated by the Chinese brand. MediaTek already counts many of the contenders for that market share, such as Xiaomi Corp, Oppo and Vivo as customers, but many of those brands use MediaTek for their low and mid-tier devices, and rely on Qualcomm for higher-end models.

Media-Tek chief financial officer David Ku (顧大為) said that the 9000 chip was the first in what is to be a series of chips aimed at persuading those customers to switch to using MediaTek in their flagship devices.

“We need to have a very strong army to march into the segment,” Ku said. “One product is not enough. This is our starting point.”

MediaTek hit US$10 billion in revenue for the first time last year, and Ku said it expects to hit US$17 billion this year, adding that 5G chips can sell for up to US$50.

“The No. 1 driving factor is really the much higher [average selling price] due to the 4G to 5G transition,” Ku said.

RECYCLE: Taiwan would aid manufacturers in refining rare earths from discarded appliances, which would fit the nation’s circular economy goals, minister Kung said Taiwan would work with the US and Japan on a proposed cooperation initiative in response to Beijing’s newly announced rare earth export curbs, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday. China last week announced new restrictions requiring companies to obtain export licenses if their products contain more than 0.1 percent of Chinese-origin rare earths by value. US Secretary of the Treasury Scott Bessent on Wednesday responded by saying that Beijing was “unreliable” in its rare earths exports, adding that the US would “neither be commanded, nor controlled” by China, several media outlets reported. Japanese Minister of Finance Katsunobu Kato yesterday also

Jensen Huang (黃仁勳), founder and CEO of US-based artificial intelligence chip designer Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) on Friday celebrated the first Nvidia Blackwell wafer produced on US soil. Huang visited TSMC’s advanced wafer fab in the US state of Arizona and joined the Taiwanese chipmaker’s executives to witness the efforts to “build the infrastructure that powers the world’s AI factories, right here in America,” Nvidia said in a statement. At the event, Huang joined Y.L. Wang (王英郎), vice president of operations at TSMC, in signing their names on the Blackwell wafer to

‘DRAMATIC AND POSITIVE’: AI growth would be better than it previously forecast and would stay robust even if the Chinese market became inaccessible for customers, it said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday raised its full-year revenue growth outlook after posting record profit for last quarter, despite growing market concern about an artificial intelligence (AI) bubble. The company said it expects revenue to expand about 35 percent year-on-year, driven mainly by faster-than-expected demand for leading-edge chips for AI applications. The world’s biggest contract chipmaker in July projected that revenue this year would expand about 30 percent in US dollar terms. The company also slightly hiked its capital expenditure for this year to US$40 billion to US$42 billion, compared with US$38 billion to US$42 billion it set previously. “AI demand actually

RARE EARTHS: The call between the US Treasury Secretary and his Chinese counterpart came as Washington sought to rally G7 partners in response to China’s export controls China and the US on Saturday agreed to conduct another round of trade negotiations in the coming week, as the world’s two biggest economies seek to avoid another damaging tit-for-tat tariff battle. Beijing last week announced sweeping controls on the critical rare earths industry, prompting US President Donald Trump to threaten 100 percent tariffs on imports from China in retaliation. Trump had also threatened to cancel his expected meeting with Chinese President Xi Jinping (習近平) in South Korea later this month on the sidelines of the APEC summit. In the latest indication of efforts to resolve their dispute, Chinese state media reported that