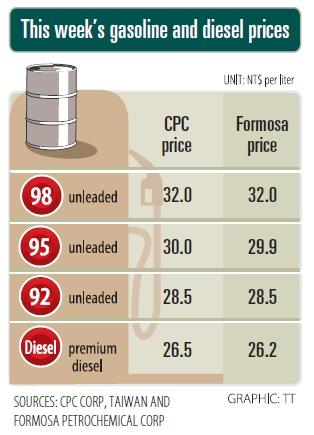

Oil refiner CPC Corp, Taiwan (CPC, 台灣中油) announced that it would today cut gasoline prices by NT$0.4 and diesel prices by NT$0.5 per liter to reflect the continued decline in international crude oil prices last week.

The second straight week of price cuts reflected the still-weak market sentiment, which is due to a supply glut after Libya resumed its crude oil exports and because the US might ease sanctions on Iranian oil exports, CPC said in a statement.

The average cost of its crude oil fell to US$71.1 per barrel last week from NT$74.31 a week earlier, the refiner said.

After taking into account the New Taiwan dollar’s depreciation of NT$0.13 against the US dollar during the week, CPC said it decided to cut wholesale prices for its fuels by 3.13 percent.

Formosa Petrochemical Corp (台塑石化) said it would match CPC’s price cuts, effective today, citing reports that Russia and other oil producers might increase their oil output and the US might release its strategic petroleum reserves, which have added to the already weak market sentiment.

In related news, CPC said that on Friday last week it signed a memorandum of understanding with Vietnam’s Sovico Holdings Co, regarding cooperation in oil exploration, oil product sales and related investments.

Sovico Holdings is a multi-sector holding company with a diversified portfolio, ranging from banking and finance to real estate, aviation, hospitality and industry.

The company has many large subsidiaries, including budget airline Vietjet Air, CPC said.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

United Microelectronics Corp (UMC, 聯電) forecast that its wafer shipments this quarter would grow up to 7 percent sequentially and the factory utilization rate would rise to 75 percent, indicating that customers did not alter their ordering behavior due to the US President Donald Trump’s capricious US tariff policies. However, the uncertainty about US tariffs has weighed on the chipmaker’s business visibility for the second half of this year, UMC chief financial officer Liu Chi-tung (劉啟東) said at an online earnings conference yesterday. “Although the escalating trade tensions and global tariff policies have increased uncertainty in the semiconductor industry, we have not