For a Wall Street star once dubbed the “Baby Buffett,” Bill Ackman is having a pretty bad year.

Huge bets on companies like Valeant Pharmaceuticals International Inc and Herbalife Ltd have delivered steep losses to the flamboyant billionaire’s Pershing Square Capital Management LP hedge fund.

With about US$12 billion under management, Pershing lost about 20 percent in the first half this year, securities filings show.

Photo: Bloomberg

Everything suggests that the second half is unlikely to be much better, after Ackman’s crusade against nutritional supplement direct sales company Herbalife, which he shorted as he labeled it a pyramid fund, was rebuffed on Friday.

Agreeing with Ackman’s longtime rival in Wall Street big-time activist investing, Carl Icahn, the US Federal Trade Commission ruled Herbalife is not a pyramid operation and, while forcing it to pay out US$200 million to injured distributors, said the company could stay in business.

Herbalife shares jumped 9.9 percent, generously benefiting Icahn, who holds 25 percent.

It is not clear how Ackman, 50, fared financially at the apparent end of his three-year siege of the company, in which Pershing took a large short position, betting Herbalife shares would sink.

“This is a victory for Herbalife shareholders and a total defeat for the short camp,” Pivotal Research Group analyst Timothy Ramey said.

Ackman did not concede, even if the market moved against him.

He said that the US Federal Trade Commission had ordered changes to the way Herbalife does business and that eventually those would undermine the company’s business model.

“We expect that once Herbalife’s business restructuring is fully implemented, these fundamental structural changes will cause the pyramid to collapse,” Pershing said in a statement.

The stylishly coiffed, Harvard grad golden boy of the exclusive New York hedge fund billionaires club, Ackman has a history of taking contrarian stakes and then going very public with them.

After Pershing made a US$1 billion bet in 2012 that Herbalife’s shares would tumble, he publicly labeled the company a Ponzi scheme, comparing it to Enron Corp, the high-flying energy group that plunged into bankruptcy in 2001, and the Bernie Madoff fund collapse seven years later.

Putting his credibility on the line, Ackman inundated media and the Internet with appearances and videos arguing his case that Herbalife would collapse.

The Pershing short gambled on Herbalife shares falling from US$47, but they have traded well above that level since February and finished at US$65.25 on Friday.

Ackman has admitted that carrying the short bet has cost the fund US$20 million a year.

Ackman’s emotional commitment to his positions was also apparent in his investment on Valeant Pharmaceuticals International Inc.

He took a huge position on the future of the Canadian drugmaker as it expanded via aggressive takeovers, only to see the shares plummet in scandals over Valeant’s business model and accounting methods.

After surging to a peak of more than US$263 in the middle of last year, Valeant’s shares have plunged to below US$23, while Pershing has clung to its sizable stake in the debt-laden company.

Ackman’s style and recent record has not impressed some on Wall Street.

“We believe Ackman typifies the activist behaviors that destroy, rather than create, long-term shareholder value,” David Trainer and Sam McBride from investment research house New Constructs said in a note.

Joseph Fahmy, managing director at Zor Capital in New York, tweeted a similar view.

“I don’t feel bad for Ackman. I feel bad for the people who piggy-backed his trade without doing their own due diligence,” he said.

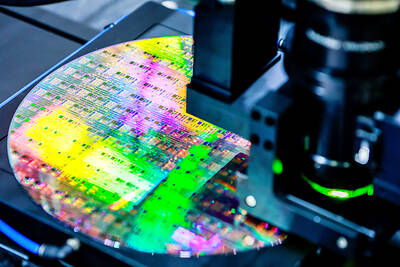

TECH TITAN: Pandemic-era demand for semiconductors turbocharged the nation’s GDP per capita to surpass South Korea’s, but it still remains half that of Singapore Taiwan is set to surpass South Korea this year in terms of wealth for the first time in more than two decades, marking a shift in Asia’s economic ranks made possible by the ascent of Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). According to the latest forecasts released on Thursday by the central bank, Taiwan’s GDP is expected to expand 4.55 percent this year, a further upward revision from the 4.45 percent estimate made by the statistics bureau last month. The growth trajectory puts Taiwan on track to exceed South Korea’s GDP per capita — a key measure of living standards — a

Samsung Electronics Co shares jumped 4.47 percent yesterday after reports it has won approval from Nvidia Corp for the use of advanced high-bandwidth memory (HBM) chips, which marks a breakthrough for the South Korean technology leader. The stock closed at 83,500 won in Seoul, the highest since July 31 last year. Yesterday’s gain comes after local media, including the Korea Economic Daily, reported that Samsung’s 12-layer HBM3E product recently passed Nvidia’s qualification tests. That clears the components for use in the artificial intelligence (AI) accelerators essential to the training of AI models from ChatGPT to DeepSeek (深度求索), and finally allows Samsung

Taiwan has imposed restrictions on the export of chips to South Africa over national security concerns, taking the unusual step of using its dominance of chip markets to pressure a country that is closely allied with China. Taiwan requires preapproval for the bulk of chips sold to the African nation, the International Trade Administration said in a statement. The decision emerged after Pretoria tried to downgrade Taipei’s representative office and force its move to Johannesburg from Pretoria, the Ministry of Foreign Affairs has said. The move reflects Taiwan’s economic clout and a growing frustration with getting sidelined by Beijing in the diplomatic community. Taiwan

READY TO HELP: Should TSMC require assistance, the government would fully cooperate in helping to speed up the establishment of the Chiayi plant, an official said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said its investment plans in Taiwan are “unchanged” amid speculation that the chipmaker might have suspended construction work on its second chip packaging plant in Chiayi County and plans to move equipment arranged for the plant to the US. The Chinese-language Economic Daily News reported earlier yesterday that TSMC had halted the construction of the chip packaging plant, which was scheduled to be completed next year and begin mass production in 2028. TSMC did not directly address whether construction of the plant had halted, but said its investment plans in Taiwan remain “unchanged.” The chipmaker started