Taiwanese TV and phone makers are expected to usher in a traditionally busy fourth quarter thanks to year-end holiday spending, with quarterly shipments of handsets and liquid-crystal-display (LCD) TVs to post growth from the third quarter, a report from Digitimes said.

Total shipments of handsets made by Taiwanese firms are expected to grow 12 percent from the third quarter to 18 million units, said the report released this month.

In the contract phone business market, US giant Motorola is still playing a main role as it releases major orders to local contract makers, with its shipments expected to account for about 20 percent of total Taiwanese volume in the current quarter, it said.

Meanwhile, sales of HTC Corp’s (宏達電) Android phones in the US market would be the key indicator of Taiwanese own brand shipment volume, it said.

“The launch of Microsoft Corp’s Windows Mobile 6.5 operating system last month didn’t really excite the market in terms of functionality and user interface,” the report said.

Therefore, HTC is expected to take advantage of the growing Android platform from Google Inc to make up for sagging sales of Windows Mobile smartphones.

HTC, the leading maker of smartphones running on both Android and Windows Mobile platforms, forecast a strong fourth quarter on Monday.

Revenues this quarter are expected to range between NT$40 billion (US$1.2 billion) to NT$42 billion, the highest of the year, with major US carriers promoting HTC phones for the Christmas season, HTC spokesman Cheng Hui-min (鄭慧明) said.

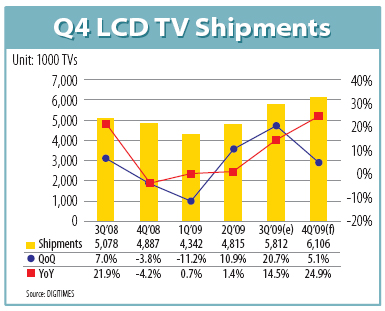

Meanwhile, Digitimes said fourth-quarter shipments of LCD TVs are expected to grow 5.1 percent from the third quarter to 6.11 million.

Brand vendors are widely expected to slash prices to promote TVs for the holiday season, thanks to an oversupply of panels, causing prices to drop.

TVs with 32-inch screens or larger would see a “significant price decrease,” with sales of such models to account for 57 percent of all shipments, the report said.

The top five contract makers, including Amtran Technology Co Ltd (瑞軒科技), TPV Technology Ltd (冠捷) and Compal Electronics Inc (仁寶電腦), are expected to command more than 90 percent of Taiwan’s total LCD TV production this quarter, it said.

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

Six Taiwanese companies, including contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), made the 2025 Fortune Global 500 list of the world’s largest firms by revenue. In a report published by New York-based Fortune magazine on Tuesday, Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), ranked highest among Taiwanese firms, placing 28th with revenue of US$213.69 billion. Up 60 spots from last year, TSMC rose to No. 126 with US$90.16 billion in revenue, followed by Quanta Computer Inc (廣達) at 348th, Pegatron Corp (和碩) at 461st, CPC Corp, Taiwan (台灣中油) at 494th and Wistron Corp (緯創) at

NEW PRODUCTS: MediaTek plans to roll out new products this quarter, including a flagship mobile phone chip and a GB10 chip that it is codeveloping with Nvidia Corp MediaTek Inc (聯發科) yesterday projected that revenue this quarter would dip by 7 to 13 percent to between NT$130.1 billion and NT$140 billion (US$4.38 billion and US$4.71 billion), compared with NT$150.37 billion last quarter, which it attributed to subdued front-loading demand and unfavorable foreign exchange rates. The Hsinchu-based chip designer said that the forecast factored in the negative effects of an estimated 6 percent appreciation of the New Taiwan dollar against the greenback. “As some demand has been pulled into the first half of the year and resulted in a different quarterly pattern, we expect the third quarter revenue to decline sequentially,”

DIVERSIFYING: Taiwanese investors are reassessing their preference for US dollar assets and moving toward Europe amid a global shift away from the greenback Taiwanese investors are reassessing their long-held preference for US-dollar assets, shifting their bets to Europe in the latest move by global investors away from the greenback. Taiwanese funds holding European assets have seen an influx of investments recently, pushing their combined value to NT$13.7 billion (US$461 million) as of the end of last month, the highest since 2019, according to data compiled by Bloomberg. Over the first half of this year, Taiwanese investors have also poured NT$14.1 billion into Europe-focused funds based overseas, bringing total assets up to NT$134.8 billion, according to data from the Securities Investment Trust and Consulting Association (SITCA),