Taiwan’s chip makers, powerful drivers of growth in the nation, may have survived their worst crisis ever, but lackluster sales and new rivals still make these risky times.

The local semiconductor industry, the fourth-largest in the world, saw sales soar by a steep margin in the second quarter, but is set to become markedly less feverish in the third quarter, analysts said.

“The slowing pace of growth shows the global recovery may not be as fast as previously anticipated,” said Mars Hsu, a Taipei-based technology analyst with Grand Cathay Securities (大華證券).

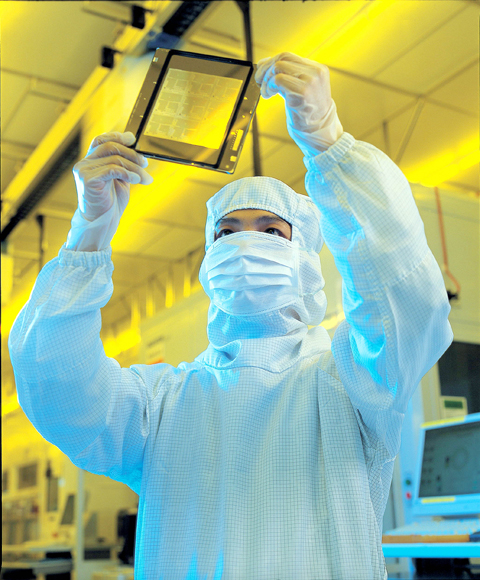

PHOTO: AFP

In the three months to June, combined revenues of the nation’s chip makers soared 69.2 percent from the previous quarter to NT$136.2 billion (US$4.18 billion), the Taiwan Semiconductor Industry Association (TSIA, 台灣半導體協會) said.

This followed a record 33.7 percent quarter-on-quarter drop in the three months to March for an industry that, more than any other, helped give Taiwan its reputation as a high-tech nation.

The pickup in sales in the second quarter was largely due to unique factors, such as a need among clients to rebuild inventories after the immediate shocks of the worst crisis in decades.

“Clients found their inventories were low as a result of the uncertainty that gripped the market after the crisis last year,” said Peng Mao-jung (彭茂榮), an analyst of the quasi-official Industrial Technology Research Institute (ITRI, 工研院).

Contributing to the fast pace of growth in the second quarter was also another one-off factor — a rush of orders from China after the Chinese government adopted massive stimulus spending to lift its flagging economy.

One-offs do not last long, and analysts suspect that the industry may be losing momentum with Peng forecasting growth of just 17 percent in the third quarter from the second.

The 17 percent growth forecast is shared by United Microelectronics Corp (UMC, 聯電), the world’s No. 2 contract microchip maker.

The company has said its demand in the third quarter, a typically busy period of the year for the chip industry, has slowed because of rising economic uncertainties.

The upshot is that the nation’s chip output will reach NT$541.5 billion this year, marking a 17.2 percent fall from the previous year.

“Basically, despite the strong rebound in the recent months, this is not going to be a good year for the local semiconductor industry,” Peng said.

On top of this, Taiwan’s chip manufacturers are now bracing themselves for a challenge from an unusual quarter — the Middle East.

Abu Dhabi investment firm Advanced Technology Investment Company (ATIC) has offered to buy Singapore’s Chartered Semiconductor Manufacturing Ltd (特�?or US$3.9 billion.

ATIC is also the main shareholder in Globalfoundries, a joint venture with US firm Advanced Micro Devices Inc (AMD).

Chartered Semiconductor and Globalfoundries together account for around 13 percent of the global market in terms of foundry services.

Although this is still dwarfed by the 49 percent held by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), it does reflect tectonic shifts in the global chip industry facilitated by the financial crisis, observers said.

“The global recession has opened up a number of opportunities for the strong to get stronger,” said Len Jelinek, a chief analyst at the iSuppli Corp, a California-based research and consultancy firm.

“[This is] causing a dramatic shift in who will be the leaders in the pure-play foundry market for years to come,” he said.

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong

RESHAPING COMMERCE: Major industrialized economies accepted 15 percent duties on their products, while charges on items from Mexico, Canada and China are even bigger US President Donald Trump has unveiled a slew of new tariffs that boosted the average US rate on goods from across the world, forging ahead with his turbulent effort to reshape international commerce. The baseline rates for many trading partners remain unchanged at 10 percent from the duties Trump imposed in April, easing the worst fears of investors after the president had previously said they could double. Yet his move to raise tariffs on some Canadian goods to 35 percent threatens to inject fresh tensions into an already strained relationship, while nations such as Switzerland and New Zealand also saw increased