■LIVESTOCK

Sheep sold for world record

A sheep has sold for a world record £231,000 (US$376,200) at a Scottish livestock auction, a British sheep society said. Deveronvale Perfection, a Texel breed admired by his new owner for his “great body and strong loin,” will be used for breeding. Experts are predicting the tup, the farming term for an uncastrated sheep, will prove a bargain over the long term for his new owner. “It comes down to genetics,” said British Texel Sheep Society chief executive, John Yates, on the society’s Web site. “Breeders are looking at the decades of sheep that this blood line can produce.” Graham Morrison, who owned Perfection, said the price surpassed his wildest dreams, the Web site said. Farmer Jimmy Douglas of Cairness, Scotland, who forked out the record amount, was quoted as saying Perfection was the best lamb he had ever seen.

■PROPERTY

Qatar to invest in Songbird

Qatar Holding LLC said it would become the largest shareholder in Songbird Estates PLC, the biggest landlord in London’s Canary Wharf, after the UK property company agreed on Friday to sell shares to repay loans. Qatar Holding would own 14.8 percent of Songbird by investing in the company’s preferred stock, the Doha-based arm of the Qatar Investment Authority said in a statement. Songbird agreed to sell shares to institutions, including Qatar Holding and China’s sovereign wealth fund to repay £880 million (US$1.4 billion) in bank loans. The UK’s biggest real-estate companies tapped investors for cash this year after a slump in commercial-property values threatened to make them breach the terms of their bank loans. Songbird is the largest shareholder in the company that owns 16 of the 30 office buildings that comprise Canary Wharf, an area by the River Thames covering 39 hectares.

■INVESTMENT

CIC boosts fund investment

China Investment Corp (CIC, 中投公司), China’s sovereign wealth fund, is continuing to shift its investments away from cash and shifting billions to hedge funds and private-equity funds, chairman Lou Jiwei (樓繼偉) said. China Investment has invested “many times” the US$500 million that CIC was reported to have placed in hedge funds and private-equity firms in June, Lou said in an interview in Beijing yesterday. He said China Investment was also investing in fund-of-funds. Lou said Beijing-based CIC’s performance this year “has not been bad” following last year’s 2.1 percent decline in its global investments. He didn’t elaborate. China Investment had US$297.5 billion in assets and 87.4 percent of its global portfolio invested in cash and cash equivalents at the end of last year, the fund reported earlier this month.

■FINANCE

Shin Kong to raise funds

Shin Kong Financial Holding Co (新光金控) said on Friday that its board had approved another NT$5 billion (US$151.9 million) fund-raising plan by issuing new shares, it said in a press statement. The new shares will first be open to the company’s shareholders for subscription before being released to the company chairman or via private placement, the statement said without providing details, including a timetable. Along with the earlier US$375 million fund raised via the issuance of global depositary receipts late last month, the new funds will be used to boost the capital adequacy ratio of the firm’s life insurance subsidiary, Shin Kong Life Insurance Co (新光人壽), Taiwan’s third-largest life insurer.

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong

A proposed 100 percent tariff on chip imports announced by US President Donald Trump could shift more of Taiwan’s semiconductor production overseas, a Taiwan Institute of Economic Research (TIER) researcher said yesterday. Trump’s tariff policy will accelerate the global semiconductor industry’s pace to establish roots in the US, leading to higher supply chain costs and ultimately raising prices of consumer electronics and creating uncertainty for future market demand, Arisa Liu (劉佩真) at the institute’s Taiwan Industry Economics Database said in a telephone interview. Trump’s move signals his intention to "restore the glory of the US semiconductor industry," Liu noted, saying that

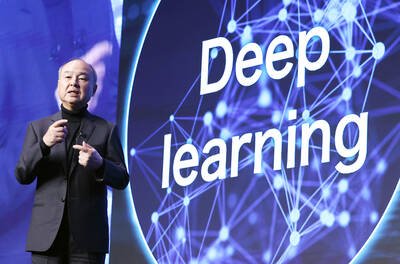

AI: Softbank’s stake increases in Nvidia and TSMC reflect Masayoshi Son’s effort to gain a foothold in key nodes of the AI value chain, from chip design to data infrastructure Softbank Group Corp is building up stakes in Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the latest reflection of founder Masayoshi Son’s focus on the tools and hardware underpinning artificial intelligence (AI). The Japanese technology investor raised its stake in Nvidia to about US$3 billion by the end of March, up from US$1 billion in the prior quarter, regulatory filings showed. It bought about US$330 million worth of TSMC shares and US$170 million in Oracle Corp, they showed. Softbank’s signature Vision Fund has also monetized almost US$2 billion of public and private assets in the first half of this year,