A six-week rally in Asian stocks faltered this week, as earnings from companies such as China Mobile Ltd and KDDI Corp reduced optimism the global economy is recovering.

China Mobile (中國移動通信), the world’s biggest wireless carrier, sank 6.6 percent in Hong Kong after first-quarter profit grew at the slowest rate in five years. KDDI, Japan’s second biggest, lost 6 percent after projecting the slowest earnings growth since 2006. PCCW Ltd, Hong Kong’s biggest phone carrier, slumped 16 percent as Chairman Richard Li abandoned his US$2.1 billion takeover bid.

“You’re seeing cold water being poured on the theme of a sharp rebound in growth,” said Tim Schroeders, who helps manage about US$1 billion at Pengana Capital Ltd in Melbourne. “It’s encouraging that a bottom has been perceived, but given the likelihood of a protracted period of low growth, some of these share prices ran ahead of reality.”

PHOTO: BLOOMBERG

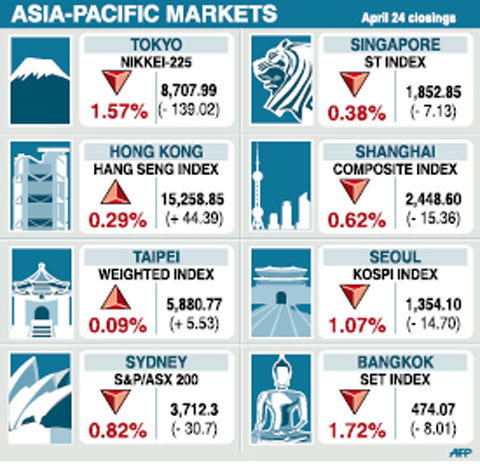

The MSCI Asia-Pacific Index slipped 0.2 this week to 89.52, following a 25 percent rally in the previous six weeks. It plunged by a record 43 percent last year as the credit crunch tipped the world’s largest economies into recession, forcing companies to cut jobs amid slumping profits.

Japan’s Nikkei 225 Stock Average and Hong Kong’s Hang Seng Index both declined 2.2 percent. Thailand’s SET Index advanced 3.8 percent as Thai Prime Minister Abhisit Vejjajiva ended 12 days of emergency rule in Bangkok, saying the nation has “returned to normal.”

Taiwanese share prices are expected to meet further technical resistance ahead of the psychological 6,000-point level, dealers said on Friday.

As the market repeatedly failed to pass the figure in the past few sessions, investors have kept alert on possible technical corrections after the bourse had staged significant gains recently, they said.

Market sentiment has become cautious before Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract microchip maker, reports its first quarter results on Thursday, they added.

Investors are also watching closely how the US auto sector will resolve its financial difficulties and how Wall Street reacts to the development, they said.

While it is possible for the market to challenge 6,000 points again next week, downside pressure is expected to drag the index down with technical support at around 5,600, dealers said.

In the week to Friday, the weighted index rose 125.39 points, or 2.18 percent, to 5,880.77 after a 0.5 percent decline a week earlier.

Average daily turnover stood at NT$130.81 billion (US$3.88 billion), compared with NT$168.57 billion a week ago.

“The market is waiting for TSMC’s comments on an outlook of the global high tech industry,” Taiwan International Securities (金鼎證券) analyst Arch Shih (施博元) said.

Taiwan’s economy has been badly hit as its electronics exports suffered steep declines amid a global economic meltdown. While major high-tech firms have canceled unpaid leave after receiving large orders from China, “investors need real numbers. The upcoming TSMC investor conference is the key,” Shih said.

Other markets on Friday:

BANGKOK: Up 1.72 percent. The Stock Exchange of Thailand composite index gained 8.01 points to 474.07. Investors welcomed the lifting of a state of emergency in and around Bangkok before profit-taking later in the day, dealers said.

KUALA LUMPUR: Up 1.40 percent. The Kuala Lumpur Composite Index gained 14.04 points to 992.68.

JAKARTA: Flat. The Jakarta Composite Index lost 1.37 points to 1,591.33.

MANILA: Up 1.7 percent. The composite index gained 35.33 points to 2,103.63. The market was lifted by regulators’ approval of a rate hike by Meralco, the country’s biggest power distributor, as well as moves in Congress to push for amendments to the constitution to remove a ban on foreigners from owning land.

WELLINGTON: Flat. The NZX-50 index fell 2.46 points to 2,656.39.

MUMBAI: Up 1.74 percent. The 30-share SENSEX rose 194.06 points to 11,329.05.

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

Six Taiwanese companies, including contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), made the 2025 Fortune Global 500 list of the world’s largest firms by revenue. In a report published by New York-based Fortune magazine on Tuesday, Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), ranked highest among Taiwanese firms, placing 28th with revenue of US$213.69 billion. Up 60 spots from last year, TSMC rose to No. 126 with US$90.16 billion in revenue, followed by Quanta Computer Inc (廣達) at 348th, Pegatron Corp (和碩) at 461st, CPC Corp, Taiwan (台灣中油) at 494th and Wistron Corp (緯創) at

NEW PRODUCTS: MediaTek plans to roll out new products this quarter, including a flagship mobile phone chip and a GB10 chip that it is codeveloping with Nvidia Corp MediaTek Inc (聯發科) yesterday projected that revenue this quarter would dip by 7 to 13 percent to between NT$130.1 billion and NT$140 billion (US$4.38 billion and US$4.71 billion), compared with NT$150.37 billion last quarter, which it attributed to subdued front-loading demand and unfavorable foreign exchange rates. The Hsinchu-based chip designer said that the forecast factored in the negative effects of an estimated 6 percent appreciation of the New Taiwan dollar against the greenback. “As some demand has been pulled into the first half of the year and resulted in a different quarterly pattern, we expect the third quarter revenue to decline sequentially,”

ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip assembly and testing service provider, yesterday said it would boost equipment capital expenditure by up to 16 percent for this year to cope with strong customer demand for artificial intelligence (AI) applications. Aside from AI, a growing demand for semiconductors used in the automotive and industrial sectors is to drive ASE’s capacity next year, the Kaohsiung-based company said. “We do see the disparity between AI and other general sectors, and that pretty much aligns the scenario in the first half of this year,” ASE chief operating officer Tien Wu (吳田玉) told an