Asian stocks declined for the third consecutive week as the deepening global recession crimped earnings and forced companies to raise capital.

Nomura Holdings Inc, Japan’s largest brokerage, slumped 7.8 percent on concern its US$3.1 billion stock sale will dilute shareholder value. Woolworths Ltd, Australia’s biggest retailer, lost 5.4 percent on lower-than-expected profit. BlueScope Steel Ltd, the nation’s largest steelmaker, tumbled 29 percent after forecasting a second-half loss and slashing its dividend.

“Pessimism about company earnings hasn’t yet run its course,” said Naoyuki Torii, general manager of equities at Fukoku Mutual Life Insurance Co, which manages about US$59 billion. “As massive losses are eating into companies’ capital, investors are expecting more businesses will sell new shares and dilute shareholders’ equity.”

The MSCI Asia-Pacific Index lost 1.1 percent in the past five days to 75.19, extending losses after posting its steepest weekly plunge since October in the previous week. The gauge, which has lost 16 percent this year, fell to the lowest in more than five years on Feb. 24.

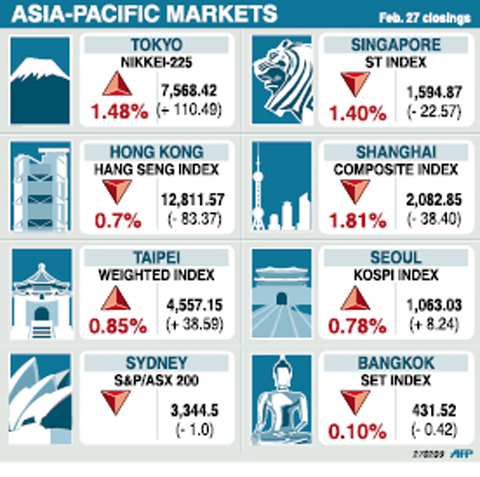

The Nikkei 225 Stock Average gained 2.1 percent this week, while Hong Kong’s Hang Seng index added 0.9 percent. China’s Shanghai Composite Index slumped 8.7 percent and Australia’s S&P/ASX 200 Index dropped 1.7 percent.

MSCI’s Asian index slumped by a record 43 percent last year as the credit crunch tipped the world’s largest economies into recession, forcing companies to cut jobs amid falling profits. Earnings estimates for companies in the gauge have been slashed 44 percent since the beginning of this year, data compiled by Bloomberg show.

Taiwanese share prices are expected to extend momentum next week, as the market is full of liquidity with bargain hunters eager to take advantage of low valuations, dealers said on Friday.

The market is expected to test 4,700 points next week, while the market is likely to see support at around 4,400 points as investors pocket profits, they said.

For the week ended Friday, the weighted index rose 120.21 points, or 2.71 percent, to 4,557.15 after a 3.35 percent fall the previous week.

Average daily turnover stood at NT$62.53 billion (US$1.79 billion), compared with NT$65.84 billion a week ago.

“After the central bank repeatedly cut its key interest rates, the market is immersed with idle money. Many investors are seeking buying opportunities,” Grand Cathay Securities (大華證券) analyst Mars Hsu said.

Last week, the central bank slashed rates for the seventh time in four months to boost the domestic economy, which contracted 8.36 percent in the fourth quarter of last year.

“Electronics stocks may have a better chance to gain as major companies have received large orders from China. It is an encouraging sign,” Hsu said.

In other markets on Friday it was:

KUALA LUMPUR: Down 0.3 percent. The Kuala Lumpur Composite Index lost 2.75 points to 890.67 as negative leads from Wall Street kept investors on the sidelines.

MANILA: Down 0.4 percent. The composite index fell 8.16 points to 1,872.22.

MUMBAI: Down 0.71 percent. The benchmark 30-share SENSEX index slid 63.25 points to 8,891.61, snapping two consecutive days of gains.

WELLINGTON: Up 0.99 percent. The benchmark NZX-50 index gained 24.88 points to 2,522.32.

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

Six Taiwanese companies, including contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), made the 2025 Fortune Global 500 list of the world’s largest firms by revenue. In a report published by New York-based Fortune magazine on Tuesday, Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), ranked highest among Taiwanese firms, placing 28th with revenue of US$213.69 billion. Up 60 spots from last year, TSMC rose to No. 126 with US$90.16 billion in revenue, followed by Quanta Computer Inc (廣達) at 348th, Pegatron Corp (和碩) at 461st, CPC Corp, Taiwan (台灣中油) at 494th and Wistron Corp (緯創) at

NEW PRODUCTS: MediaTek plans to roll out new products this quarter, including a flagship mobile phone chip and a GB10 chip that it is codeveloping with Nvidia Corp MediaTek Inc (聯發科) yesterday projected that revenue this quarter would dip by 7 to 13 percent to between NT$130.1 billion and NT$140 billion (US$4.38 billion and US$4.71 billion), compared with NT$150.37 billion last quarter, which it attributed to subdued front-loading demand and unfavorable foreign exchange rates. The Hsinchu-based chip designer said that the forecast factored in the negative effects of an estimated 6 percent appreciation of the New Taiwan dollar against the greenback. “As some demand has been pulled into the first half of the year and resulted in a different quarterly pattern, we expect the third quarter revenue to decline sequentially,”

RESHAPING COMMERCE: Major industrialized economies accepted 15 percent duties on their products, while charges on items from Mexico, Canada and China are even bigger US President Donald Trump has unveiled a slew of new tariffs that boosted the average US rate on goods from across the world, forging ahead with his turbulent effort to reshape international commerce. The baseline rates for many trading partners remain unchanged at 10 percent from the duties Trump imposed in April, easing the worst fears of investors after the president had previously said they could double. Yet his move to raise tariffs on some Canadian goods to 35 percent threatens to inject fresh tensions into an already strained relationship, while nations such as Switzerland and New Zealand also saw increased