Federal prosecutors investigating the collapse of Lehman Brothers have subpoenaed several executives associated with the company, including former CEO Richard Fuld, a source briefed on the inquiry said.

An attorney for Lehman Brothers Holdings, Harvey Miller, told a bankruptcy court judge on Thursday that at least 12 people have received grand jury subpoenas in connection with several ongoing probes of the bank’s demise.

He did not identify which executives had been asked for information, but said the company was dealing with separate investigations by federal prosecutors in New Jersey, Brooklyn and Manhattan. New Jersey’s attorney general has said state securities regulators there are also investigating.

Separately, Singapore’s central bank was investigating accusations of misconduct in the sale of investments packaged by Lehman Brothers Holdings and other financial institutions (FI) hit by the global financial crisis, news reports said yesterday.

The Monetary Authority of Singapore “confirms that we have been conducting formal inquiries into allegation of breaches of law, inadequate internal controls by the FIs or poor sales practices by their representatives,” the authority said in a statement on Friday.

It was the latest move by the central bank to help some of the 10,000 retail investors in Singapore who invested S$500 million (US$337.91 million) in financial products linked to Lehman Brothers.

Singaporeans who bought failed Lehman minibonds have been pressing the government to help salvage their investments. The central bank has not ruled out buying back Lehman minibonds.

Meanwhile, the Hong Kong Monetary Authority appointed PricewaterhouseCoopers LLP to monitor bank repurchases of minibonds guaranteed by Lehman Brothers.

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong

A proposed 100 percent tariff on chip imports announced by US President Donald Trump could shift more of Taiwan’s semiconductor production overseas, a Taiwan Institute of Economic Research (TIER) researcher said yesterday. Trump’s tariff policy will accelerate the global semiconductor industry’s pace to establish roots in the US, leading to higher supply chain costs and ultimately raising prices of consumer electronics and creating uncertainty for future market demand, Arisa Liu (劉佩真) at the institute’s Taiwan Industry Economics Database said in a telephone interview. Trump’s move signals his intention to "restore the glory of the US semiconductor industry," Liu noted, saying that

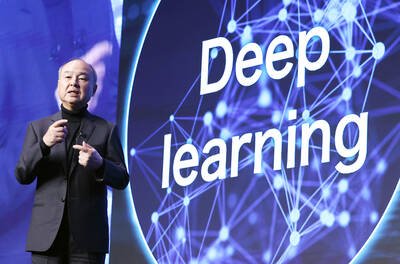

AI: Softbank’s stake increases in Nvidia and TSMC reflect Masayoshi Son’s effort to gain a foothold in key nodes of the AI value chain, from chip design to data infrastructure Softbank Group Corp is building up stakes in Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the latest reflection of founder Masayoshi Son’s focus on the tools and hardware underpinning artificial intelligence (AI). The Japanese technology investor raised its stake in Nvidia to about US$3 billion by the end of March, up from US$1 billion in the prior quarter, regulatory filings showed. It bought about US$330 million worth of TSMC shares and US$170 million in Oracle Corp, they showed. Softbank’s signature Vision Fund has also monetized almost US$2 billion of public and private assets in the first half of this year,