Asian stocks closed mostly higher on Friday with investors shrugging off a mixed performance by Wall Street and ongoing concerns about a further sell-off in China.

However, fears that Beijing would again move to cool its markets -- after tripling the tax on stock transactions earlier in the week -- resulted in Shanghai falling 2.65 percent and Hong Kong dropping 0.15 percent.

Those investor jitters were limited to China and elsewhere the mood was far more buoyant.

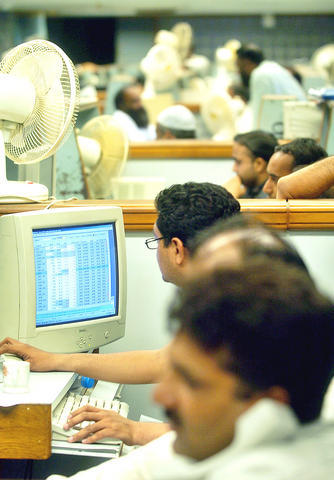

PHOTO: AFP

Seoul, up 0.90 percent, and Manila with a gain of 2.09 percent both closed at record highs, while Taipei approached its best finish in seven years with a 1.29 percent rise and Tokyo was at a three-month high with a gain of 0.47 percent.

Thai investors appeared content after a court banned former Thai premier Thaksin Shinawatra and his party from politics and its benchmark was 2.24 percent higher.

Jakarta was closed for a public holiday.

TAIPEI

Share prices closed near seven-year highs as investors snapped up laggard stocks in active trade.

Dealers said trading turned aggressive as investors set aside worries over a possible sell-off in Chinese equities as Beijing's move to triple taxes on stock transactions at least slowed the Chinese market's rise.

The weighted index closed up 104.95 points at 8,249.90 on turnover of NT$129.95 billion (US$3.93 billion).

Dealers said the fall in Taipei shares on Thursday may have been overdone given that the rest of the region mostly posted gains.

"In a way, our market corrected its exceptional weakness yesterday, which contrasted with a regional upswing," said an analyst with a local securities house who preferred not to be named.

TOKYO

Share prices ended the week at a fresh three-month high as the weak yen boosted exporters and after the tech-heavy NASDAQ advanced overnight.

Dealers said the market was also feeling relief that this week's beating on the Chinese stock market has had a limited impact in Japan.

The NIKKEI-225 index closed up 83.13 points at 17,958.88. Volume rose to 2.49 billion shares from 2.16 billion on Thursday.

HONG KONG

Share prices closed 0.15 percent weaker, reversing course after the Shanghai bourse finished sharply lower amid worries that China may take additional measures to rein in its markets.

Major local blue chips reversed early gains, but China insurers ended higher on news that China plans to allow insurers to invest in overseas equities.

The Hang Seng Index closed down 31.6 points at 20,602.87.

SEOUL

Share prices closed 0.9 percent higher, chalking up a fifth consecutive record finish on the week led by Samsung Electronics' nearly four percent gain.

Dealers said a return to favour of the key IT stocks and brokerages helped the market to an unprecedented 13th week of gains although stocks finished well off their highs on the day as retail investors took some quick profits.

The KOSPI index ended up 15.33 points at 1,716.24.

SHANGHAI

Share prices closed 2.65 percent lower on continued concerns over more possible tightening policies following a hike in stock transaction taxes earlier this week.

Dealers said a late decline wiped out morning gains and brought the Shanghai Composite Index below the key 4,000 points level at one stage, with swings of over 200 points in the trading range, but it managed to close the day just above 4,000.

The Shanghai Composite Index fell 108.91 points or 2.65 percent at 4,000.72.

SYDNEY

Share prices closed 0.32 percent higher as fears that this week's losses on Chinese markets would spark a global sell-off eased.

Dealers said overnight gains in base metal prices helped the all important resources sector while a steadier performance on the Chinese markets -- at least while Australia was open -- helped sentiment.

The S&P/ASX 200 closed up 20.0 points at 6,333.5.

SINGAPORE

Share prices closed 1.06 percent higher on the back of strong gains in banks and other blue chips, with the Straits Times index touching a new intraday high.

Dealers said that investor sentiment was buoyed by comments from analysts at leading financial houses, who said the Chinese economy is likely to hold despite measures by Beijing to cool the market.

The index closed up 37.19 points at 3,548.32.

KUALA LUMPUR

Share prices closed 0.98 percent higher on follow-through buying in line with regional gains, dealers said. The composite index gained 13.18 points to 1,360.07.

BANGKOK

Share prices closed up 2.24 percent at a year high as investors welcomed a court ruling disbanding Shinawatra's party and barring him from politics.

Dealers said the market bucked a trend of rising regional markets.

The composite index jumped 16.53 points to 753.93.

MUMBAI

Share prices rose 0.18 percent in choppy trade a day after India's economy grew a faster than expected 9.4 percent in the year to March.

Dealers said fertilizer stocks rose as the annual monsoon rains, crucial for the country's farmers, advanced north.

The 30-share SENSEX rose 26.29 points to 14,570.75.

Nvidia Corp CEO Jensen Huang (黃仁勳) today announced that his company has selected "Beitou Shilin" in Taipei for its new Taiwan office, called Nvidia Constellation, putting an end to months of speculation. Industry sources have said that the tech giant has been eyeing the Beitou Shilin Science Park as the site of its new overseas headquarters, and speculated that the new headquarters would be built on two plots of land designated as "T17" and "T18," which span 3.89 hectares in the park. "I think it's time for us to reveal one of the largest products we've ever built," Huang said near the

China yesterday announced anti-dumping duties as high as 74.9 percent on imports of polyoxymethylene (POM) copolymers, a type of engineering plastic, from Taiwan, the US, the EU and Japan. The Chinese Ministry of Commerce’s findings conclude a probe launched in May last year, shortly after the US sharply increased tariffs on Chinese electric vehicles, computer chips and other imports. POM copolymers can partially replace metals such as copper and zinc, and have various applications, including in auto parts, electronics and medical equipment, the Chinese ministry has said. In January, it said initial investigations had determined that dumping was taking place, and implemented preliminary

Intel Corp yesterday reinforced its determination to strengthen its partnerships with Taiwan’s ecosystem partners including original-electronic-manufacturing (OEM) companies such as Hon Hai Precision Industry Co (鴻海精密) and chipmaker United Microelectronics Corp (UMC, 聯電). “Tonight marks a new beginning. We renew our new partnership with Taiwan ecosystem,” Intel new chief executive officer Tan Lip-bu (陳立武) said at a dinner with representatives from the company’s local partners, celebrating the 40th anniversary of the US chip giant’s presence in Taiwan. Tan took the reins at Intel six weeks ago aiming to reform the chipmaker and revive its past glory. This is the first time Tan

CUSTOMERS’ BURDEN: TSMC already has operations in the US and is a foundry, so any tariff increase would mostly affect US customers, not the company, the minister said Taiwanese manufacturers are “not afraid” of US tariffs, but are concerned about being affected more heavily than regional economic competitors Japan and South Korea, Minister of Economic Affairs J.W. Kuo (郭智輝) said. “Taiwan has many advantages that other countries do not have, the most notable of which is its semiconductor ecosystem,” Kuo said. The US “must rely on Taiwan” to boost its microchip manufacturing capacities, Kuo said in an interview ahead of his one-year anniversary in office tomorrow. Taiwan has submitted a position paper under Section 232 of the US Trade Expansion Act to explain the “complementary relationship” between Taiwan and the US