Hon Hai Precision Industry Co’s (鴻海精密) production lines in Zhengzhou, China, are still running normally despite a new lockdown in the city amid a spike in COVID-19 infections, Minister of Economic Affairs Wang Mei-hua (王美花) said yesterday.

Yesterday, authorities placed Zhengzhou’s population of 12.6 million people under a one-week lockdown that prohibits them from leaving their housing compounds.

Zhengzhou has also ordered that schools hold classes online, and that public and private-sector employees work from home.

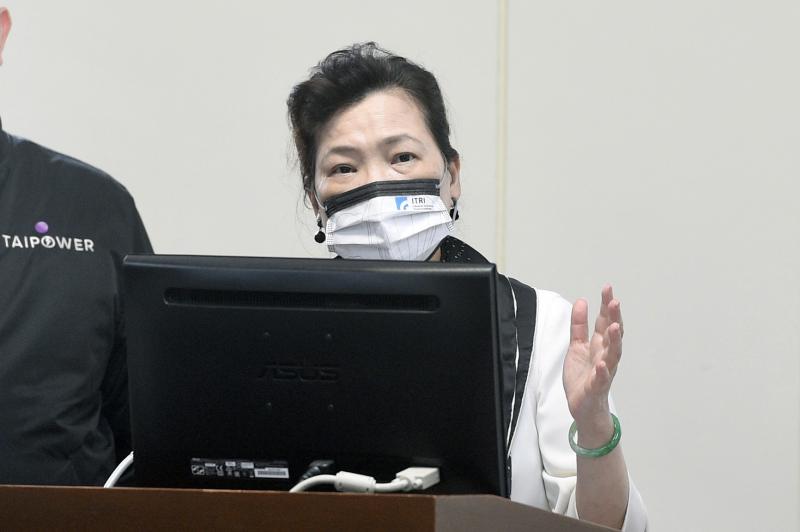

Photo: George Tsorng, Taipei Times

The city implemented lockdowns in several districts last month, as well as earlier this year.

Speaking with reporters on the sidelines of a meeting of the legislature’s Economics Committee, Wang said that lockdowns in several of China’s manufacturing hubs have disrupted industrial supply chains and the delivery of raw materials.

However, Hon Hai, also known as Foxconn Technology Group (富士康科技集團), is still rolling products off its lines in Zhengzhou thanks to a so-called “closed loop” scheme, in which the employees live and work on the company campus, Wang said, after the ministry checked with the company.

The lockdown in Zhengzhou has raised concerns over iPhone production as Hon Hai’s Zhengzhou campus is one of the most important production bases for Apple Inc, which unveiled the latest iPhone SE in March.

Analysts have said that the Zhengzhou campus mass produces the iPhones, while Hon Hai’s production hub in Shenzhen develops and introduces new iPhone models.

Before the lockdown, media reports had said that Hon Hai launched a massive recruitment campaign in Zhengzhou, as Apple’s iPhone 13 series has been popular with consumers.

Hon Hai also used the recruitment drive to prepare for the production of the iPhone 14 series, which is expected in September, they said.

The reports quoted South Korea’s The Elec as saying that Apple had increased production of the larger iPhone 13 Pro and iPhone 13 Pro Max by about 10 million units for the second quarter.

Hon Hai is the largest assembler of the two iPhone 13 models.

The company has more than 1 million workers in China.

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

RECORD-BREAKING: TSMC’s net profit last quarter beat market expectations by expanding 8.9% and it was the best first-quarter profit in the chipmaker’s history Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which counts Nvidia Corp as a key customer, yesterday said that artificial intelligence (AI) server chip revenue is set to more than double this year from last year amid rising demand. The chipmaker expects the growth momentum to continue in the next five years with an annual compound growth rate of 50 percent, TSMC chief executive officer C.C. Wei (魏哲家) told investors yesterday. By 2028, AI chips’ contribution to revenue would climb to about 20 percent from a percentage in the low teens, Wei said. “Almost all the AI innovators are working with TSMC to address the

FUTURE PLANS: Although the electric vehicle market is getting more competitive, Hon Hai would stick to its goal of seizing a 5 percent share globally, Young Liu said Hon Hai Precision Industry Co (鴻海精密), a major iPhone assembler and supplier of artificial intelligence (AI) servers powered by Nvidia Corp’s chips, yesterday said it has introduced a rotating chief executive structure as part of the company’s efforts to cultivate future leaders and to enhance corporate governance. The 50-year-old contract electronics maker reported sizable revenue of NT$6.16 trillion (US$189.67 billion) last year. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), has been under the control of one man almost since its inception. A rotating CEO system is a rarity among Taiwanese businesses. Hon Hai has given leaders of the company’s six