Asian markets yesterday were mixed, while the US dollar held strong gains after the US Federal Reserve brought forward its forecasts for hiking interest rates, as it looks to prevent overheating in the US economy, which is enjoying a blockbuster recovery.

After a much-anticipated meeting, top bank officials maintained their ultra-easy monetary policy, and repeated their belief that the sharp spikes in inflation were expected as businesses reopen and people return to their daily lives.

Officials have for months pledged not to budge from their highly accommodative measures and would stay the course until unemployment is tamed and prices are rising excessively for a long period of time.

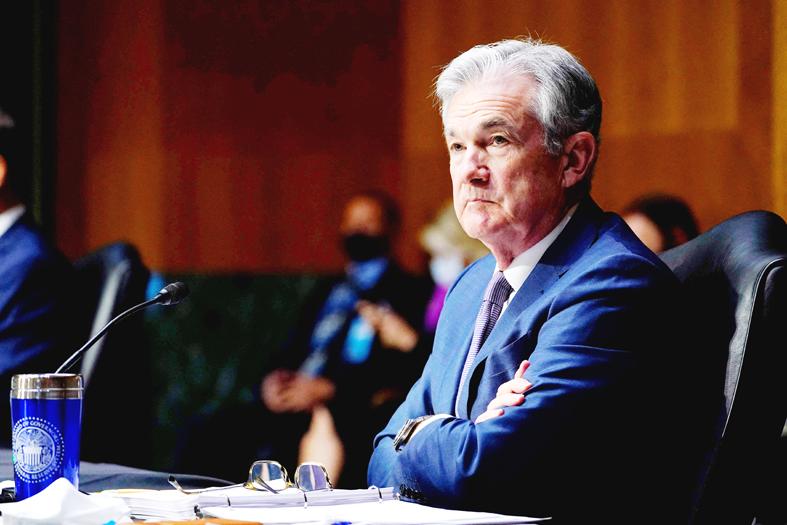

Photo: AFP

However, with the rebound looking well established, they have lately edged closer toward tapering policy, and Wednesday’s meeting highlighted that.

The closely watched “dot plot” of policymakers’ forecasts for interest rates showed 11 of the 18 committee members expected at least two hikes in 2023.

As recently as March, estimates showed only seven officials seeing a liftoff in 2023. Now there are seven who see next year as a target.

After the meeting, US Federal Reserve Chairman Jerome Powell said that the projections “do not represent a committee decision or plan,” but that the bank was ready to alter policy if it sees signs of inflation moving “materially and persistently beyond levels consistent with our goal” of 2 percent.

Inflation has surpassed that for the past three consecutive months and hit a 13-year high last month.

Since inflation has lagged the bank’s target for more than a decade and unemployment remains at 5.8 percent, achieving “substantial further progress is still a ways off,” Powell told reporters in his news conference following the meeting.

He said that the “recovery is incomplete” and improvement has been “uneven,” with employment in hard-hit sectors well below pre-COVID-19-pandemic levels.

The Fed officials’ median forecast for annual inflation this year increased to 3.4 percent from the previous 2.4 percent in March, but they see the rate slowing to 2.1 percent next year, according to the projections.

Committee members also boosted their growth outlook to 7 percent from 6.5 percent.

Powell also said that the board had started talking about when to wind in its bond-buying scheme, which along with low rates and vast government stimulus has been crucial to driving a more than year-long rebound in equities from their lows in April last year.

The Fed would give plenty of notice before making any major changes, and would “do what we can to avoid a market reaction,” he said.

“Powell’s press conference delivered a handful of dovish reminders: vaccinations have a ways to go, that the base case is still that inflation is driven by reopening momentum and that they are ways away from substantial further progress,” OANDA Corp strategist Edward Moya said.

All three main Wall Street indices ended in the red, but off their earlier lows.

After an initial sell-off, Asian markets also pared or reversed losses.

Asian markets were mostly down, but also paring initial steep losses, as traders see the tightening measures are being debated owing to the positive economic outlook.

Jakarta, Manila, Mumbai, Seoul, Singapore, Sydney, Tokyo and Wellington were all in the red, while Taipei, Bangkok, Hong Kong and Shanghai edged up.

Frankfurt, London and Paris all fell soon after the opening bell.

The prospect of higher US rates sent the US dollar surging against the yen, British pound and euro, and maintained its strength in Asia, while rallying across the board against other units.

It was up more than 1 percent against the South Korean won, Australian dollar, Mexican peso and South African rand, while the Indonesian rupiah, Thai baht and Canadian dollar were also under pressure.

The greenback’s rise also weighed on US dollar-priced oil, with both main contracts retreating from multiyear highs. Still, observers said they considered that the black gold would enjoy further upside owing to an expected pickup in demand as the world recovers from the pandemic.

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

RECORD-BREAKING: TSMC’s net profit last quarter beat market expectations by expanding 8.9% and it was the best first-quarter profit in the chipmaker’s history Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which counts Nvidia Corp as a key customer, yesterday said that artificial intelligence (AI) server chip revenue is set to more than double this year from last year amid rising demand. The chipmaker expects the growth momentum to continue in the next five years with an annual compound growth rate of 50 percent, TSMC chief executive officer C.C. Wei (魏哲家) told investors yesterday. By 2028, AI chips’ contribution to revenue would climb to about 20 percent from a percentage in the low teens, Wei said. “Almost all the AI innovators are working with TSMC to address the

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”