Shares in Top Glove Corp Bhd yesterday plunged after Malaysia said that it would close some factories of the world’s biggest rubber glove maker as more than 2,000 of its workers had tested positive for COVID-19.

Top Glove’s shares were down 7.48 percent at the close of trade after the government said that 28 factory buildings would be shut in phases, although it did not provide a timetable.

The company, which commands one-quarter of the global latex glove market, has racked up record profits this year on skyrocketing demand for its products and protective gear, thanks to the COVID-19 pandemic. Despite yesterday’s slump, its shares have surged more than fourfold this year.

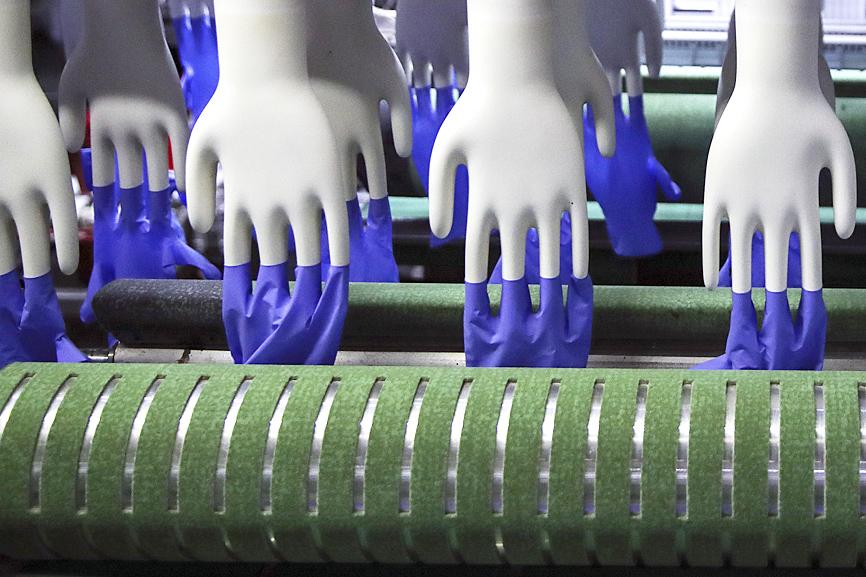

Photo: EPA-EFE

Malaysia itself makes just less than two-thirds of the world’s rubber gloves, according to the Malaysian Rubber Glove Manufacturers Association.

Hartalega Holdings Bhd and Supermax Corp Bhd are the other two top glovemakers in the country.

The Malaysian Ministry of Health reported a sharp rise in cases in the area where Top Glove factories and dormitories are located, with 2,453 workers testing positive for the virus out of 5,767 screened.

Top Glove runs 47 factories across Malaysia, Thailand, China and Vietnam, with 36 of them producing gloves. Europe and North America are its biggest markets.

In a stock exchange filing on Monday, Top Glove said that it had temporarily stopped production at 16 of the 28 facilities since Wednesday last week, with the balance of 12 facilities operating at much reduced capacities.

The firm did not immediately respond to an e-mail seeking details, including the effect on production.

MIDF Research analyst Ng Bei Shan said in a note the closures would reduce production capacity by 50 percent, adding that a two-week closure could hurt net income by 4 percent in fiscal year 2021 if average selling prices stay the same.

However, tightened supply might also boost prices, cushioning the impact, she said.

The closures have not yet affected the company’s orders, Ng said, adding that she is maintaining her earnings estimates for fiscal year 2021.

“The development of the temporary closure of its facilities in stages is still fluid. As such, the actual impact to Top Glove’s full-year earnings may be hard to ascertain at this point,” she said.

Two other analysts predicted a 2 percent hit to annual profit.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day

Thousands of parents in Singapore are furious after a Cordlife Group Ltd (康盛人生集團), a major operator of cord blood banks in Asia, irreparably damaged their children’s samples through improper handling, with some now pursuing legal action. The ongoing case, one of the worst to hit the largely untested industry, has renewed concerns over companies marketing themselves to anxious parents with mostly unproven assurances. This has implications across the region, given Cordlife’s operations in Hong Kong, Macau, Indonesia, the Philippines and India. The parents paid for years to have their infants’ cord blood stored, with the understanding that the stem cells they contained