US stocks on Friday closed lower as investors wrestled with fiscal stimulus developments, concerns over a lengthy rollout of vaccines, and a growing number of state-level shutdowns to combat the spiraling COVID-19 pandemic.

Stay-at-home plays such as Zoom Video Communications Inc and Netflix Inc, which have outperformed throughout the health crisis, helped curb the NASDAQ’s loss.

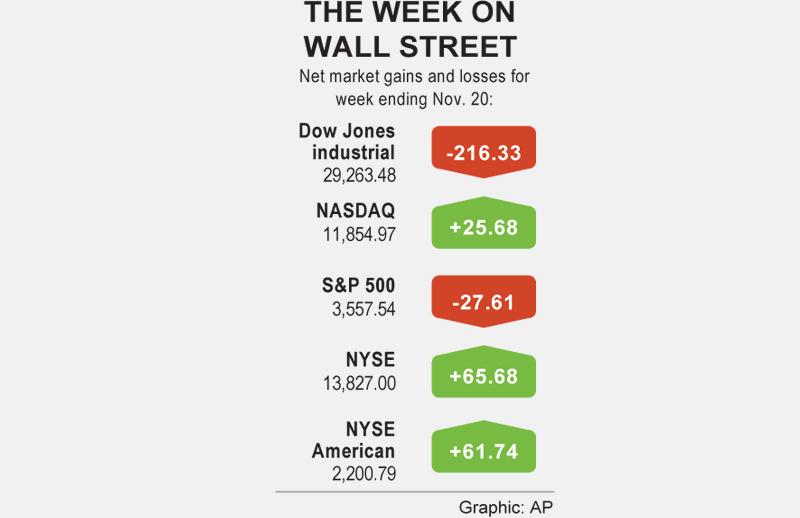

The Dow Jones Industrial Average fell 219.75 points, or 0.75 percent, to 29,263.48, the S&P 500 lost 24.33 points, or 0.68 percent, to 3,557.54 and the NASDAQ Composite dropped 49.74 points, or 0.42 percent, to 11,854.97.

Photo: Reuters

Throughout the week, the ebb and flow of vaccine news and spiking infections had investors oscillating between economically sensitive cyclical stocks and pandemic-resistant market leaders.

The S&P 500 and the Dow posted marginal losses for the week at 0.73 percent and 0.77 percent respectively, while the tech-laden NASDAQ settled 0.22 percent higher from last Friday’s close.

“Markets are still stuck in a push-and-pull between the dramatic rise of new COVID cases versus apparent progress on vaccines,” said David Carter, chief investment officer at Lenox Wealth Advisors in New York. “This is likely to continue until we have an approved and distributed vaccine.”

US Secretary of the Treasury Steven Mnuchin late on Thursday announced that he would allow key pandemic relief lending programs at the US Federal Reserve to expire at the end of the year, saying that the US$455 billion allocated last spring under the Coronavirus Aid, Relief, and Economic Security Act should be returned to the US Congress to be reallocated as grants for small companies.

The decision to pull the plug on lending programs deemed essential by the central bank comes at a time of spiraling new COVID-19 infections and a fresh wave of layoffs, and was called “disappointing” by Chicago Fed president Charles Evans.

“This dust-up between the Fed and the [US Department of the] Treasury could have serious implications, as markets want to see the two institutions working well together,” Carter said. “The timing of this dust-up is unfortunate, as the risk of COVID is still very much with us.”

Record infection numbers in the US have caused COVID-19 hospitalizations to soar 50 percent and have prompted a new round of school and businesses closures, curfews and social distancing restrictions, hobbling economic recovery from the deepest recession since the Great Depression.

In the latest development in the race to develop a vaccine, Pfizer Inc has applied to the US Food and Drug Administration for emergency use authorization of its COVID-19 vaccine, the first application of its kind in the battle against the disease. The drugmaker’s shares rose 1.4 percent, and provided the biggest lift to the S&P 500.

Of the 11 major sectors in the S&P 500, only utilities eked out a gain by the closing bell. Technology and industrials suffered the largest percentage losses on the day.

Declining issues outnumbered advancing ones on the NYSE by a 1.06-to-1 ratio; on the NASDAQ, a 1.12-to-1 ratio favored advancers.

The S&P 500 posted 17 new 52-week highs and no new lows; the NASDAQ Composite recorded 122 new highs and 10 new lows.

Volume on US exchanges was 10.69 billion shares, compared with the 10.70 billion average over the past 20 trading days.

Additional reporting by staff writer

Stephen Garrett, a 27-year-old graduate student, always thought he would study in China, but first the country’s restrictive COVID-19 policies made it nearly impossible and now he has other concerns. The cost is one deterrent, but Garrett is more worried about restrictions on academic freedom and the personal risk of being stranded in China. He is not alone. Only about 700 American students are studying at Chinese universities, down from a peak of nearly 25,000 a decade ago, while there are nearly 300,000 Chinese students at US schools. Some young Americans are discouraged from investing their time in China by what they see

MAJOR DROP: CEO Tim Cook, who is visiting Hanoi, pledged the firm was committed to Vietnam after its smartphone shipments declined 9.6% annually in the first quarter Apple Inc yesterday said it would increase spending on suppliers in Vietnam, a key production hub, as CEO Tim Cook arrived in the country for a two-day visit. The iPhone maker announced the news in a statement on its Web site, but gave no details of how much it would spend or where the money would go. Cook is expected to meet programmers, content creators and students during his visit, online newspaper VnExpress reported. The visit comes as US President Joe Biden’s administration seeks to ramp up Vietnam’s role in the global tech supply chain to reduce the US’ dependence on China. Images on

New apartments in Taiwan’s major cities are getting smaller, while old apartments are increasingly occupied by older people, many of whom live alone, government data showed. The phenomenon has to do with sharpening unaffordable property prices and an aging population, property brokers said. Apartments with one bedroom that are two years old or older have gained a noticeable presence in the nation’s six special municipalities as well as Hsinchu county and city in the past five years, Evertrust Rehouse Co (永慶房產集團) found, citing data from the government’s real-price transaction platform. In Taipei, apartments with one bedroom accounted for 19 percent of deals last

US CONSCULTANT: The US Department of Commerce’s Ursula Burns is a rarely seen US government consultant to be put forward to sit on the board, nominated as an independent director Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday nominated 10 candidates for its new board of directors, including Ursula Burns from the US Department of Commerce. It is rare that TSMC has nominated a US government consultant to sit on its board. Burns was nominated as one of seven independent directors. She is vice chair of the department’s Advisory Council on Supply Chain Competitiveness. Burns is to stand for election at TSMC’s annual shareholders’ meeting on June 4 along with the rest of the candidates. TSMC chairman Mark Liu (劉德音) was not on the list after in December last