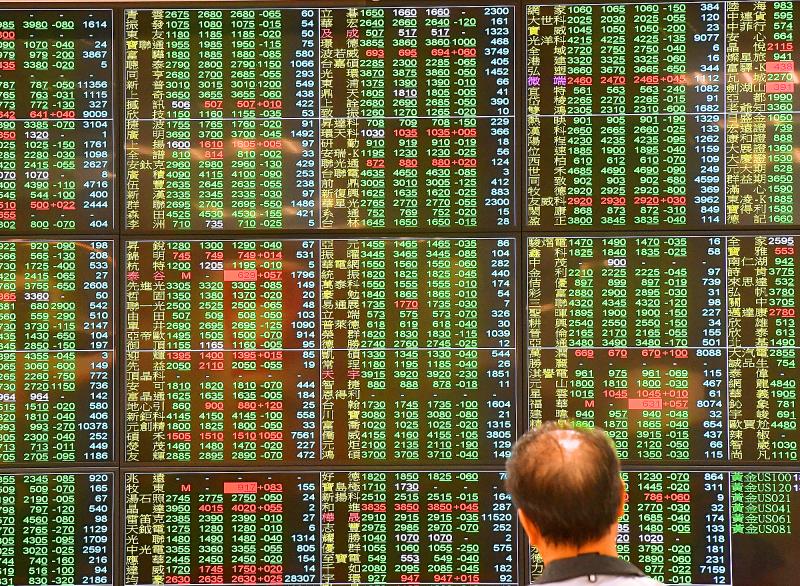

The TAIEX yesterday plunged more than 300 points to end below 12,300 points and the three-month moving average of 12,577, as market sentiment was hurt by a steep drop on Wall Street overnight.

The index closed down 319.50 points, or 2.54 percent, at the day’s low of 12,264.38. Turnover totaled NT$243.499 billion (US$8.31 billion), Taiwan Stock Exchange data showed.

Elsewhere in Asia, shares were also mostly lower, as caution set in after a retreat on Wall Street driven by a decline in technology shares.

Photo: CNA

The Dow Jones Industrial Average fell 525 points, or 1.92 percent, and the tech-heavy NASDAQ dropped 3.02 percent.

Japan’s benchmark Nikkei 225 declined 1.1 percent to 23,081.70, while Australia’s S&P/ASX 200 fell 0.8 percent to 5,875.90.

South Korea’s KOSPI plunged 2.3 percent to 2,280.28, while Hong Kong’s Hang Seng dropped 1.9 percent to 23,297.47, and the Shanghai Composite fell 1.5 percent to 3,231.51.

With the daily trading volume on Taiwan’s main board and the over-the-counter market holding at about NT$250 billion, there is still room for the TAIEX to regain some momentum, Minister of Finance Su Jain-rong (蘇建榮) said.

The National Stabilization Fund committee is to meet on Oct. 12 to determine whether to continue to buy stocks to help prop up the market, Su said.

Among the affected tech heavyweights, contract chipmaker Taiwan Semiconductor Manufacturing Co (台積電) dropped 2.42 percent to close at NT$423. It was the seventh consecutive session of decline for the stock since Wednesday last week, when it hit a high of NT$462.

Meanwhile, integrated circuit designer MediaTek Inc (聯發科) shed 2.76 percent to close at NT$600, and Largan Precision Co (大立光), a supplier of smartphone camera lenses to Apple Inc, fell 1.3 percent to end at NT$3,425.

Financial sector performance was also weak, with Yuanta Financial Holdings Co (元大金控) losing 3.11 percent to close at NT$17.15 and China Development Financial Holding Corp (中華開發金控) finishing 2.96 percent lower at NT$8.21.

Amid projections of a continued global spread of COVID-19, some biotech shares bucked the downturn.

Abnova (Taiwan) Corp (亞諾法生技) gained 9.91 percent to close at NT$83.2, while Chunghwa Chemical Synthesis & Biotech Co (中化生) surged 9.93 percent to finish at NT$75.3.

Foreign institutional investors sold a net NT$43.68 billion of shares yesterday, after a net sell of NT$27.6 billion in the previous three sessions, according to Taiwan Stock Exchange data.

Additional reporting by AP

Stephen Garrett, a 27-year-old graduate student, always thought he would study in China, but first the country’s restrictive COVID-19 policies made it nearly impossible and now he has other concerns. The cost is one deterrent, but Garrett is more worried about restrictions on academic freedom and the personal risk of being stranded in China. He is not alone. Only about 700 American students are studying at Chinese universities, down from a peak of nearly 25,000 a decade ago, while there are nearly 300,000 Chinese students at US schools. Some young Americans are discouraged from investing their time in China by what they see

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday reported record sales for the first quarter, which analysts attributed to solid demand for emerging technologies. Consolidated revenue totaled NT$592.64 billion (US$18.51 billion) in the January-to-March period, up 16.5 percent from a year earlier, but down 5.26 percent from the previous quarter, TSMC said in a statement. The first-quarter revenue beat analysts’ average projection of NT$579.5 billion, Bloomberg News reported. That performance lends weight to expectations that the world’s most valuable chipmaker would return to solid growth this year after weathering a post-COVID-19-pandemic cratering of smartphone and computer sales. TSMC is budgeting

MAJOR DROP: CEO Tim Cook, who is visiting Hanoi, pledged the firm was committed to Vietnam after its smartphone shipments declined 9.6% annually in the first quarter Apple Inc yesterday said it would increase spending on suppliers in Vietnam, a key production hub, as CEO Tim Cook arrived in the country for a two-day visit. The iPhone maker announced the news in a statement on its Web site, but gave no details of how much it would spend or where the money would go. Cook is expected to meet programmers, content creators and students during his visit, online newspaper VnExpress reported. The visit comes as US President Joe Biden’s administration seeks to ramp up Vietnam’s role in the global tech supply chain to reduce the US’ dependence on China. Images on

US CONSCULTANT: The US Department of Commerce’s Ursula Burns is a rarely seen US government consultant to be put forward to sit on the board, nominated as an independent director Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday nominated 10 candidates for its new board of directors, including Ursula Burns from the US Department of Commerce. It is rare that TSMC has nominated a US government consultant to sit on its board. Burns was nominated as one of seven independent directors. She is vice chair of the department’s Advisory Council on Supply Chain Competitiveness. Burns is to stand for election at TSMC’s annual shareholders’ meeting on June 4 along with the rest of the candidates. TSMC chairman Mark Liu (劉德音) was not on the list after in December last