Expectations that US interest rates would stay ultra low for as long as needed on Friday helped lift most Asian equities, but Tokyo tumbled after Japanese Prime Minister Shinzo Abe said he would resign to undergo treatment for a chronic illness, raising questions over the future of his signature stimulus policy.

Volatility surged in Japan, with the benchmark TOPIX finishing the session down 0.68 percent after sliding as much as 1.6 percent.

However, it still managed to gain 0.05 for the week.

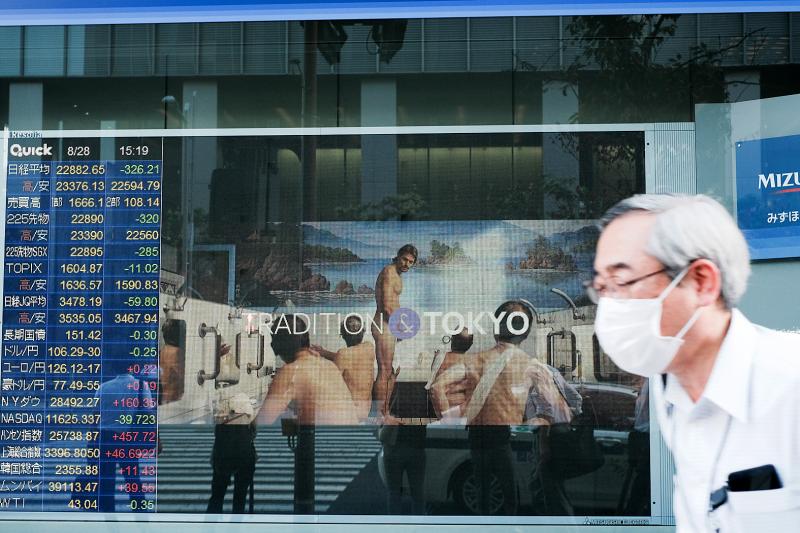

Photo: Bloomberg

Tokyo’s Nikkei 225 initially dropped more than 2 percent, but ended down 1.41 percent at 22,882.65. It lost 0.16 percent from a week earlier.

The news also sent the yen, a safe haven in times of uncertainty, surging briefly to 105.61 against the dollar, from 106.74.

“Abenomics may have had split views, but the fact that they put forward a clear policy of getting out of deflation was a positive for the equity markets,” said Hiroshi Matsumoto, head of Japan investment at Pictet Asset Management. “It’s not the end of the world for the Japanese economy, but we cannot clearly see who the successor will be, and there’s a question of how much Abenomics policies will be carried forward.”

Abe came to power for the second time in 2012, touting new plans to revive the economy through unprecedented monetary easing and regulatory reform that was eventually labeled “Abenomics.” Few market participants had expected he would step down after his right-hand man, Japanese Chief Cabinet Secretary Yoshihide Suga, said that Abe should be able to serve out the remainder of his term as a party leader.

The prime minister confirmed reports in a press conference that he was dealing with ulcerative colitis, a chronic digestive condition that also forced him to step down as premier in 2007.

The TAIEX was also down on Friday, losing 68.46 points, or 0.53 percent, to close at 12,728.85 on turnover of NT$204.557 billion. It gained 0.96 percent for the week.

US Federal Reserve Chairman Jerome Powell on Thursday said that the Fed would be in no rush to reel in inflation, even if it overshoots the central bank’s two percent target, instead opting for an average that took into account periods of weak price rises.

Powell said that policymakers would stick with the new framework “for some time,” indicating that an era of cheap borrowing is here for the foreseeable future.

“In the absence of fresh positive economic news recently, this statement should cheer investor sentiment,” said Tai Hui (許長泰), chief Asia market strategist at JPMorgan Asset Management. “Monetary policy is likely to stay accommodative for even longer. Not only will the Fed need to provide sufficient support to help the economy through the [COVID-19] pandemic fallout, but also policy rates should be kept low beyond that to generate sufficient inflationary pressure.”

“The search for income for Asian investors will continue — this should be supportive of risk assets such as equities, corporate bonds and emerging-market fixed-income,” Tai added.

In China, the Shanghai Composite Index gained 1.6 percent to close at 3,403.81. It was up 0.68 percent for the week.

Hong Kong’s Hang Seng Index closed 0.56 percent higher at 25,422.06, and gained 1.23 percent for the week.

In South Korea, the KOSPI rose 0.4 percent to 2,353.80, increasing 2.14 percent from a week earlier.

Additional reporting by staff writer, with CNA

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

RECORD-BREAKING: TSMC’s net profit last quarter beat market expectations by expanding 8.9% and it was the best first-quarter profit in the chipmaker’s history Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which counts Nvidia Corp as a key customer, yesterday said that artificial intelligence (AI) server chip revenue is set to more than double this year from last year amid rising demand. The chipmaker expects the growth momentum to continue in the next five years with an annual compound growth rate of 50 percent, TSMC chief executive officer C.C. Wei (魏哲家) told investors yesterday. By 2028, AI chips’ contribution to revenue would climb to about 20 percent from a percentage in the low teens, Wei said. “Almost all the AI innovators are working with TSMC to address the

FUTURE PLANS: Although the electric vehicle market is getting more competitive, Hon Hai would stick to its goal of seizing a 5 percent share globally, Young Liu said Hon Hai Precision Industry Co (鴻海精密), a major iPhone assembler and supplier of artificial intelligence (AI) servers powered by Nvidia Corp’s chips, yesterday said it has introduced a rotating chief executive structure as part of the company’s efforts to cultivate future leaders and to enhance corporate governance. The 50-year-old contract electronics maker reported sizable revenue of NT$6.16 trillion (US$189.67 billion) last year. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), has been under the control of one man almost since its inception. A rotating CEO system is a rarity among Taiwanese businesses. Hon Hai has given leaders of the company’s six