Trading on Wall Street was subdued on Friday as doubts crept in about a new US stimulus bill, while the S&P 500 hovered below record highs as a swathe of domestic data showed the economy was still smarting from the COVID-19 pandemic.

Aggressive stimulus measures have helped the three main US stock indices bounce back from a coronavirus-driven crash in March, and the S&P 500 briefly traded above its Feb. 19 record close for a second straight day on Thursday.

Although the benchmark index rose for a third straight week, it has struggled to top its all-time high as prospects of more fiscal aid faded with the US Senate and House of Representatives in recess and no fresh talks scheduled.

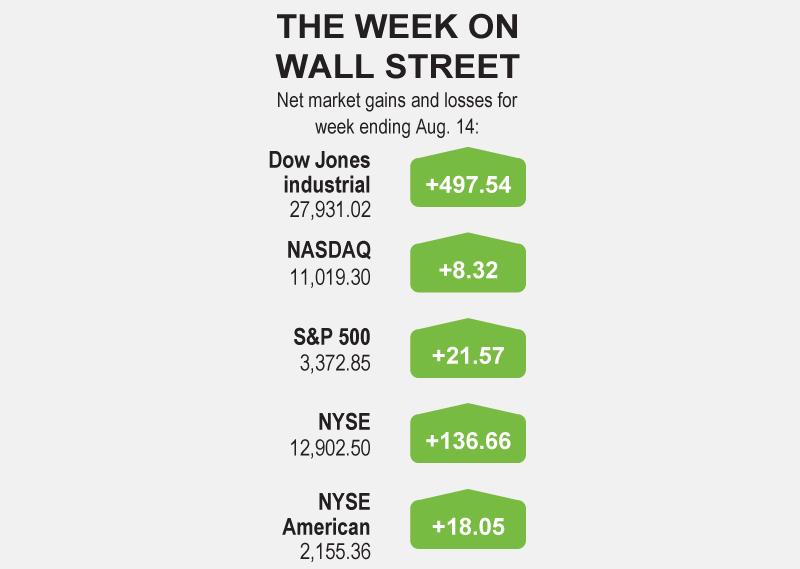

Graphic: AP

“A lot of the economic data points that we will see in the next 2 to 3 months are definitely going to hinge on not having a stalemate in talks,” said David Wagner, portfolio manager and analyst at Aptus Capital Advisors in Cincinnati, Ohio.

US retail sales increased less than expected last month and could slow further due to spiraling COVID-19 cases and a reduction in unemployment benefit checks, data showed on Friday.

Separately, readings showed that US factory output increased more than expected last month, but remained below pre-pandemic levels, while consumer sentiment was largely steady in the first half of this month.

“We still have a long way to go [in terms of an economic recovery], and income support is the way to power the consumer through. If we get strong retail sales data over the next two months, given the lack of recent government action, it should be very positive,” Wagner said.

Uncertainty over the timing of a stimulus agreement has undercut sentiment in the past few sessions, with the upcoming US presidential election expected to add another layer of caution.

The Dow Jones Industrial Average on Friday rose 34.3 points, or 0.12 percent, to 27,931.02. The S&P 500 lost 0.58 points, or 0.02 percent, to close at 3,372.85, while the NASDAQ Composite was down 23.20 points, or 0.21 percent, at 11,019.30.

For the week, the Dow rose 1.81 percent, the S&P 500 increased 0.64 percent and the NASDAQ gained 0.08 percent.

Technology, which has been the best performing sector through the pandemic, led declines among the 11 major S&P indices, while financials and industrials outperformed.

Shares of German biotechnology firm CureVac BV nearly tripled in their NASDAQ debut, marking the first stock market debut of a company developing a potential vaccine for the novel coronavirus.

Applied Materials Inc gained 4.4 percent after it forecast fourth-quarter revenue above analysts’ estimates, following a rebound in demand for chip equipment and services.

Advancing issues outnumbered decliners by a 1.13-to-1 ratio on the NYSE. Declining issues outnumbered advancers for a 1.21-to-1 ratio on the NASDAQ.

The S&P index recorded 15 new 52-week highs and no new lows, while the NASDAQ recorded 39 new highs and seven new lows.

Additional reporting by staff writer

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

RECORD-BREAKING: TSMC’s net profit last quarter beat market expectations by expanding 8.9% and it was the best first-quarter profit in the chipmaker’s history Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which counts Nvidia Corp as a key customer, yesterday said that artificial intelligence (AI) server chip revenue is set to more than double this year from last year amid rising demand. The chipmaker expects the growth momentum to continue in the next five years with an annual compound growth rate of 50 percent, TSMC chief executive officer C.C. Wei (魏哲家) told investors yesterday. By 2028, AI chips’ contribution to revenue would climb to about 20 percent from a percentage in the low teens, Wei said. “Almost all the AI innovators are working with TSMC to address the

FUTURE PLANS: Although the electric vehicle market is getting more competitive, Hon Hai would stick to its goal of seizing a 5 percent share globally, Young Liu said Hon Hai Precision Industry Co (鴻海精密), a major iPhone assembler and supplier of artificial intelligence (AI) servers powered by Nvidia Corp’s chips, yesterday said it has introduced a rotating chief executive structure as part of the company’s efforts to cultivate future leaders and to enhance corporate governance. The 50-year-old contract electronics maker reported sizable revenue of NT$6.16 trillion (US$189.67 billion) last year. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), has been under the control of one man almost since its inception. A rotating CEO system is a rarity among Taiwanese businesses. Hon Hai has given leaders of the company’s six