The NASDAQ on Friday jumped more than 1 percent, powered by strong earnings from some of the largest US companies, but the Dow Jones Industrial Average and S&P 500 finished with smaller gains as uncertainty about the government’s next round of COVID-19 aid kept economic worries on the radar.

Apple Inc shares surged 10.5 percent to close at a record US$425.04 in the wake of blowout quarterly results and a four-for-one stock split announcement.

Amazon.com Inc gained 3.7 percent after posting its biggest profit ever, while Facebook Inc jumped 8.2 percent after the social media platform blew past revenue expectations.

Photo:EPA-EFE

Google parent Alphabet Inc fell 3.3 percent though, the biggest drag on the S&P 500 and the NASDAQ, as it posted the first quarterly sales dip in its 16 years as a public company.

“The results were just fabulous, just so strong,” said Tim Ghriskey, chief investment strategist at Inverness Counsel in New York. “These are extremely profitable companies and they produce products that people want.”

The four companies are among the top five in market capitalization, representing about 20 percent of the S&P 500’s total.

Apple’s gain pushed it ahead of Saudi Arabian Oil Co as the world’s most valuable public company, Refinitiv data showed.

The White House and the Democrats were still negotiating relief aid for the COVID-19 pandemic, but were not yet on a path toward reaching a deal, US House of Representatives Speaker Nancy Pelosi said, hours before a federal unemployment benefit expired.

“It seems like they are far apart and supposedly they are working at it and there is a lot of name calling, and as usual, there is a lot of bad blood between these two parties and they have to come to some compromise, clearly, but they are not there, that’s for sure,” Ghriskey said.

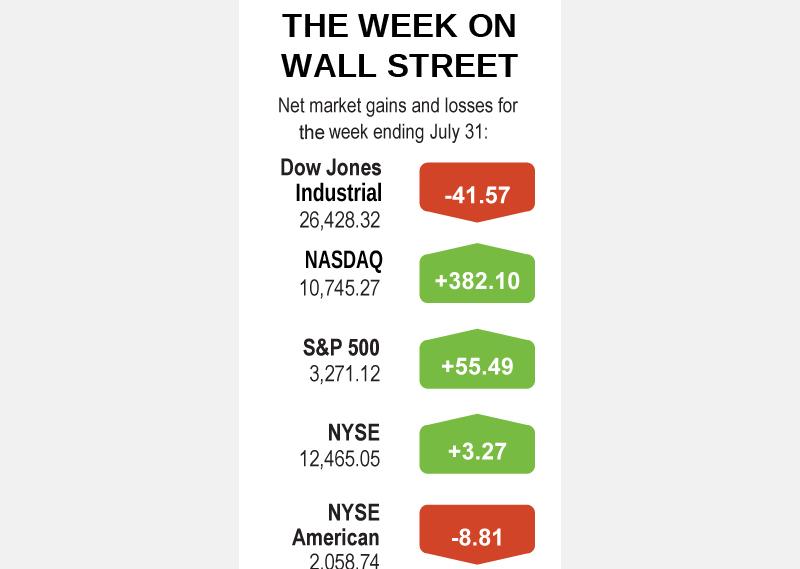

The Dow Jones rose 114.67 points, or 0.44 percent, to 26,428.32, the S&P 500 gained 24.9 points, or 0.77 percent, to 3,271.12 and the NASDAQ Composite added 157.46 points, or 1.49 percent, to 10,745.27.

It was a choppy session with each major index up and down. The Dow at one point fell more than 1 percent.

In late trade, stocks moved higher into the close as Microsoft Corp shares pared losses of more than 2 percent after reports the company was said to be in talks to buy video app TikTok.

Kansas City Southern also provided a late boost, ending the session 9.7 percent higher after the Wall Street Journal reported a group of buyout investors were considering a takeover bid for the rail operator.

The benchmark index is now about 3.4 percent shy of its February all-time high, but faltering macroeconomic data and rising COVID-19 cases in the US were making investors cautious again.

Still, the S&P notched its fourth weekly gain in the past five weeks and saw a fourth straight month of gains, with a lift from massive fiscal and monetary stimulus measures to buttress the US economy.

For the week, the S&P gained 1.73 percent, the Dow shed 0.16 percent and the NASDAQ climbed 3.69 percent. For the month, the S&P rose 5.52 percent, the Dow advanced 2.39 percent and the NASDAQ rallied 6.83 percent.

Energy stocks were the worst performing among the 11 major S&P sectors after Chevron Corp reported a US$8.3 billion loss on asset writedowns and ExxonMobil Corp recorded a second consecutive quarterly loss.

Stephen Garrett, a 27-year-old graduate student, always thought he would study in China, but first the country’s restrictive COVID-19 policies made it nearly impossible and now he has other concerns. The cost is one deterrent, but Garrett is more worried about restrictions on academic freedom and the personal risk of being stranded in China. He is not alone. Only about 700 American students are studying at Chinese universities, down from a peak of nearly 25,000 a decade ago, while there are nearly 300,000 Chinese students at US schools. Some young Americans are discouraged from investing their time in China by what they see

MAJOR DROP: CEO Tim Cook, who is visiting Hanoi, pledged the firm was committed to Vietnam after its smartphone shipments declined 9.6% annually in the first quarter Apple Inc yesterday said it would increase spending on suppliers in Vietnam, a key production hub, as CEO Tim Cook arrived in the country for a two-day visit. The iPhone maker announced the news in a statement on its Web site, but gave no details of how much it would spend or where the money would go. Cook is expected to meet programmers, content creators and students during his visit, online newspaper VnExpress reported. The visit comes as US President Joe Biden’s administration seeks to ramp up Vietnam’s role in the global tech supply chain to reduce the US’ dependence on China. Images on

New apartments in Taiwan’s major cities are getting smaller, while old apartments are increasingly occupied by older people, many of whom live alone, government data showed. The phenomenon has to do with sharpening unaffordable property prices and an aging population, property brokers said. Apartments with one bedroom that are two years old or older have gained a noticeable presence in the nation’s six special municipalities as well as Hsinchu county and city in the past five years, Evertrust Rehouse Co (永慶房產集團) found, citing data from the government’s real-price transaction platform. In Taipei, apartments with one bedroom accounted for 19 percent of deals last

US CONSCULTANT: The US Department of Commerce’s Ursula Burns is a rarely seen US government consultant to be put forward to sit on the board, nominated as an independent director Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday nominated 10 candidates for its new board of directors, including Ursula Burns from the US Department of Commerce. It is rare that TSMC has nominated a US government consultant to sit on its board. Burns was nominated as one of seven independent directors. She is vice chair of the department’s Advisory Council on Supply Chain Competitiveness. Burns is to stand for election at TSMC’s annual shareholders’ meeting on June 4 along with the rest of the candidates. TSMC chairman Mark Liu (劉德音) was not on the list after in December last