European shares on Friday closed in the red after EU lawmakers failed to agree on a coronavirus rescue package and British Prime Minister Boris Johnson announced that he had been infected.

The pan-European STOXX 600 on Friday started the day about 2 percent lower, then closed down 10.48 points, or 3.3 percent, at 310.90 after the announcement about Johnson’s test.

The declines followed a three-day rally. The index marked its best week since 2011, gaining 6.1 percent from a close of 293.04 on March 20.

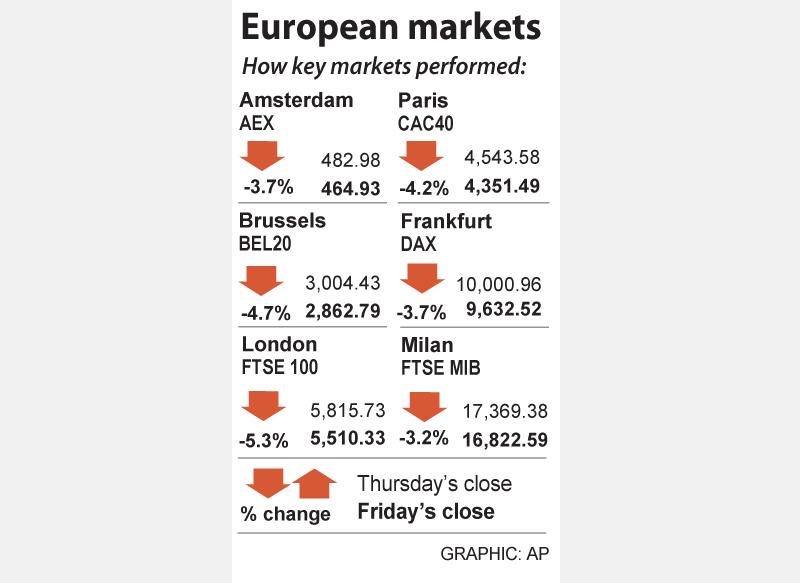

London’s blue-chip FTSE 100 on Friday extended its losses after the news, closing down 304.48 points, or 5.3 percent, at 5,511.25, but still gaining 6.2 percent from 5,190.78 a week earlier.

With most of Europe practically under lockdown due to the COVID-19 pandemic, a recession appears imminent.

EU lawmakers on Thursday extended the deadline for agreeing on a comprehensive economic rescue package by two weeks over a dispute between the ailing south and the fiscally conservative north.

“Perhaps Boris testing positive contributed to the sell-off, though it would have happened anyway,” TS Lombard head of strategy Andrea Cicione said in London.

“The bottom line is that the recovery from this crisis will be a lot slower than consensus expects, and it will be further slowed down by the high level of unemployment and lack of capex,” Cicione added.

Stephen Innes, chief market strategist at financial services firm AxiCorp Financial Services Pty Ltd, wrote in a note: “There was no specific new coordinated action to ramp up the fiscal response to the crisis and, in particular, no agreement around ‘corona bonds.’”

A swathe of bumper stimulus measures worldwide had bought about a modicum of stability in equity markets, prompting the three-day rally.

However, with the outbreak showing no signs of slowing, risk assets are likely due for more pain. Cases in the US are now the highest in the world.

Oil and gas stocks, while dropping 4.6 percent on the day, outperformed their peers over the course of the week, surging about 19 percent as they continued to recover from a 24-year low.

European automakers were the worst performers on the day, shedding about 5.8 percent.

Travel and leisure stocks fell 5.8 percent, with cruise ship operator Carnival Corp slumping nearly 21 percent to the bottom of the index.

Banks dropped 5.4 percent as the European Banking Federation said that they should halt this year’s dividend payments to preserve capital and continue to lend until the effects of the coronavirus epidemic are clearer.

Additional reporting by staff writer

Taiwan Transport and Storage Corp (TTS, 台灣通運倉儲) yesterday unveiled its first electric tractor unit — manufactured by Volvo Trucks — in a ceremony in Taipei, and said the unit would soon be used to transport cement produced by Taiwan Cement Corp (TCC, 台灣水泥). Both TTS and TCC belong to TCC International Holdings Ltd (台泥國際集團). With the electric tractor unit, the Taipei-based cement firm would become the first in Taiwan to use electric vehicles to transport construction materials. TTS chairman Koo Kung-yi (辜公怡), Volvo Trucks vice president of sales and marketing Johan Selven, TCC president Roman Cheng (程耀輝) and Taikoo Motors Group

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

RECORD-BREAKING: TSMC’s net profit last quarter beat market expectations by expanding 8.9% and it was the best first-quarter profit in the chipmaker’s history Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which counts Nvidia Corp as a key customer, yesterday said that artificial intelligence (AI) server chip revenue is set to more than double this year from last year amid rising demand. The chipmaker expects the growth momentum to continue in the next five years with an annual compound growth rate of 50 percent, TSMC chief executive officer C.C. Wei (魏哲家) told investors yesterday. By 2028, AI chips’ contribution to revenue would climb to about 20 percent from a percentage in the low teens, Wei said. “Almost all the AI innovators are working with TSMC to address the

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”