Russia is to embark on a new program of privatization, two-and-a-half years after its last major sale of state assets, officials were quoted as saying yesterday.

After the chaotic asset sales of the 1990s under former Russian president Boris Yeltsin’s term created a class of super-rich oligarchs and a major public backlash, the government has lately preferred to increase its stakes in firms.

But the financial crisis has blown a major whole in the Russian budget, with the budget deficit predicted to be around 8 percent of GDP this year and reduced only slightly to 6.9 percent next year.

Russian Finance Minister Alexei Kudrin told the Vedomosti financial daily that with the income from privatization Russia could reduce its use of reserve funds and cut the volume of planned bond issues needed to make up the budget shortfall.

“In other words the sum [from privatization] will go to reducing the deficit,” he said.

But Vedomosti quoted government sources as saying that a new privatization drive would be aimed as much at improving the image of Russia, which is still criticized by the West for having excessive state control of the economy.

“It’s clear that for the most part we are not talking about additional budget income — now is not the best economic time for sales — but about image, to show the world the liberalism of the government,” a source said.

Russian First Deputy Prime Minister Igor Shuvalov, a key ally of Russian Prime Minister Vladimir Putin, told Bloomberg TV in an interview that “now is the time that we can return” to privatization. He said that the government had “good assets” to offer.

Russia’s last major asset sale was the May 2007 privatization of 22.5 percent of its second largest bank, state-owned VTB, which raised US$8 billion.

Russia in July 2006 sold 15 percent in state-owned oil giant Rosneft which raised US$10.4 billion for the state coffers.

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

CHINA REACTS: The patrol and reconnaissance plane ‘transited the Taiwan Strait in international airspace,’ the 7th Fleet said, while Taipei said it saw nothing unusual The US 7th Fleet yesterday said that a US Navy P-8A Poseidon flew through the Taiwan Strait, a day after US and Chinese defense heads held their first talks since November 2022 in an effort to reduce regional tensions. The patrol and reconnaissance plane “transited the Taiwan Strait in international airspace,” the 7th Fleet said in a news release. “By operating within the Taiwan Strait in accordance with international law, the United States upholds the navigational rights and freedoms of all nations.” In a separate statement, the Ministry of National Defense said that it monitored nearby waters and airspace as the aircraft

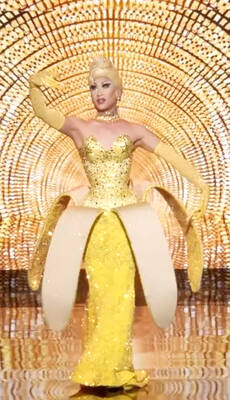

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique