The owner of the Philadelphia Inquirer and Philadelphia Daily News filed for bankruptcy protection on Sunday in an effort to restructure its debt load.

Philadelphia Newspapers Inc, owned by Philadelphia Media Holdings LLC, is the second newspaper company in two days, and fourth in recent months, to seek bankruptcy protection.

“This restructuring is focused solely on our debt, not our operations,” chief executive officer Brian Tierney said in a statement. “Our operations are sound and profitable.”

The filing on Sunday indicated the company had between US$100 million and US$500 million in assets and liabilities in the same range. The company said it would continue the normal operations of its newspapers, magazines and online businesses without interruption during the debt-restructuring process. In a story posted on its Web site on Sunday, the company said it had a debt load of US$390 million.

The company said it will continue the normal operations of its newspapers, magazines and online businesses without interruption during the debt-restructuring process. In a story posted on its Web site on Sunday, the company said it had a debt load of US$390 million.

“In the last two years, we experienced the rare trifecta of a dramatic decline in revenue, the worst economic crisis since the Great Depression and a debt structure out of line with current economic realities,” Tierney said.

The filing is the latest blow to newspapers. The Journal Register Co filed for bankruptcy on Saturday. The Chicago-based Tribune Co sought bankruptcy protection in December and the Star Tribune of Minneapolis followed suit last month.

Tierney said the company’s goal was to bring its debt in line with “the realities of the current economic and business conditions.” The company said it decided to turn to bankruptcy court after negotiating with its lenders for the last 11 months.

The filings reiterate that the newspaper company hopes to reconfigure its debt rather than restructure its operations. The company was profitable by one accounting measure last year, earning US$36 million before interest, taxes, depreciation and amortization, and excluding one-time items. That figure is expected to be at least US$25 million this year.

Tierney said in his statement that, in conjunction with its filing, the company is seeking court approval of up to US$25 million in debtor-in-possession (DIP) financing. The proposed DIP financing, plus the cash flow from operations, will ensure the company’s ability to satisfy obligations associated with its normal course of business, including wages and benefits, as well as payment of post-petition obligations to vendors under existing terms.

The company has long sought to offset declines in advertising revenue and circulation with moneysaving moves and improved efficiency, including sharing editorial functions of the two papers’ newsrooms.

The Newspaper Guild of Greater Philadelphia notified its union members of the filing in an e-mail on Sunday night.

The e-mail tells members to stay calm and report for work and that “the company is still in business, the papers are still publishing.” The communication tells Guild members the union contract remains in full force and that workers’ wages and benefits will continue to be paid.

A group of investors led by Tierney bought the two Philadelphia papers for US$562 million in June 2006.

According to the Audit Bureau of Circulations, the Philadelphia Inquirer had an average weekday circulation of 300,674 as of Sept. 30, down 11 percent from the prior year. That made it the nation’s No. 19 daily by circulation.

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

CHINA REACTS: The patrol and reconnaissance plane ‘transited the Taiwan Strait in international airspace,’ the 7th Fleet said, while Taipei said it saw nothing unusual The US 7th Fleet yesterday said that a US Navy P-8A Poseidon flew through the Taiwan Strait, a day after US and Chinese defense heads held their first talks since November 2022 in an effort to reduce regional tensions. The patrol and reconnaissance plane “transited the Taiwan Strait in international airspace,” the 7th Fleet said in a news release. “By operating within the Taiwan Strait in accordance with international law, the United States upholds the navigational rights and freedoms of all nations.” In a separate statement, the Ministry of National Defense said that it monitored nearby waters and airspace as the aircraft

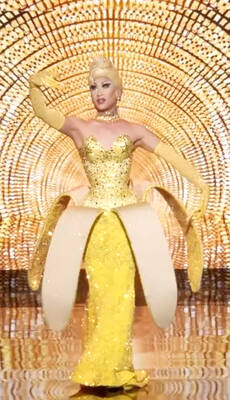

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique