European stocks gained for a second week, erasing this year’s loss, as companies from Vodafone Group PLC to Electrolux AB reported better-than-estimated results and governments stepped up measures to revive the global economy.

Vodafone, the largest mobile-phone company, rose 6.7 percent this week after sales beat analysts’ projections. Electrolux, the second-biggest appliance maker, climbed 16 percent on a smaller-than-expected loss. Infineon Technologies AG increased 17 percent as Europe’s second-largest maker of semiconductors said it would deepen cost cuts and lower investments to preserve cash. Xstrata PLC led mining shares higher as metals prices rallied.

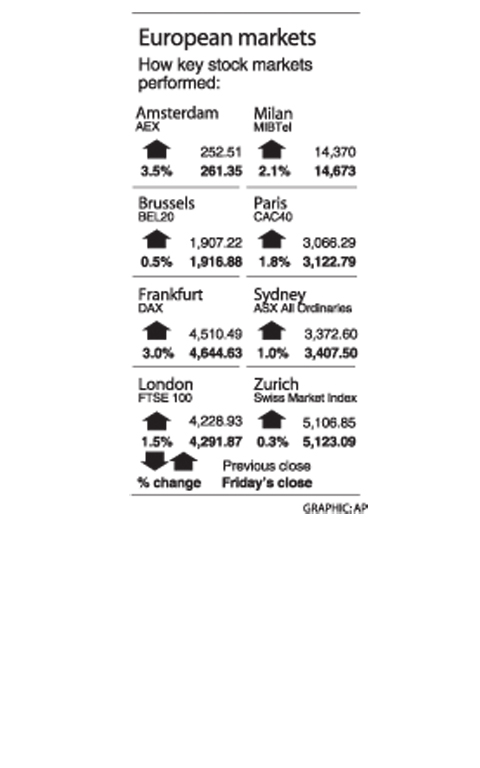

The Dow Jones STOXX 600 Index added 3.8 percent to 198.53, for a 0.1 percent gain this year.

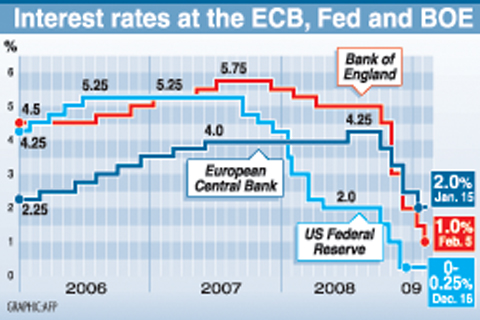

The measure has climbed 8.8 percent in the past two weeks amid speculation companies will weather the crisis that drove the US, Europe and Japan into simultaneous recessions and government measures and interest-rate cuts will revive the economy.

“Earnings from companies that depend on the economy have done better and that is reassuring,” said Bruno Ducros, a fund manager at Cardif Asset Management in Paris, which oversees about US$2.6 billion in stocks.

“It’s motivating the market. There are stimulus plans all over the world and that’s a very positive element,” he said.

National benchmark indexes increased in 15 of the 18 western European markets. Germany’s DAX Index rose 7.1 percent, while France’s CAC 40 advanced 5 percent. The UK’s FTSE 100 added 3.4 percent as Aviva PLC and BHP Billiton Ltd rallied.

Profits for companies in the index are expected to decline 1.6 percent this year following a 20 percent slump last year, according to data compiled by Bloomberg.

Governments around the world are fighting to revive a global economy burdened by more than US$1 trillion of losses and writedowns tied to the credit crisis.

China’s government started investing the second allocation of a 4 trillion-yuan (US$585 billion) economic stimulus package, the offical Xinhua news agency reported. Japan’s central bank said it will buy ¥1 trillion (US$10.9 billion) of shares held by financial institutions, while Australia announced A$42 billion (US$28 billion) in extra spending.

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

LANDSLIDES POSSIBLE: The agency advised the public to avoid visiting mountainous regions due to more expected aftershocks and rainfall from a series of weather fronts A series of earthquakes over the past few days were likely aftershocks of the April 3 earthquake in Hualien County, with further aftershocks to be expected for up to a year, the Central Weather Administration (CWA) said yesterday. Based on the nation’s experience after the quake on Sept. 21, 1999, more aftershocks are possible over the next six months to a year, the agency said. A total of 103 earthquakes of magnitude 4 on the local magnitude scale or higher hit Hualien County from 5:08pm on Monday to 10:27am yesterday, with 27 of them exceeding magnitude 5. They included two, of magnitude

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique