Chanel fashion’s decision to call off a prestigious but costly global art show is the latest sign that even the shine of the luxury industry is beginning to wear thin because of the crisis.

While big profits are still on the cards for the luxury sector in the months ahead, global sales are down, prices stagnating and less and less new boutiques opening.

“This is the sector’s toughest crisis in decades,” said Annie Girac, a consultant for Euler Hermes SFAC credit insurance firm.

Paris-based Chanel on Friday announced a premature end to the Chanel Mobile Art exhibition, a high-end arty tribute to its quilted bag-with-chain that traveled from Hong Kong to Tokyo to New York and had been due to continue to London, Moscow and Paris.

“In the current context we have to arbitrate. We prefer to refocus on our strategic investments,” Chanel said.

In just a year, said a Paris bank analyst, solid groups such as Switzerland’s Richemont, which owns the brands Cartier and Montblanc, or France’s LVMH, which owns Vuittonand Gucci, have lost 40 percent of their share value.

“We had never seen anything like this,” he said.

Italy’s Bulgari is expecting a fall in profits this year while Tiffany in the US has warned of a possible staff cut because of a third quarter drop in turnover.

Meanwhile LVMH, the world’s leading luxury conglomerate, saw its third quarter growth sliced 50 percent in comparison to the first two terms this year.

After expanding for four years with more than 10 percent annual growth, the luxury sector faces a 4 percent drop in sales next year, US investment bank JPMorgan said.

For some labels, the fall could be as much as a 10 percent to 15 percent, Deutsche Bank said.

But the crisis will hit some countries and products harder than others, said Emmanuel Bruley des Varannes, an analyst at French bank Societe Generale.

“The Japanese market,” he said, “has been very badly hit because the country is in a recession.”

LVMH sales in Japan have dived 7 percent in the first nine months, with the firm forced to drop prices both because of financial turmoil and to the 30 percent drop in the euro against the yen in the last three months.

And last week the luxury giant dropped plans to open the world’s biggest Vuitton store in Tokyo.

Commenting on the effect of the crisis on various luxury goods, Bruney des Varannes said watch makers were taking a bigger punch than makers of leather goods.

Swiss watch exports last month dropped more than 15 percent, with falls highest on the big Hong Kong and US markets.

France’s usually lucrative champagne exports too are wobbly, with sales to the US market down 17 percent.

“To protect themselves, luxury labels are cutting back on planned openings of new boutiques, freezing staff recruitment, closing some shops and refocusing activities,” he said.

Also See: Second-hand luxury goods defy crisis

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

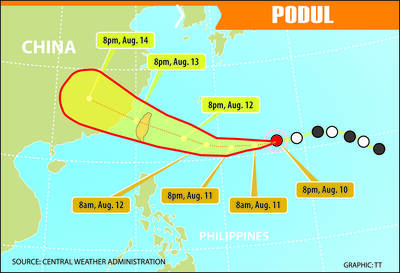

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

CHINA’s BULLYING: The former British prime minister said that he believes ‘Taiwan can and will’ protect its freedom and democracy, as its people are lovers of liberty Former British prime minister Boris Johnson yesterday said Western nations should have the courage to stand with and deepen their economic partnerships with Taiwan in the face of China’s intensified pressure. He made the remarks at the ninth Ketagalan Forum: 2025 Indo-Pacific Security Dialogue hosted by the Ministry of Foreign Affairs and the Prospect Foundation in Taipei. Johnson, who is visiting Taiwan for the first time, said he had seen Taiwan’s coastline on a screen on his indoor bicycle, but wanted to learn more about the nation, including its artificial intelligence (AI) development, the key technology of the 21st century. Calling himself an