American International Group Inc (AIG), the insurer rescued by the US government, may be forced to slow the pace of asset sales because of their complexities and the global financial crisis.

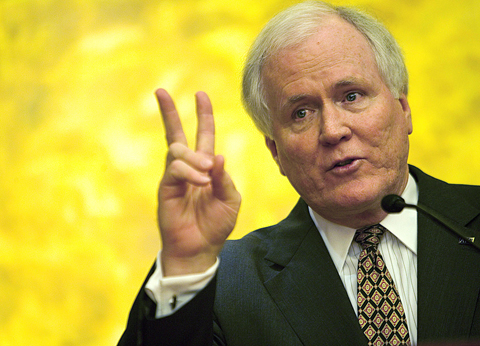

“These are challenging times to undertake divesture,” said chief executive officer Edward Liddy at an American Chamber of Commerce lunch in Hong Kong yesterday. “It’s quite possible that the pace and order of our divestiture will change.”

AIG is selling businesses including life insurance, retirement services and an airplane-leasing unit to repay a government loan of as much as US$60 billion. The loan is part of an expanded US$152.5 billion rescue package that spared it from bankruptcy and gave the government a 79.9 percent stake.

PHOTO: BLOOMBERG

AIG has drawn down about US$30 billion of the debt facility. Its asset sales would aim to reduce the debt and to help redeem preferred stock it sold, Liddy said.

“The plan I laid out back in early October I think remains valid today,” he said. “We’re going to pay back the US taxpayers every single penny we owe them.”

The size and complexity of the assets it is trying to sell is a main reason for the uncertainty of the timing, Liddy said. American Life Insurance Co, for example, operates in 30 different countries. Potential investors would need time to conduct due diligence and they would want to ascertain AIG has all the regulatory approval, he said.

“For businesses of this complexity, this breadth and this amount of dollars, it just takes time to get the buyers up to speed,” he told reporters after his speech.

AIG executives have met with regulators in different countries to garner support for the asset sales and have discussed plans with investment bankers, he added. They will meet potential buyers in the US in January, said Liddy, who is visiting Hong Kong, Tokyo and Singapore to meet staff.

In Asia, Liddy reiterated the group is seeking to sell in entirety its American Life Insurance unit, and in Japan, the AIG Star Life Insurance Co and AIG Edison Life Insurance Co operations.

After the sale, it will focus on global property casualty operations and its Asian life insurance business. American Life Insurance, which offers wealth management, retirement planning, life and health insurance, operates in Japan and South Asia in the region, according to its Web site.

AIG agreed to sell its 50 percent stakes in units of energy producer Tenaska Inc back to the company’s employee owners as part of the asset divestment plan.

Early this month, it also announced the sale of AIG Private Bank Ltd, a unit catering to wealthy individuals in Asia and the Middle East, to Abu Dhabi-based Aabar Investment PJSC for 307 million Swiss francs (US$256 million).

More asset sales may be announced soon, Liddy said.

RETHINK? The defense ministry and Navy Command Headquarters could take over the indigenous submarine project and change its production timeline, a source said Admiral Huang Shu-kuang’s (黃曙光) resignation as head of the Indigenous Submarine Program and as a member of the National Security Council could affect the production of submarines, a source said yesterday. Huang in a statement last night said he had decided to resign due to national security concerns while expressing the hope that it would put a stop to political wrangling that only undermines the advancement of the nation’s defense capabilities. Taiwan People’s Party Legislator Vivian Huang (黃珊珊) yesterday said that the admiral, her older brother, felt it was time for him to step down and that he had completed what he

Taiwan has experienced its most significant improvement in the QS World University Rankings by Subject, data provided on Sunday by international higher education analyst Quacquarelli Symonds (QS) showed. Compared with last year’s edition of the rankings, which measure academic excellence and influence, Taiwanese universities made great improvements in the H Index metric, which evaluates research productivity and its impact, with a notable 30 percent increase overall, QS said. Taiwanese universities also made notable progress in the Citations per Paper metric, which measures the impact of research, achieving a 13 percent increase. Taiwanese universities gained 10 percent in Academic Reputation, but declined 18 percent

BULLY TACTICS: Beijing has continued its incursions into Taiwan’s airspace even as Xi Jinping talked about Taiwan being part of the Chinese family and nation China should stop its coercion of Taiwan and respect mainstream public opinion in Taiwan about sovereignty if its expression of goodwill is genuine, the Ministry of Foreign Affairs (MOFA) said yesterday. Ministry spokesman Jeff Liu (劉永健) made the comment in response to media queries about a meeting between former president Ma Ying-jeou (馬英九) and Chinese President Xi Jinping (習近平) the previous day. Ma voiced support for the so-called “1992 consensus,” while Xi said that although the two sides of the Taiwan Strait have “different systems,” this does not change the fact that they are “part of the same country,” and that “external

UNDER DISCUSSION: The combatant command would integrate fast attack boat and anti-ship missile groups to defend waters closest to the coastline, a source said The military could establish a new combatant command as early as 2026, which would be tasked with defending Taiwan’s territorial waters 24 nautical miles (44.4km) from the nation’s coastline, a source familiar with the matter said yesterday. The new command, which would fall under the Naval Command Headquarters, would be led by a vice admiral and integrate existing fast attack boat and anti-ship missile groups, along with the Naval Maritime Surveillance and Reconnaissance Command, said the source, who asked to remain anonymous. It could be launched by 2026, but details are being discussed and no final timetable has been announced, the source