Henry Paulson's selection as US Treasury secretary may enhance the standing of the department as it pushes for flexible exchange rates abroad and battles protectionism at home.

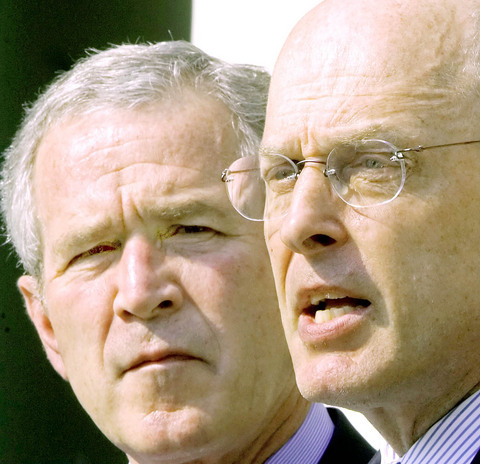

Paulson, whom US President George W. Bush nominated for the post on Tuesday after seven years running Goldman Sachs Group Inc, likes to boast he has visited China more than 70 times since 1990.

He'll need that experience and the authority that comes from the president's backing in talks to persuade China to let its currency appreciate.

PHOTO: AFP

"He is going to be a major player, and I think the president sees it very much the same way," said Robert Hormats, vice chairman of Goldman Sachs International in New York.

"He knows the Chinese leaders, he knows how the economy works, he knows of the benefits for American companies operating in China and he knows about the competitive challenge," Hormats said.

Treasury has been without a champion in the president's inner circle in the way that it had under Robert Rubin, former president Bill Clinton's longest-serving Treasury chief. Paulson only agreed to take the job after assurances from Bush that he would have a strong voice in shaping policy, not just selling it, said a person briefed by Paulson.

"I don't see how the president could have done any better than picking Hank Paulson," said Pete Peterson, senior chairman of the Blackstone Group, who has been critical of Bush fiscal policies that turned a surplus into a record deficit.

A former administration official with ties to both the White House and Wall Street said that Paulson's expertise on China was the single biggest reason Bush picked him -- a sign that Bush views dealing with China on currency and trade issues as a primary focus of his economic plans for his final two years in office.

"This is a very good deal for this administration," said Vin Weber, a former Minnesota congressman who is now a lobbyist with close ties to Bush.

Paulson is "one of the most prominent financial services executives in the country. It's the kind of person that they really have needed, and now they've got it," Weber said.

Still, Paulson's influence may be limited because he is joining an unpopular administration that's in its last years in office and there's no sign new economic policies are afoot.

"This is not a criticism of Paulson, it's just a sign of the times," said Don Straszheim, vice chairman of Roth Capital Partners in Newport Beach, California.

"We're in the sixth year of this administration. Economic policy is not going to capture the public's fancy in the next 24 months no matter who's at Treasury," he said.

It's far from certain Paulson, with little Washington experience, will be able to match his Wall Street success in his dealings within the administration and with Congress.

Paulson's predecessor, John Snow, advocated "quiet diplomacy" with China, resulting in a 2.1 percent revaluation of the yuan in July and not much movement since then. The yuan has strengthened about 1 percent since the shift.

The pace of change is angering members of Congress, who blame China for the record US$726 billion US trade deficit last year. About 20 bills are working their way through Capitol Hill advocating some kind of penalties against China.

"The biggest challenge is keeping protectionist forces at bay, pressing against the isolationist, protectionist pressures that you see in the Congress today," Snow said in an interview after the announcement on Tuesday. "Those are absolutely real threats, and they have to be guarded against."

Snow said that he suggested Paulson to the White House as his replacement.

RETHINK? The defense ministry and Navy Command Headquarters could take over the indigenous submarine project and change its production timeline, a source said Admiral Huang Shu-kuang’s (黃曙光) resignation as head of the Indigenous Submarine Program and as a member of the National Security Council could affect the production of submarines, a source said yesterday. Huang in a statement last night said he had decided to resign due to national security concerns while expressing the hope that it would put a stop to political wrangling that only undermines the advancement of the nation’s defense capabilities. Taiwan People’s Party Legislator Vivian Huang (黃珊珊) yesterday said that the admiral, her older brother, felt it was time for him to step down and that he had completed what he

Taiwan has experienced its most significant improvement in the QS World University Rankings by Subject, data provided on Sunday by international higher education analyst Quacquarelli Symonds (QS) showed. Compared with last year’s edition of the rankings, which measure academic excellence and influence, Taiwanese universities made great improvements in the H Index metric, which evaluates research productivity and its impact, with a notable 30 percent increase overall, QS said. Taiwanese universities also made notable progress in the Citations per Paper metric, which measures the impact of research, achieving a 13 percent increase. Taiwanese universities gained 10 percent in Academic Reputation, but declined 18 percent

CHINA REACTS: The patrol and reconnaissance plane ‘transited the Taiwan Strait in international airspace,’ the 7th Fleet said, while Taipei said it saw nothing unusual The US 7th Fleet yesterday said that a US Navy P-8A Poseidon flew through the Taiwan Strait, a day after US and Chinese defense heads held their first talks since November 2022 in an effort to reduce regional tensions. The patrol and reconnaissance plane “transited the Taiwan Strait in international airspace,” the 7th Fleet said in a news release. “By operating within the Taiwan Strait in accordance with international law, the United States upholds the navigational rights and freedoms of all nations.” In a separate statement, the Ministry of National Defense said that it monitored nearby waters and airspace as the aircraft

UNDER DISCUSSION: The combatant command would integrate fast attack boat and anti-ship missile groups to defend waters closest to the coastline, a source said The military could establish a new combatant command as early as 2026, which would be tasked with defending Taiwan’s territorial waters 24 nautical miles (44.4km) from the nation’s coastline, a source familiar with the matter said yesterday. The new command, which would fall under the Naval Command Headquarters, would be led by a vice admiral and integrate existing fast attack boat and anti-ship missile groups, along with the Naval Maritime Surveillance and Reconnaissance Command, said the source, who asked to remain anonymous. It could be launched by 2026, but details are being discussed and no final timetable has been announced, the source