After decades of being stifled by strict foreign exchange controls, corporate India has gone on a shopping spree -- snapping up companies everywhere from Britain to Korea.

Still, the country has no home-based takeover tycoons to rival Kolkata-born "king of steel" Lakshmi Mittal, whose Rotterdam-headquartered company Mittal Steel has mounted a US$22.7 billion bid for rival Arcelor.

But with India's economy growing at a cracking eight percent, the nation's cash-flush firms are becoming global players, purchasing companies in all sectors from software to pharmaceuticals, information technology and energy.

While many of the acquisitions are small, that's seen as changing in coming years as Indian companies head increasingly abroad.

"We're really at an exciting time for Indian business," said Alan Rosling, executive director of Tata Sons, holding firm of tea-to-telecoms Tata group, India's second largest conglomerate.

"It's not just the Indian government liberalizing [the economy] -- it's the world globalizing," he said.

Firms in Indian hands include well-known British tea brands Tetley Tea and Typhoo Tea, the trucking unit of South Korea's Daewoo Group and Bermuda-based bandwidth provider Flag Telecom whose undersea cables link the world.

Last year, the value of India's 118 purchases of foreign firms totaled US$2.91 billion, said Marti Subrahmanyam, finance professor at Stern School of Business at New York University. That's around seven times the tally in 2001.

While the amount is puny by world standards, analysts say India's takeover hunger will rise as firms aim to attain critical mass to compete globally and to leverage their low-cost production base.

"There's a need for corporates in the developing world to restructure to deal with the compulsions of globalization," Mustafa Hamdy, Vienna University of Technology management professor, told a recent Kolkata business forum.

India's biggest deals last year included the US$313 million purchase by Matrix Laboratories of Belgium's DocPharma, TV maker Videocon's acquisition of the color picture-tube business of France's Thomson for US$292 million and Tata Chemical's US$112-million takeover of British soda ash manufacturer Brunner Mond. Its products are used to make glass and detergents.

India's burgeoning business process outsourcing (BPO) sector, in particular, is extremely keen on foreign purchases, eager to acquire niche skills swiftly in such areas as retail, insurance or health care.

"We need acquisitions to acquire relevant scale, capability and to plug gaps in service operatings," said Alok Mitra, chief financial officer of Mphasis BFL, one of the busiest BPO overseas buyers.

This foreign expansion flurry was impossible until recently. Indian firms were slow to hit the global acquisition trail because of tight government controls on exporting rupees as foreign reserves were too low.

In 1991 reserves sank to less than US$1 billion, creating a financial crisis that forced India to open its economy to foreigners. Now, thanks to a rush of foreign investment, coffers are brimming at US$140 billion and exchange controls have eased.

The nation's deal-making, however, is still dwarfed by its giant Chinese neighbors who pay in the billions of dollars for acquisitions rather than in the millions like India. The average Indian purchase is US$30 million which means they do not often hit international headlines.

Also Indian firms have done nothing as high-profile as Chinese computer maker LeNovo's US$1.75 billion purchase of IBM's PC division which included the famous ThinkPad.

In fact, India's deal-making last year represented just one percent of total global merger activity valued at US$2.1 trillion, according to accounting firm KPMG.

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

LANDSLIDES POSSIBLE: The agency advised the public to avoid visiting mountainous regions due to more expected aftershocks and rainfall from a series of weather fronts A series of earthquakes over the past few days were likely aftershocks of the April 3 earthquake in Hualien County, with further aftershocks to be expected for up to a year, the Central Weather Administration (CWA) said yesterday. Based on the nation’s experience after the quake on Sept. 21, 1999, more aftershocks are possible over the next six months to a year, the agency said. A total of 103 earthquakes of magnitude 4 on the local magnitude scale or higher hit Hualien County from 5:08pm on Monday to 10:27am yesterday, with 27 of them exceeding magnitude 5. They included two, of magnitude

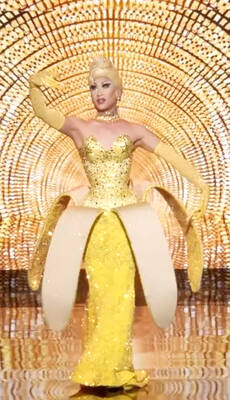

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique