Investors, pumping up stocks in anticipation of an economic bounce in the second half of this year, are now nervously awaiting the hard evidence from corporate America, analysts say.

Over the next few weeks, most US companies will report profits for the second quarter of this year. Operating profits are widely expected to be up by between 5 percent and 10 percent from year-ago levels.

But Wall Street is rising fast because investors are banking on much richer profits in the second half of the year fueled by a recovery in the wider economy, market analysts said.

If the economic and corporate recovery is postponed again, after repeatedly being knocked back after the Sept. 11, 2001 attacks, the stock market rally may unravel, they said.

"I think there is a danger that we could slip into another correction here," said Thomson First Call research director Charles Hill. "This rally has been built on expectations that we are going to get back to a more traditional recovery, and that may not be on the cards."

Analysts generally expect firms on the Standard and Poor's 500 index to boost operating profits by 5.2 percent in the second quarter when compared to a year ago, according to a Thomson First Call survey.

But profits for the three months will likely rise by an even steeper margin than the analysts' consensus expectation, increasing by eight to 10 percent from year-ago levels, Hill forecast.

For the rest of year, analysts' expectations were even higher.

The consensus forecast was for company profits to rise 12.7 percent from a year ago in the third quarter of this year, and by 21.4 percent in the fourth quarter, Hill said.

"But here we are now, a few days into the second half and we are not hearing anything from the companies in the aggregate about things getting materially better," he said. "The economic numbers are certainly not showing much of a sign of improvement, particularly last week. So, you really wonder."

The US unemployment rate shot up unexpectedly to a nine-year high of 6.4 percent last month, the government said last week.

But other data showed a tentative recovery, including a more buoyant survey of the US services sector.

Many analysts are tipping a sharp rebound in economic growth for the rest of the year, fueled in part by 45-year-low interest rates and a US$350 billion package of tax cuts.

And corporate bosses, usually grim, appeared to be gaining hope.

A business confidence barometer based on a survey of about 100 chief executives leapt to 60 points in the second quarter from 53 points in the first quarter, a private survey showed.

"Latest survey results show steady improvement in chief executive confidence levels since the beginning of the year," said Lynn Franco, director of consumer research for the Conference Board, which conducted the poll.

"Growing optimism about profits suggests stronger corporate performance ahead," she said.

But the US economy was still suffering from too much capacity lying idle after the investment binge of the late 1990s, Hill said.

Companies were waiting for consumers to mop up the excess before investing more money, he said.

"Ultimately, for this recovery to have legs we have got to have business spending pick up to a more normal pace," Hill cautioned.

ROLLER-COASTER RIDE: More than five earthquakes ranging from magnitude 4.4 to 5.5 on the Richter scale shook eastern Taiwan in rapid succession yesterday afternoon Back-to-back weather fronts are forecast to hit Taiwan this week, resulting in rain across the nation in the coming days, the Central Weather Administration said yesterday, as it also warned residents in mountainous regions to be wary of landslides and rockfalls. As the first front approached, sporadic rainfall began in central and northern parts of Taiwan yesterday, the agency said, adding that rain is forecast to intensify in those regions today, while brief showers would also affect other parts of the nation. A second weather system is forecast to arrive on Thursday, bringing additional rain to the whole nation until Sunday, it

CONDITIONAL: The PRC imposes secret requirements that the funding it provides cannot be spent in states with diplomatic relations with Taiwan, Emma Reilly said China has been bribing UN officials to obtain “special benefits” and to block funding from countries that have diplomatic ties with Taiwan, a former UN employee told the British House of Commons on Tuesday. At a House of Commons Foreign Affairs Committee hearing into “international relations within the multilateral system,” former Office of the UN High Commissioner for Human Rights (OHCHR) employee Emma Reilly said in a written statement that “Beijing paid bribes to the two successive Presidents of the [UN] General Assembly” during the two-year negotiation of the Sustainable Development Goals. Another way China exercises influence within the UN Secretariat is

LANDSLIDES POSSIBLE: The agency advised the public to avoid visiting mountainous regions due to more expected aftershocks and rainfall from a series of weather fronts A series of earthquakes over the past few days were likely aftershocks of the April 3 earthquake in Hualien County, with further aftershocks to be expected for up to a year, the Central Weather Administration (CWA) said yesterday. Based on the nation’s experience after the quake on Sept. 21, 1999, more aftershocks are possible over the next six months to a year, the agency said. A total of 103 earthquakes of magnitude 4 on the local magnitude scale or higher hit Hualien County from 5:08pm on Monday to 10:27am yesterday, with 27 of them exceeding magnitude 5. They included two, of magnitude

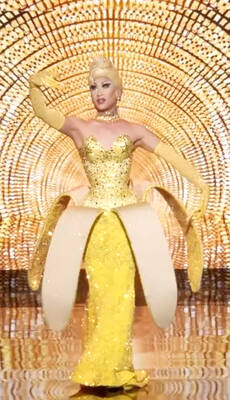

Taiwan’s first drag queen to compete on the internationally acclaimed RuPaul’s Drag Race, Nymphia Wind (妮妃雅), was on Friday crowned the “Next Drag Superstar.” Dressed in a sparkling banana dress, Nymphia Wind swept onto the stage for the final, and stole the show. “Taiwan this is for you,” she said right after show host RuPaul announced her as the winner. “To those who feel like they don’t belong, just remember to live fearlessly and to live their truth,” she said on stage. One of the frontrunners for the past 15 episodes, the 28-year-old breezed through to the final after weeks of showcasing her unique