Representatives from nearly 100 legal and financial entities across Taiwan gathered yesterday in Taipei for the nation’s third round of mutual evaluations by members of the Asia/Pacific Group on Money Laundering (APG), while Premier William Lai (賴清德) expressed confidence in the national delegation.

The evaluation runs through Friday next week, and is conducted by a nine-member team led by APG Secretariat member David Shannon, who is to present a preliminary report on the final day.

Under review are 37 government agencies, including the Judicial Yuan, the Ministry of Justice, the Financial Supervisory Commission, the central bank, the Ministry of Economic Affairs and the Ministry of the Interior, as well as 56 private entities, such as financial agencies, accountants, lawyers, real-estate agencies and non-profit organizations.

Photo provided by the Executive Yuan

Shannon said at the opening ceremony held at state-run Hua Nan Financial Holdings Co’s (華南金控) headquarters that this is his 17th time conducting APG mutual evaluations, and that the Taiwanese delegation is by far the best organized, considering the involvement of high-level officials and their collaboration with the private sector.

Taiwan joined the APG as a founding member in 1997, and was the first Asian nation to promulgate legislation against money laundering, the 1996 Money Laundering Control Act (洗錢防制法), Lai said.

Inefficient implementation of the act led to Taiwan being placed on the APG’s “regular follow-up” list in 2007, before the nation was subjected to fewer follow-ups in 2011, placed on a transitional list in 2014 and removed from follow-up last year, pending the results of the next evaluation, the Executive Yuan said.

Photo provided by the Executive Yuan

A negative evaluation would affect the nation’s capital outflow, as well as the overseas businesses of financial agencies and other Taiwanese enterprises, it added.

“Some offshore units of Taiwanese financial entities have had a problem complying with legal regulations and been punished by foreign governments,” Lai said.

Lai cited the case of the New York branch of state-run Mega Financial Holding Co (兆豐金控), which in 2016 contravened US money laundering and banking secrecy laws and was fined US$180 million by the New York State Department of Financial Services.

Photo provided by the Executive Yuan

US federal financial regulators in January fined the bank another US$29 million after its New York, Chicago and Silicon Valley branches failed an inspection.

To prevent similar contraventions, the government requires financial businesses to communicate problems and tighten controls over domestic and overseas units, Lai said.

After establishing the Anti-Money Laundering Office in March last year, the government amended the Money Laundering Control Act, the Company Act (公司法) and the Counter-Terrorism Financing Act (資恐防制法), while promulgating the Mutual Assistance in Criminal Matters Act (國際刑事司法互助法) and the Corporation Act (財團法人法), he said.

Citing amendments passed in July that overhauled the Company Act, Lai said the government abolished “bearer shares” in an effort to push companies to have more transparent management.

The Legislative Yuan on Friday last week passed amendments to the Money Laundering Control Act, which regulates virtual currency trading and stipulates a maximum fine of NT$10 million (US$324,981) for firms that have not established an internal auditing mechanism.

The legislature also passed amendments to the Counter-Terrorism Financing Act, granting authorities the discretion to deny sanctioned parties an appeal window.

“The evaluation is a starting point rather than a destination. Taiwan will continue to follow the regulations of the APG and the Financial Action Task Force,” Lai said..

Recalling his participation in a mock evaluation held by the Executive Yuan last year, Minister of Justice Tsai Ching-hsiang (蔡清祥) said that many government officials panic over such evaluations, but added that the government is confident that it will earn a good grade in this year’s mutual evaluations.

The ministry has identified drug trafficking, fraud, organized crime, corruption, smuggling, securities crimes, third-party money laundering and tax evasion as the top crimes associated with money laundering, with one of the government’s tasks being to monitor the cash flow of people engaged in those activities, Tsai added.

Since paying the substantial US fines, Mega Financial Holding has endeavored to tighten protocols to curb money laundering and to improve controls for offshore units, Financial Supervisory Commission Chairman Wellington Koo (顧立雄) said, adding that the company’s progress would impress foreign evaluators.

Other financial entities have also increased the amount of resources devoted to preventing financial crimes, as shown by a higher number of reports on suspicious transactions and closer collaboration with law enforcement in investigating unlawful dealings, Koo said.

The evaluation team is to release a preliminary report next week and the government would be able to respond to the team’s recommendations at a meeting in March next year, the Executive Yuan said.

When Taiwan presents its report to the APG at the organization’s 22nd annual meeting in July next year, the third round of mutual evaluations would be successfully concluded, it added.

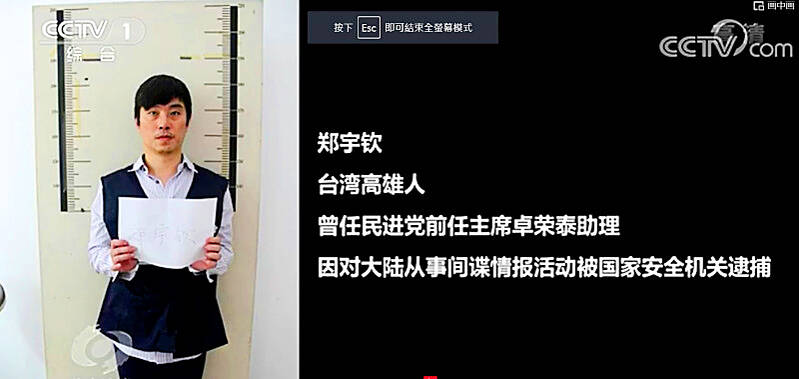

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

LIKE FAMILY: People now treat dogs and cats as family members. They receive the same medical treatments and tests as humans do, a veterinary association official said The number of pet dogs and cats in Taiwan has officially outnumbered the number of human newborns last year, data from the Ministry of Agriculture’s pet registration information system showed. As of last year, Taiwan had 94,544 registered pet dogs and 137,652 pet cats, the data showed. By contrast, 135,571 babies were born last year. Demand for medical care for pet animals has also risen. As of Feb. 29, there were 5,773 veterinarians in Taiwan, 3,993 of whom were for pet animals, statistics from the Animal and Plant Health Inspection Agency showed. In 2022, the nation had 3,077 pediatricians. As of last

XINJIANG: Officials are conducting a report into amending an existing law or to enact a special law to prohibit goods using forced labor Taiwan is mulling an amendment prohibiting the importation of goods using forced labor, similar to the Uyghur Forced Labor Prevention Act (UFLPA) passed by the US Congress in 2021 that imposed limits on goods produced using forced labor in China’s Xinjiang region. A government official who wished to remain anonymous said yesterday that as the US customs law explicitly prohibits the importation of goods made using forced labor, in 2021 it passed the specialized UFLPA to limit the importation of cotton and other goods from China’s Xinjiang Uyghur region. Taiwan does not have the legal basis to prohibit the importation of goods