The Supreme Administrative Court yesterday ordered Chao Chen Shou (趙陳熟), wife of Farglory Group founder Chao Teng-hsiung (趙藤雄), to pay taxes of NT$55.1 million (US$1.77 million at the current exchange rate) on her “gift” of company shares to her sons.

The court rejected her appeal of an earlier conviction for not paying the gift tax on a 2007 transfer of company stock as a gift to her sons, Frank Chao (趙文嘉) and George Chao (趙信清), at an estimated value of NT$120 million.

It was the final ruling and cannot be appealed.

She at the time was on the board of directors for Farglory International Investment Co, a subsidiary of Farglory Group.

Lawyers representing the National Taxation Bureau took the case to court, saying that Chao Chen had contravened financial regulations to avoid paying taxes.

Court documents showed that Farglory International Investment in March 2007 voted to issue 5 million new shares to increase capital.

As a board member, Chao Chen was entitled to a share of the issuance, but she said that she gave up her ratio by transferring the right to purchase the shares to her sons, who completed the transaction on April 9, 2007.

At that time, Frank Chao was chairman of Farglory Land Development Co and George Chao was president of Farglory Life Insurance Co, both group subsidiaries.

An investigation by the bureau found that the transfer was a gift with financial benefit for her sons, and she therefore had to pay gift tax of NT$55.1 million.

Chao Chen said that she did not exercise her entitlement to the shares, which the company then passed on, so it should not be seen as a gift.

However, the court ruled that as Chao Chen and her husband had owned 99.9 percent of Farglory International Investment, they had the power to pass the right to purchase new shares to whomever they chose.

Court documents also showed that she had the right to buy the shares at NT$50 apiece, far below the market price of NT$215.64, therefore constituting a contravention of inside trading rules by confering substantial financial gain on her family members.

Former president Ma Ying-jeou’s (馬英九) mention of Taiwan’s official name during a meeting with Chinese President Xi Jinping (習近平) on Wednesday was likely a deliberate political play, academics said. “As I see it, it was intentional,” National Chengchi University Graduate Institute of East Asian Studies professor Wang Hsin-hsien (王信賢) said of Ma’s initial use of the “Republic of China” (ROC) to refer to the wider concept of “the Chinese nation.” Ma quickly corrected himself, and his office later described his use of the two similar-sounding yet politically distinct terms as “purely a gaffe.” Given Ma was reading from a script, the supposed slipup

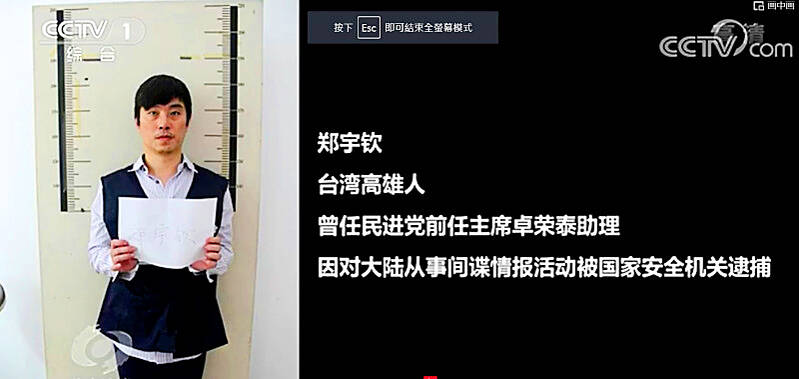

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

The bodies of two individuals were recovered and three additional bodies were discovered on the Shakadang Trail (砂卡礑) in Taroko National Park, eight days after the devastating earthquake in Hualien County, search-and-rescue personnel said. The rescuers reported that they retrieved the bodies of a man and a girl, suspected to be the father and daughter from the Yu (游) family, 500m from the entrance of the trail on Wednesday. The rescue team added that despite the discovery of the two bodies on Friday last week, they had been unable to retrieve them until Wednesday due to the heavy equipment needed to lift

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,