The National Communications Commission (NCC) yesterday said that it would scrutinize the investment structure of a pending sale of China Network Systems (CNS) and verify the sources of funding for the transaction.

A deal was signed earlier this year to sell the nation’s largest multiple system operator to an investment team led by KHL Capital chairman Gary Kuo (郭冠群) for about NT$51.5 billion (US$1.68 billion).

Two of the investment team’s largest shareholders are investment firms set up through the Y.L. Lin Hung Tai Education Foundation, which is owned by the Hung Tai Group, a real-estate developer.

The Chinese-language Wealth Magazine yesterday published an investigative report that said the two investment firms have invested about NT$8 billion in the deal and would together hold nearly half of CNS if the government approves the deal.

The case is another example of big corporations turning organizations such as nonprofit foundations, which were originally designed to encourage the wealthy to engage in charity, into an investment mechanism to evade taxes, the magazine said.

The foundation on Wednesday said that it has not directly invested in CNS, adding that its funds are used strictly for educational and cultural charities, as well as medical supply donations.

The Hung Tai Group has been focusing on real-estate businesses, Kuo said on Wednesday, adding that buying CNS was mainly a “complementary investment” that would help the group branch out to the cable TV industry, which has a high cash flow.

NCC Chairwoman Nicole Chan (詹婷怡) said in an interview on the sidelines of a forum yesterday that the commission would first determine the investment structure of the transaction.

“We will then study the laws that the commission has been entrusted to enforce,” Chan said. “We will also communicate the facts of the deal to the public through a series of processes, including consulting media experts and holding public and administrative hearings.”

In addition to the investment structure, the commission would also examine the sources of funding that Kuo’s investment team have used for the purchase of CNS to determine if the deal has contravened laws banning media investments by political parties, the government and the military, she said.

This is the fourth time CNS’ largest shareholder, MBK Partners, has attempted to sell the company. Other potential buyers have included Want Want China Times Group from 2011 to 2013, Ting Hsin International Group from 2014 to 2015 and Morgan Stanley from 2015 to last year.

As the transaction involves MBK, an overseas private equity firm, exiting through the sale of a Taiwanese multiple system operator, any deal would require approval from the NCC, the Investment Commission, the Fair Trade Commission and other government agencies.

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not

POLICE INVESTIGATING: A man said he quit his job as a nurse at Taipei Tzu Chi Hospital as he had been ‘disgusted’ by the behavior of his colleagues A man yesterday morning wrote online that he had witnessed nurses taking photographs and touching anesthetized patients inappropriately in Taipei Tzu Chi Hospital’s operating theaters. The man surnamed Huang (黃) wrote on the Professional Technology Temple bulletin board that during his six-month stint as a nurse at the hospital, he had seen nurses taking pictures of patients, including of their private parts, after they were anesthetized. Some nurses had also touched patients inappropriately and children were among those photographed, he said. Huang said this “disgusted” him “so much” that “he felt the need to reveal these unethical acts in the operating theater

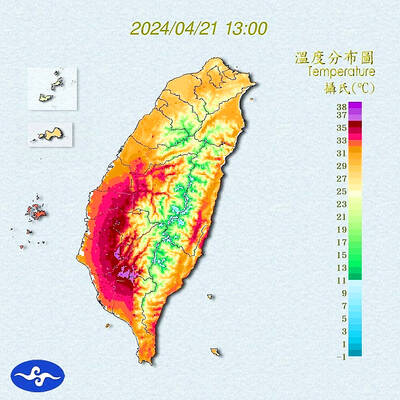

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching