Private-school teachers and education group representatives yesterday called on the government to make all private-school teachers eligible for tax-free retirement savings plans.

The three-pillar pension system for faculty members of private elementary schools, junior and senior-high schools, colleges and universities was first introduced in 2010 and designed to ensure financial stability for retired educators at three different levels, National Federation of Teachers’ Unions president Chang Hsu-cheng (張旭政) said at a news conference in Taipei yesterday.

While pillar one is a defined benefit retirement plan funded by the state-run civil servant insurance scheme, pillar two is a defined contribution account to which both the school and teacher are required to contribute, he said.

Pillar three is a savings plan that allows teachers to contribute more of their own salaries into their defined contribution account, but the option is only available when their school agrees to contribute NT$1 per teacher per month, Chang said.

“The additional savings plan is well designed and essential to the effectiveness of the three-pillar pension system, but although the system has been in place for more than seven years, only one-third of private schools have utilized it,” he said.

This has affected many teachers’ right to a better life after retirement, he said.

“According to statistics from the Ministry of Education, assuming a teacher retired after working at a school for 30 years, every month they would receive NT$15,000 to NT$18,000 from their pillar one plan, and NT$15,000 to NT$16,000 from pillar two, with a monthly total of a little over NT$30,000,” Chang said.

“An additional savings plan would allow them to receive NT$6,000 to NT$10,000 more every month, which would be a huge help,” he added.

“On average, NT$50,000 of the pillar three savings account is tax-free, which means teachers on the savings plan can save up to NT5,000 to NT6,000 in tax every month,” Jinwen University of Science and Technology assistant professor Hung Ching-chih (洪清池) said.

Teachers and education groups called on the ministry to take measures to solve the issue and urged legislators to amend the Act Governing the Retirement, Bereavement Compensation, Discharge with Severance Pay Benefits for the Teaching and Other Staff of School Legal Persons and their Respective Private Schools (學校法人及其所屬私立學校教職員退休撫卹離職資遣條例) by dropping the rule that allows schools to control whether teachers can utilize the tax-free retirement savings plan.

Chinese Nationalist Party (KMT) Legislator Apollo Chen (陳學聖), who attended the news conference, promised to propose an amendment soon.

“The reason many schools have not executed the pillar three savings plan is because they are unwilling to, not because they are unable to, and so far the ones that are already using it have not experienced any financial difficulties at all,” he said.

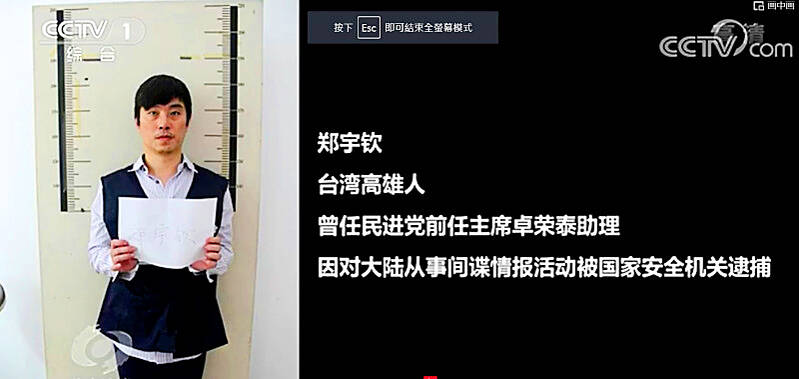

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

LIKE FAMILY: People now treat dogs and cats as family members. They receive the same medical treatments and tests as humans do, a veterinary association official said The number of pet dogs and cats in Taiwan has officially outnumbered the number of human newborns last year, data from the Ministry of Agriculture’s pet registration information system showed. As of last year, Taiwan had 94,544 registered pet dogs and 137,652 pet cats, the data showed. By contrast, 135,571 babies were born last year. Demand for medical care for pet animals has also risen. As of Feb. 29, there were 5,773 veterinarians in Taiwan, 3,993 of whom were for pet animals, statistics from the Animal and Plant Health Inspection Agency showed. In 2022, the nation had 3,077 pediatricians. As of last

XINJIANG: Officials are conducting a report into amending an existing law or to enact a special law to prohibit goods using forced labor Taiwan is mulling an amendment prohibiting the importation of goods using forced labor, similar to the Uyghur Forced Labor Prevention Act (UFLPA) passed by the US Congress in 2021 that imposed limits on goods produced using forced labor in China’s Xinjiang region. A government official who wished to remain anonymous said yesterday that as the US customs law explicitly prohibits the importation of goods made using forced labor, in 2021 it passed the specialized UFLPA to limit the importation of cotton and other goods from China’s Xinjiang Uyghur region. Taiwan does not have the legal basis to prohibit the importation of goods