A package of 31 incentives for Taiwanese businesspeople and creative professionals announced by China on Wednesday last week is an attempt to draw all talent from Taiwan and leave it “poor and stupid,” academics said.

The incentives, announced by China’s Taiwan Affairs Office, included tax cuts, investment capital and relaxed restrictions on certification for 134 professions. Twelve of the incentives are aimed at Taiwanese enterprises and 19 at individuals.

The incentives are “very strategic and systematic,” and are part of an attempt to use trade to promote unification, Democratic Progressive Party (DPP) Legislator Julian Kuo (郭正亮) said.

During the previous Chinese Nationalist Party (KMT) administration, Beijing provided benefits, such as investment, trade and exchange opportunities, and now under the DPP administration it is trying to draw money and talent from Taiwan, he said.

The situation presents a serious challenge to the nation, he added.

The dropping of quotas for professional certification exams is causing an exodus of Taiwanese talent, while allowing Taiwanese enterprises to participate in the “Made in China 2025” initiative has caused an exodus of capital, he said.

Through its unilateral relaxation of restrictions in the electronics, financial and publishing sectors, China has bypassed the controversial cross-strait service trade agreement, he said.

A review of the agreement has been shelved in the legislature since it was halted by the 2014 Sunflower movement.

Beijing also plans to relax regulations on cross-strait cooperation in film and TV productions, following the removal of restrictions on Taiwanese publications and movies marketed in China.

Huang Chieh-cheng (黃介正), an assistant professor at Tamkang University’s Graduate Institute of International Affairs and Strategic Studies, said Beijing wants to attract Taiwanese elite to China, leaving Taiwan with no talent.

China’s strategy differs this time in its focus on the general public, instead of officials, he said.

The government should bring the nation’s corporate leaders to the table to discuss ways of keeping professionals in Taiwan, and even attracting Chinese talent to Taiwan.

Chinese Culture University College of Social Sciences dean Chao Chien-min (趙建民) said that China’s strategy of trying to drain Taiwan of its talent would not be viewed favorably by the Taiwanese public.

“Strategically attracting all of the nation’s talent will not be seen as an act of goodwill,” Chao said. “Instead, Taiwanese would be even more anxious about the state of cross-strait relations if China were to drain the nation’s talent and resources.”

This would work against Beijing’s aims of gaining the trust and confidence of Taiwanese, he added.

In related news, Formosa Plastics Group (FPG) chairman William Wong (王文淵) said that the Chinese package offers risks and opportunities for Taiwanese enterprises.

“China’s 31 incentives should be good news for Taiwanese companies,” Wong told a press conference.

However, the program might not be a good thing for Taiwan as a whole, as it is hard to say how the Chinese government would implement the new policy, he said, adding that it was likely to intensify international competition for the local talent.

FPG hopes to continue expanding its investments in China, partly to take advantage of its cultural similarities with Taiwan compared with other markets, such as the US and the Philippines, he said.

“We have no option but to seek opportunities abroad if Taiwan fails to provide a favorable investment environment,” Wong said.

FPG operates more than 10 production bases in China, with investments in the petrochemical, electric material and machinery industries, its Web site showed.

Additional reporting by Kuo Chia-erh

China’s 31 incentives for Taiwan

Investments

■ The same policies will apply to both mainland enterprises and enterprises invested by Taiwanese compatriots in mainland China (hereafter referred to as Taiwanese-funded enterprises). The government encourages Taiwanese businesspeople to invest in and establish high-end manufacturing, smart manufacturing, green manufacturing and other enterprises in mainland China; and to establish regional headquarters and research and development design centers. Correspondingly, Taiwanese-funded enterprises can enjoy policies related to taxes, investments and others that support these endeavors.

■ Taiwanese-funded enterprises can, using a franchise model, participate in the establishment and construction of energy, transportation, water resources, environmental protection, municipal public works and other infrastructure.

■ Taiwanese-funded enterprises can participate in government procurement fairly.

■ Through joint-venture cooperations, mergers, restructuring and other methods, Taiwanese-funded enterprises can participate in the mixed-ownership reform of state-owned enterprises.

■ The government will continue to establish cross-strait industrial cooperation regions in midwestern and northeastern China. It encourages Taiwanese-funded enterprises to transfer to midwestern and northeastern China and participate in the “One Belt, One Road” initiative, and to expand the domestic and international markets. It will aggressively push the establishment of demonstration areas for Taiwanese-business investment and cross-strait environmental protection cooperation.

Technology and R&D

■ The government will assist and support qualified Taiwanese-funded enterprises to enjoy preferential tax policies for new high-tech enterprises according to the law, including: a reduced corporate income tax rate of 15 percent; eligibility for weighted deductions for research and development fees; and full refunds of value-added taxes when research and development centers established in mainland China purchase mainland equipment.

■ Independent legal entities registered in mainland China by Taiwanese science and technology research institutions, institutions of higher education and enterprises can lead or participate in the declaration of key projects in the national research and development plan and enjoy the same policies as mainland science and technology research institutions, higher education institutions and enterprises. Science and technology researchers in the Taiwan area employed by independent legal entities registered in mainland China can act as the responsible person for key projects in the national research and development plan in the declaration and enjoy the same policies as mainland Chinese science and technology researchers. In terms of Taiwanese region intellectual property rights transferred to mainland China, the mainland Chinese intellectual property rights incentive policy can be applied.

Land use

■ The same policies related to land use apply to both Taiwanese-funded enterprises and mainland enterprises. To encourage intensive land use, priority, in terms of the supply of land, will be given to Taiwanese businesses that invest in industrial projects. When confirming the lower price for releasing the land, 70 percent of the minimum price for supplying land in an equal or higher category to mainland Chinese for industrial purposes can be used.

■ Taiwanese-funded enterprises in the agricultural industry can enjoy the same subsidies as mainland Chinese enterprises in the purchase of agricultural machines; industrialization of key major enterprises; and other preferential policies.

Financial sector

■ Taiwanese financial institutions and businesses can cooperate with China UnionPay and mainland Chinese non-bank payment services in accordance with the laws and regulations to provide convenient and small-sum payment services to Taiwanese compatriots.

■ Taiwanese credit-checking institutions can cooperate with mainland Chinese credit-checking institutions to provide cross-strait compatriots and businesses with credit-checking services.

■ Taiwanese-funded banks can work with their mainland Chinese counterparts and provide financial services for the real economy through syndicated loans and other methods.

■ Taiwanese compatriots who are already certified to trade in stocks, futures and funds in Taiwan need only take a statute exam in accordance with mainland law, and do not need to take knowledge exams to work as traders in the mainland.

Talent

■ Taiwanese compatriots can sign up to participate in 53 occupational license exams for professional technicians and 81 occupational license exams for skilled workers.

■ Taiwanese professionals can apply to participate in the national “Thousand Talent Plan.” Taiwanese professionals working in mainland China can apply to participate in the national “Ten Thousand Talent Plan.”

■ Taiwanese compatriots can apply for national funding for the natural sciences, social sciences, arts, young people in science and other types of funding.

■ Taiwanese compatriots and relevant associations are encouraged to participate in programs aimed at assisting the poor through community education and housing programs, and other grassroots work.

■ Taiwanese professors are encouraged to hold teaching positions at mainland universities, with their academic achievements being admissible for the mainland evaluation system.

■ For the convenience of Taiwanese compatriots, mainland job-hunting Web sites and job-placement agencies are being upgraded and promoted to facilitate use of the Mainland Travel Permit for Taiwan Residents for job hunting.

Culture

■ The government encourages Taiwanese compatriots to participate in the reading of Chinese classics, the protection of cultural heritage, the passing on and development of intangible cultural heritage and the passing on and development of other outstanding aspects of traditional Chinese culture. It encourages Taiwanese groups and individuals in the fields of arts and culture to participate in events, hosted by mainland Chinese overseas, that allow people to understand China, Chinese holidays and Chinese New Year; and to participate in plans to promote Chinese culture. Qualified cross-strait cultural projects can be included in the resource library for overseas Chinese cultural centers.

■ The government encourages the China Charity Award, the Plum Performance Award, the Golden Eagle Award and other awards in the fields of economics, technology, culture and society to include the Taiwan region in their nominations for different categories. Taiwanese compatriots working in mainland China can participate in the judging and selection of honorable titles in their local area, such as National Model Worker, “May 1st” Labor Medal, China Skill Award and the National “March 8th” Red-banner Pacesetter Award.

■ A “green passage” for books imported from Taiwan is to be established, simplifying the inspection and approval process. Books imported from Taiwan will be handled with priority.

■ Taiwanese compatriots are encouraged to join the mainland’s economic, cultural and arts-related social organizations and business associations, as well as to participate in all related activities.

■ The development of research into Chinese culture, history and ethnicity by cross-strait education and cultural research institutions, and the application of research results are to be encouraged and supported.

■ Taiwan Area organizations focused on cross-strait non-governmental exchanges can apply for funding for this purpose.

Entertainment

■ Taiwanese individuals can participate in the production of an unlimited number of mainland Chinese broadcast television shows, movies and television series.

■ Institutions that release movies, broadcast television networks, online music and video providers and cable networks can import an unlimited number of movies and television series produced in Taiwan.

■ The government will ease its restrictions on the proportion of main creators, mainland Chinese elements and the proportion of investments for movies and television series coproduced by Taiwan and mainland China. It will cancel the application fee for these projects and shorten the amount of time required to review the synopses of these projects.

Medical and healthcare

■ Taiwanese students in master’s degree programs at mainland universities can apply to sit for examinations to be certified as doctors in the mainland after one year of study.

■ Taiwanese compatriots who become certified as doctors in the mainland can apply to be registered medical practitioners in the mainland.

■ Taiwanese doctors who meet prerequisites can apply to be certified as mainland medical practitioners. Taiwanese doctors who meet prerequisites can apply to be short-term practitioners of medicine in the mainland and may reapply when each term expires.

Translated by staff writers Sherry Hsiao and William Hetherington

Source: China’s Taiwan Affairs Office Web site

FLU SEASON: Twenty-six severe cases were reported from Tuesday last week to Monday, including a seven-year-old girl diagnosed with influenza-associated encephalopathy Nearly 140,000 people sought medical assistance for diarrhea last week, the Centers for Disease Control (CDC) said on Tuesday. From April 7 to Saturday last week, 139,848 people sought medical help for diarrhea-related illness, a 15.7 percent increase from last week’s 120,868 reports, CDC Epidemic Intelligence Center Deputy Director Lee Chia-lin (李佳琳) said. The number of people who reported diarrhea-related illness last week was the fourth highest in the same time period over the past decade, Lee said. Over the past four weeks, 203 mass illness cases had been reported, nearly four times higher than the 54 cases documented in the same period

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

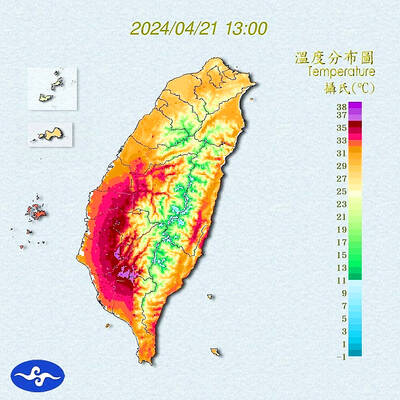

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not