Former First Commercial Bank (第一銀行) chairman Joseph Tsai (蔡慶年) was released on NT$100,000 bail yesterday morning after 10 hours of questioning by Kaohsiung prosecutors over the investigation into a NT$20.5 billion (US$684.06 million) syndicated loan to Ching Fu Shipbuilding Co (慶富造船).

A manager surnamed Tiao (刁) who headed First Commercial Bank’s syndicated loan department was also released on NT$100,000 bail.

The Kaohsiung District Prosecutors’ Office is heading the judicial investigation into suspected financial irregularities, money laundering and other activities that breached the banking regulations when Ching Fu was awarded a NT$35.8 billion contract to build six minesweepers for the navy.

The six minesweepers were part of the nation’s indigenous warship program, but Ching Fu defaulted on the NT$20.5 billion syndicated loan, which forced nine local banks to lose a combined NT$20.1 billion.

Kaohsiung prosecutors working in coordination with their counterparts in Taipei on Thursday raided several locations, including First Commercial Bank’s headquarters in Taipei, the bank’s main office in Kaohsiung and Tsai’s residence in Taipei.

Aside from Tsai and Tiao, 13 other First Commercial Bank employees, along with a Ching Fu manager surnamed Yang (楊), who was in charge of the company’s finances, were summoned for questioning.

During the questioning Tsai reportedly denied any wrongdoing and told prosecutors that “the syndicate loan could not be decided by me alone.”

“The decision was made at a meeting of the board of directors,” he told prosecutors.

Tsai reportedly said his bank had at first rejected the loan application due to Ching Fu’s high debt ratio, but then in June 2015, Ching Fu increased its capitalization to NT$3 billion, up from NT$530 million.

In October that year, the bank’s board of directors convened and decided to approve the loan, which was also partly based on the profits that would be generated from the long-term service and maintenance contract for the six minesweepers after they had been built.

State-run First Commercial Bank was the lead bank of the syndicated loan, but due to insolvency and other financial problems, Ching Fu defaulted on the loan in October.

A report last month by the Executive Yuan found major derelictions of duty by the Ministry of National Defense and First Commercial Bank in awarding the contract and loan to the financially unstable company.

Ministry officials failed to ensure that Ching Fu had the financial capability to carry out the project; failed to ensure the company had the manufacturing ability to produce the minesweepers; and failed to hold a negotiation process with China Fu and a potentially more qualified bidder, CSBC Corp (台船), before resorting to lot-drawing to decide the winner of the navy’s minesweeper tender, the report said.

Ching Fu’s other creditors are Land Bank of Taiwan (土地銀行), Taiwan Cooperative Bank (合庫銀行), Bank of Taiwan (臺灣銀行), Hua Nan Commercial Bank (華南銀行), Chang Hwa Commercial Bank (彰化銀行), Taiwan Business Bank (台灣企銀), Agricultural Bank of Taiwan (農業金庫) and the Export-Import Bank of the Republic of China (中國輸出入銀行).

Former president Ma Ying-jeou’s (馬英九) mention of Taiwan’s official name during a meeting with Chinese President Xi Jinping (習近平) on Wednesday was likely a deliberate political play, academics said. “As I see it, it was intentional,” National Chengchi University Graduate Institute of East Asian Studies professor Wang Hsin-hsien (王信賢) said of Ma’s initial use of the “Republic of China” (ROC) to refer to the wider concept of “the Chinese nation.” Ma quickly corrected himself, and his office later described his use of the two similar-sounding yet politically distinct terms as “purely a gaffe.” Given Ma was reading from a script, the supposed slipup

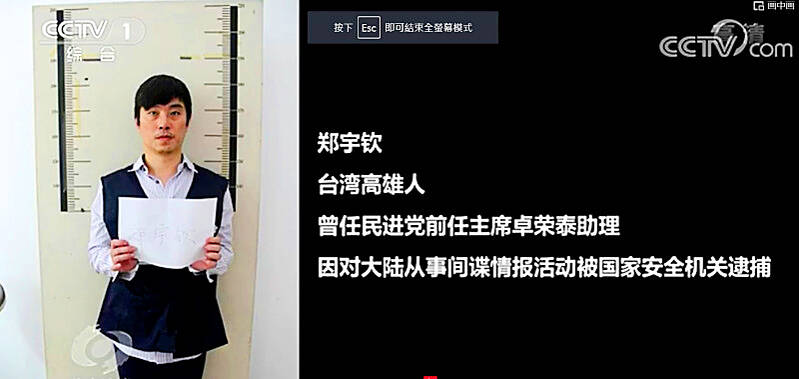

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

The bodies of two individuals were recovered and three additional bodies were discovered on the Shakadang Trail (砂卡礑) in Taroko National Park, eight days after the devastating earthquake in Hualien County, search-and-rescue personnel said. The rescuers reported that they retrieved the bodies of a man and a girl, suspected to be the father and daughter from the Yu (游) family, 500m from the entrance of the trail on Wednesday. The rescue team added that despite the discovery of the two bodies on Friday last week, they had been unable to retrieve them until Wednesday due to the heavy equipment needed to lift