Democratic Progressive Party Legislator Lin Chun-hsien (林俊憲) yesterday urged the Financial Supervisory Commission (FSC) to curb bad debts stemming from fraud and loan sharking on Internet-based peer-to-peer lending platforms.

Lin made the remark during an event at the Legislative Yuan that charged the commission of failing to regulate peer-to-peer financial activities.

FSC officials were invited to the event to offer a response.

Most borrowers on online peer-to-peer lending platforms have trouble securing loans from banks because of poor credit scores, Lin said, adding that as they are more likely to end up in arrears, lenders often impose extremely high interest rates.

Online lending platforms have existed for years in other nations and have caused many problems, Lin said, adding that in China they are blamed for generating an estimated 60 billion yuan (US$9.2 billion) of bad debt.

Chinese students who lack means are taking out so-called “campus loans” online, sometimes in exchange for sexually explicit photographs as collateral, he said.

The British, US and Chinese governments have been taking steps to regulate online peer-to-peer lending, with the UK drafting laws and regulations that specifically tackle the issue, he added.

“In Taiwan, peer-to-peer lending remains a legal gray area that harbors bad debt, fraud and usurious interest rates, and has serious implications to our society. Enforcement of financial regulations should be carried out in accordance with an entity’s functional behavior, not its institutional type,” Lin said.

“New FSC Chairman Wellington Koo (顧立雄) should do things in a way that differs from the business-as-usual approach of the past,” he added.

FSC official Chou Cheng-shan (周正山) said peer-to-peer lending platforms are online service providers, not financial service providers that the commission is empowered to regulate.

However, the agency has discussed the matter with platform operators and believes that existing laws provide it with the legal leverage to regulate some peer-to-peer exchanges, he said.

For example, platforms are not authorized to issue bonds or financial products, charge lenders before loans are made, violate legal protections on privacy, collect debts illegally or market their services in ways that contravene the law, he added.

The commission has encouraged platform operators to work with established financial institutions and has called on the Bankers Association of the Republic of China to draft trade rules to regulate online lending, Chou said.

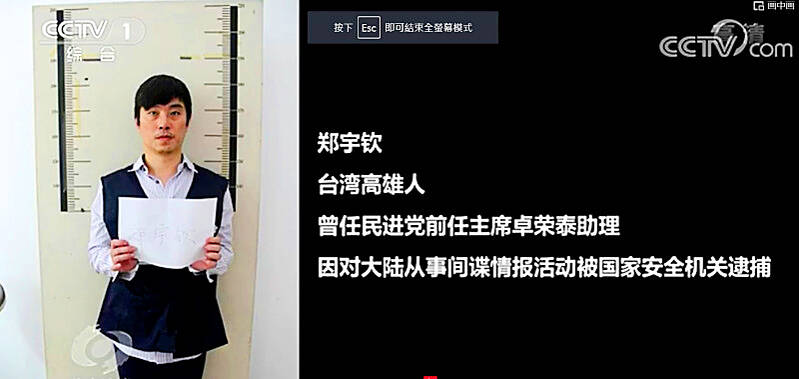

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

LIKE FAMILY: People now treat dogs and cats as family members. They receive the same medical treatments and tests as humans do, a veterinary association official said The number of pet dogs and cats in Taiwan has officially outnumbered the number of human newborns last year, data from the Ministry of Agriculture’s pet registration information system showed. As of last year, Taiwan had 94,544 registered pet dogs and 137,652 pet cats, the data showed. By contrast, 135,571 babies were born last year. Demand for medical care for pet animals has also risen. As of Feb. 29, there were 5,773 veterinarians in Taiwan, 3,993 of whom were for pet animals, statistics from the Animal and Plant Health Inspection Agency showed. In 2022, the nation had 3,077 pediatricians. As of last

XINJIANG: Officials are conducting a report into amending an existing law or to enact a special law to prohibit goods using forced labor Taiwan is mulling an amendment prohibiting the importation of goods using forced labor, similar to the Uyghur Forced Labor Prevention Act (UFLPA) passed by the US Congress in 2021 that imposed limits on goods produced using forced labor in China’s Xinjiang region. A government official who wished to remain anonymous said yesterday that as the US customs law explicitly prohibits the importation of goods made using forced labor, in 2021 it passed the specialized UFLPA to limit the importation of cotton and other goods from China’s Xinjiang Uyghur region. Taiwan does not have the legal basis to prohibit the importation of goods