People will be able to make donations to athletes and deduct the donations from their taxes if an amendment to the Sports Industry Development Act (運動產業發展條例) passes the Legislative Yuan, the Sports Administration said in a statement yesterday.

The agency issued the statement after the legislature’s Education and Culture Committee on May 17 gave a preliminary approval to the amendment, which is widely seen as an incentive that would motivate people to help athletes struggling to raise money to compete in local or international events.

Article 26 of the act offers tax deductions for business entities that donate to designated sports associations, sports teams and athletes.

It states that the donations made by businesses can be written off as operational costs or expenditures from their revenue tax.

No limits are set on the amount that can be listed as tax deductible.

The same incentive applies if businesses financially support sports events held for their employees, donate to the government for the purpose of building sports facilities or providing sports equipment, or purchase tickets for students or financially disadvantaged people to attend sports events.

However, the regulations do not grant incentives to individuals who make the same kind of donations, which the proposal aims to change by amending Article 26, the agency said.

Individuals would be required to deposit their donations to a designated bank account opened by the Sports Administration.

Donations that are not intended for any specific athlete or sports association would be considered as donations to the government and the entire sum can be listed as deductible, it said.

However, if the individuals specify that the donations are for certain athletes or sports associations, they would then be eligible for listing the donation as tax deductible as per Article 17 in the Income Tax Act (所得稅法).

According to the article, contributions and donations made to educational, cultural, public welfare or charity organizations can be listed as tax deductible provided that the deductible amount does not exceed 20 percent of the person’s gross consolidated income.

People making the donations will not be levied additional gift tax, according to the proposed amendment.

Chang Ru-min (張儒民), a specialist in the agency’s planning division, said that it would have to stipulate various rules of enforcement if the amendment is passed and promulgated by President Tsai Ying-wen (蔡英文).

“The Ministry of Finance has been cautious about this matter and wanted the Sports Administration to act as gatekeeper,” he said, adding that the agency has also been asked to deliberate on the qualifications of the athletes eligible for receiving donations.

Chang said that the Sports Administration would also make evaluations after the amendment is passed regarding the types of athletes who are likely to benefit the most from the tax incentive and the amount of losses in tax revenue that the government would face after the changes.

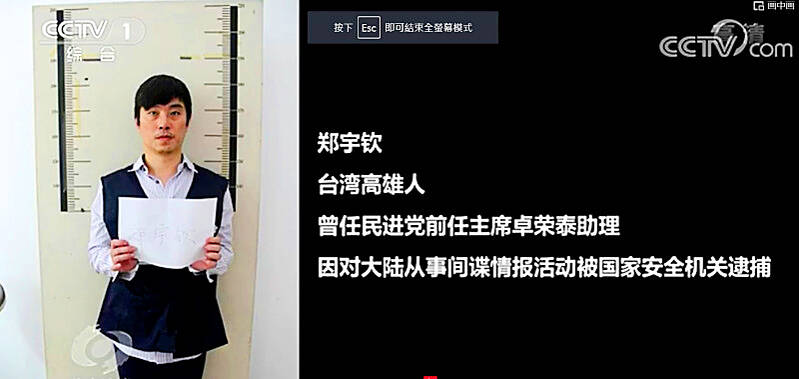

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

THE HAWAII FACTOR: While a 1965 opinion said an attack on Hawaii would not trigger Article 5, the text of the treaty suggests the state is covered, the report says NATO could be drawn into a conflict in the Taiwan Strait if Chinese forces attacked the US mainland or Hawaii, a NATO Defense College report published on Monday says. The report, written by James Lee, an assistant research fellow at Academia Sinica’s Institute of European and American Studies, states that under certain conditions a Taiwan contingency could trigger Article 5 of NATO, under which an attack against any member of the alliance is considered an attack against all members, necessitating a response. Article 6 of the North Atlantic Treaty specifies that an armed attack in the territory of any member in Europe,

LIKE FAMILY: People now treat dogs and cats as family members. They receive the same medical treatments and tests as humans do, a veterinary association official said The number of pet dogs and cats in Taiwan has officially outnumbered the number of human newborns last year, data from the Ministry of Agriculture’s pet registration information system showed. As of last year, Taiwan had 94,544 registered pet dogs and 137,652 pet cats, the data showed. By contrast, 135,571 babies were born last year. Demand for medical care for pet animals has also risen. As of Feb. 29, there were 5,773 veterinarians in Taiwan, 3,993 of whom were for pet animals, statistics from the Animal and Plant Health Inspection Agency showed. In 2022, the nation had 3,077 pediatricians. As of last

XINJIANG: Officials are conducting a report into amending an existing law or to enact a special law to prohibit goods using forced labor Taiwan is mulling an amendment prohibiting the importation of goods using forced labor, similar to the Uyghur Forced Labor Prevention Act (UFLPA) passed by the US Congress in 2021 that imposed limits on goods produced using forced labor in China’s Xinjiang region. A government official who wished to remain anonymous said yesterday that as the US customs law explicitly prohibits the importation of goods made using forced labor, in 2021 it passed the specialized UFLPA to limit the importation of cotton and other goods from China’s Xinjiang Uyghur region. Taiwan does not have the legal basis to prohibit the importation of goods