The Labor Insurance Fund is expected to report deficits by 2017 and declare bankruptcy by 2027, a Council of Labor Affairs (CLA) report released on Tuesday said.

Due to the rapidly ageing population, the insurance fund — which provides money for retired workers’ pensions — will begin to record a deficit in 2017, three years before the original projection, the report showed.

Based on the renewed assessment, the fund is headed for bankruptcy in 2027 rather than in 2031, as previously projected, the report added. The new projections mean that those who are 50 years old this year will possibly be faced with a bankrupt labor insurance fund by the time they apply for their pensions, the agency said.

To ensure that every worker will receive a pension, the agency has proposed amendments to the Labor Insurance Act (勞工保險條例) that include adjusting the insurance premium rate upward, ensuring that the government allocates a budget for hidden losses incurred through poor fund investments and making “the government liable for the final payments,” CLA officials said.

Asked by lawmakers if the labor insurance fund is approaching bankruptcy, CLA Minister Pan Shih-wei (潘世偉) said “there is no problem with the fund in the short term.”

In the long run, the CLA will establish a fund operation mechanism that will “ease people’s minds,” he added.

Meanwhile, Cabinet Deputy Secretary-General Huang Min-kung (黃敏恭) said hidden debts are an unavoidable part of labor insurance operations. With or without written regulations stipulating that the government must ensure that payments are made, workers’ benefits will not be jeopardized, he said. Huang added that the volume of the labor insurance fund has increased from NT$200 billion (US$6.8 billion) in 2009 to NT$520.2 billion as of Aug. 31.

“Currently, inflows and outflows are normal,” he said.

Former president Ma Ying-jeou’s (馬英九) mention of Taiwan’s official name during a meeting with Chinese President Xi Jinping (習近平) on Wednesday was likely a deliberate political play, academics said. “As I see it, it was intentional,” National Chengchi University Graduate Institute of East Asian Studies professor Wang Hsin-hsien (王信賢) said of Ma’s initial use of the “Republic of China” (ROC) to refer to the wider concept of “the Chinese nation.” Ma quickly corrected himself, and his office later described his use of the two similar-sounding yet politically distinct terms as “purely a gaffe.” Given Ma was reading from a script, the supposed slipup

The bodies of two individuals were recovered and three additional bodies were discovered on the Shakadang Trail (砂卡礑) in Taroko National Park, eight days after the devastating earthquake in Hualien County, search-and-rescue personnel said. The rescuers reported that they retrieved the bodies of a man and a girl, suspected to be the father and daughter from the Yu (游) family, 500m from the entrance of the trail on Wednesday. The rescue team added that despite the discovery of the two bodies on Friday last week, they had been unable to retrieve them until Wednesday due to the heavy equipment needed to lift

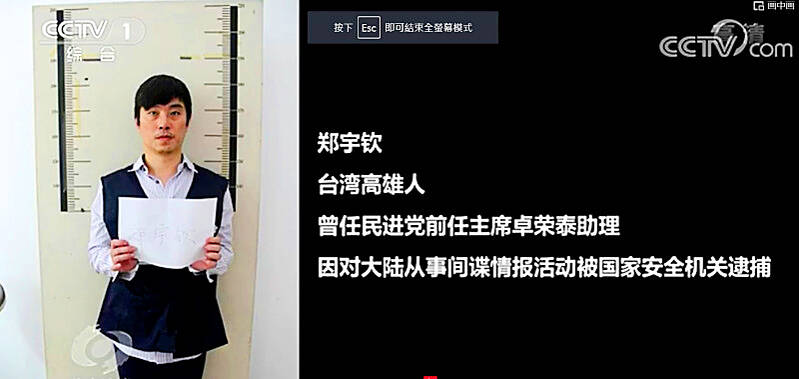

Former Czech Republic-based Taiwanese researcher Cheng Yu-chin (鄭宇欽) has been sentenced to seven years in prison on espionage-related charges, China’s Ministry of State Security announced yesterday. China said Cheng was a spy for Taiwan who “masqueraded as a professor” and that he was previously an assistant to former Cabinet secretary-general Cho Jung-tai (卓榮泰). President-elect William Lai (賴清德) on Wednesday last week announced Cho would be his premier when Lai is inaugurated next month. Today is China’s “National Security Education Day.” The Chinese ministry yesterday released a video online showing arrests over the past 10 years of people alleged to be

MIX-UP: Kaohsiung Municipal Min-Sheng Hospital director Yen Chia-chi was suspended from his duties after surgeons operated on the wrong patient last week The Kaohsiung Department of Health yesterday fined Kaohsiung Municipal Min-Sheng Hospital NT$500,0000 for misidentifying two patients and consequently causing one of them to undergo the wrong surgery last week. The hospital’s director Yen Chia-chi (顏家祺) was suspended from his duties. The surgeon who was scheduled to operate on the patient was given a major demerit and is subject to subsequent disciplinary actions. Demerits were given to the anesthesiologist, the nurse in the operation room, the nurse in the ward and the worker who helped transfer the patient from the ward to the operation room for having failed to verify the patient’s identity. Meanwhile, the