The Cabinet has proposed revisions to tax deduction regulations, which the Council of Grand Justices ruled to be in violation of the principles of equality enshrined in the Constitution.

According to Article 17 of the Income Act (所得稅法), taxpayers are not allowed to claim dependent exemption for non-lineal relatives and their family members between 20 and 60 years of age.

Non-kin members aged between 20 and 60 living together with taxpayers are not qualified for the tax credit either.

The Council of Grand Justices ruled that the article was unconstitutional because it violated Article 7 of the Constitution that all citizens of the Republic of China, irrespective of sex, religion, race, class or party affiliation, are equal before the law.

The Grand Justices said that the tax deduction rule made taxpayers less willing to take care of their dependents under the age of 60 who do not have the ability to earn a living on their own.

In response to the ruling from the Council of Grand Justices, the Ministry of Finance proposed the amendments to remove the age limits.

The amendment requires legislative approval before it can take effect.

Deputy Secretary-General of the Executive Yuan Huang Min-kung (黃敏恭) said the Cabinet has put the amendment on its priority list for legislative deliberation in the next legislative session, beginning on Sept. 18.

The finance ministry said it hopes that the new regulation would take effect before next year’s tax-filing season in May.

Kuo Yen-e (郭燕娥), a middle-aged woman living in Taiwan, had requested that the Council of the Grand Justices interpret the rule years ago after she lost an administrative lawsuit against the National Tax Administration of Northern Taiwan Province, which had denied her the right to claim tax exemption for her disabled sister-in-law in her 40s.

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not

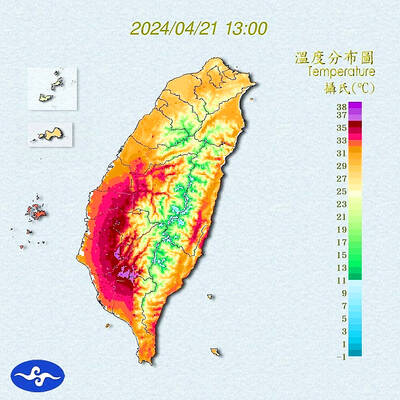

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching

POLICE INVESTIGATING: A man said he quit his job as a nurse at Taipei Tzu Chi Hospital as he had been ‘disgusted’ by the behavior of his colleagues A man yesterday morning wrote online that he had witnessed nurses taking photographs and touching anesthetized patients inappropriately in Taipei Tzu Chi Hospital’s operating theaters. The man surnamed Huang (黃) wrote on the Professional Technology Temple bulletin board that during his six-month stint as a nurse at the hospital, he had seen nurses taking pictures of patients, including of their private parts, after they were anesthetized. Some nurses had also touched patients inappropriately and children were among those photographed, he said. Huang said this “disgusted” him “so much” that “he felt the need to reveal these unethical acts in the operating theater